Debit Income Statement Meaning

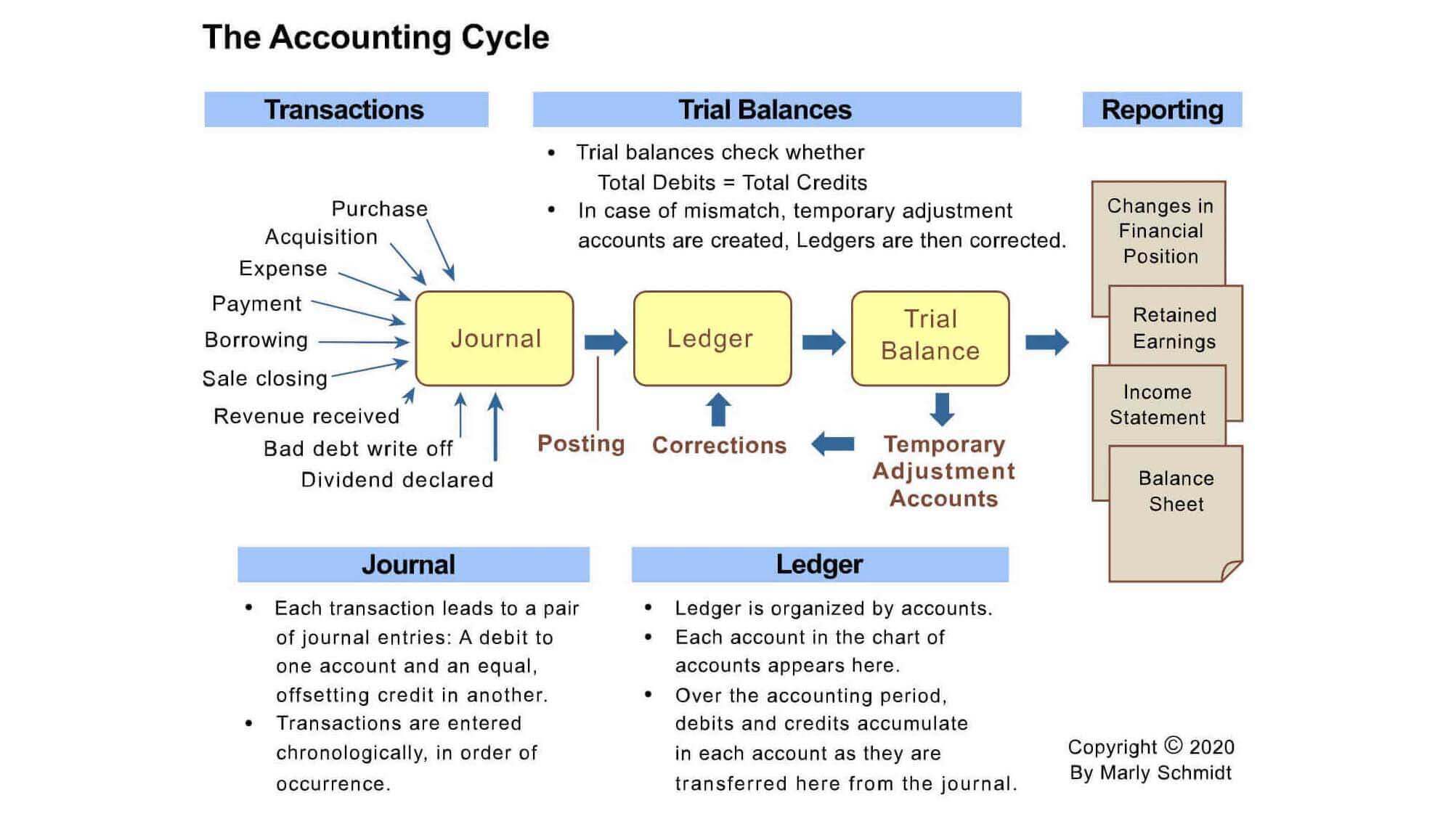

What you need to know today is that debit means left or left side for example every accounting entry will have a debit entered on the left side of a general ledger account.

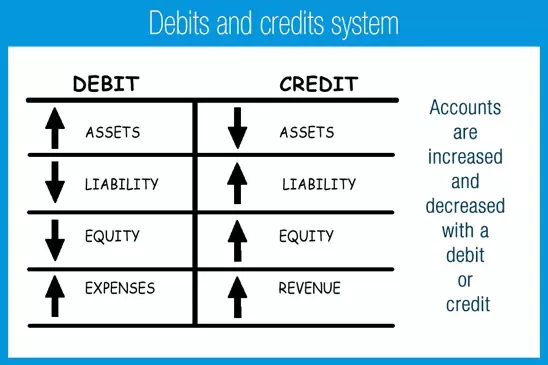

Debit income statement meaning. What is the meaning of debit. If the balance sheet entry is a credit then the company must show the salaries expense as a debit on the income statement. Debits and credits occur simultaneously in every financial transaction in double entry bookkeeping. For dividends it would be an equity account but have a normal debit balance meaning debit will increase and credit will decrease.

We also learned that net income is revenues expenses and calculated on the income statement. Income accounts on the income statement are typically called sales revenues income or gains in all cases a credit increases the income account balance and a debit decreases the balance. For example if you debit a cash account. There can be considerable confusion about the inherent meaning of a debit or a credit.

If you are more concerned with accounts that appear on the income statement then these additional rules apply. We learned that net income is added to equity. The g stands for gains which represent increases in the company s share price. The income statement is one of the main four financial statements that are issued by companies.

A debit decreases the balance and a credit increases the balance. As with the definition of debit there is a helpful mnemonic to keep track of what constitutes a credit in the business world. The term debit is similar to the term used in italy more than 500 years ago when the double entry accounting system was documented. Balance sheet income statement statement of owner s equity and statement.

Recording changes in income statement accounts. Remember every credit must be balanced by an equal debit in this. For example when a writer sells an article for 100 she would enter a transaction into her accounting software that contained a debit to cash for.