An Income Statement Reports Revenues Earned Less Expenses Incurred

Income statement is prepared on the accruals basis of accounting.

An income statement reports revenues earned less expenses incurred. Using the cash basis of accounting the december income statement will report 0 revenues and expenses of 1 500 for a net loss of 8 500 even though i had earned 10 000 in accounting fees. Received 910 cash for services provided to a customer during july. Julia simao teixeira de andrade acct 230 54383 chapter 11 discussion questions dr. Gaap and ifrs prepare the same four basic financial statements.

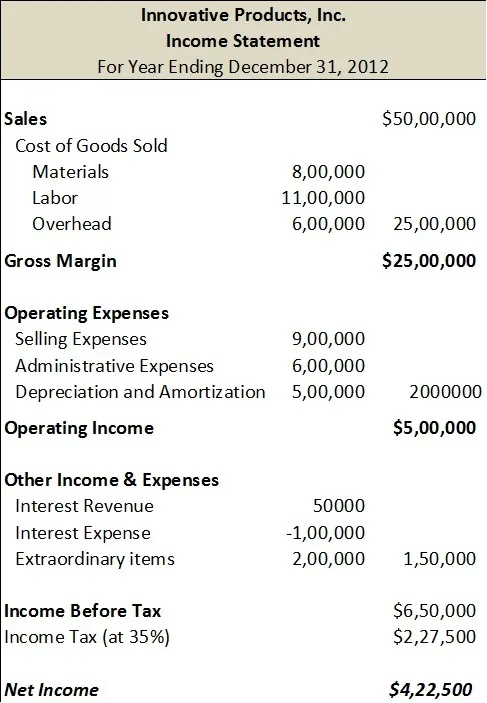

The multi step income statement categorizes both revenues gains expenses and losses into operating and non operating items. Further the balance sheet will not report the obligation for the utilities that were used. Businesses selling physical goods can use the income statement to track changes in returns cost of goods or operating expenses as a percentage of sales to quickly fix issues in the business. An income statement reports the revenues earned less expenses incurred by a business over a period of time.

The balance sheet reports the assets liabilities and equity of a business at a point in time. 1 the income statement reports revenues earned and expenses incurred during a period of time. To prepare an income statement small businesses need to analyze and report their revenues expenses and the resulting profits or losses for a specific reporting period. Conversely expenses are recognized in the income statement when they are incurred even if they are paid for in the.

An income statement reports the revenues earned less the expenses incurred by a business over a period of time. This means that income including revenue is recognized when it is earned rather than when receipts are realized although in many instances income may be earned and received in the same accounting period. The statement of cash flows reports cash receipts and. Here is an example of how to prepare an income statement from paul s adjusted trial balance in our earlier accounting cycle examples.

T the following transactions occurred during july. Rent expense salaries expense utilities expense rental revenues total revenues. Furthermore it also showcases gross profit which is nothing but sales less cost of goods sold. An income statement reports information for a specific date indicating the financial progress of a business in earning a net income or a net loss.

As you can see this example income statement is a single step statement because it only lists expenses in one main category. Thus you must remember that the income statement records revenues or expenses on the accrual basis of accounting. It is prepared on an accrued basis. The income statement also called a profit and loss statement is one of the major financial statements issued by businesses along with the balance sheet and cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)