Gaap Statement Of Comprehensive Income

Statement of comprehensive income.

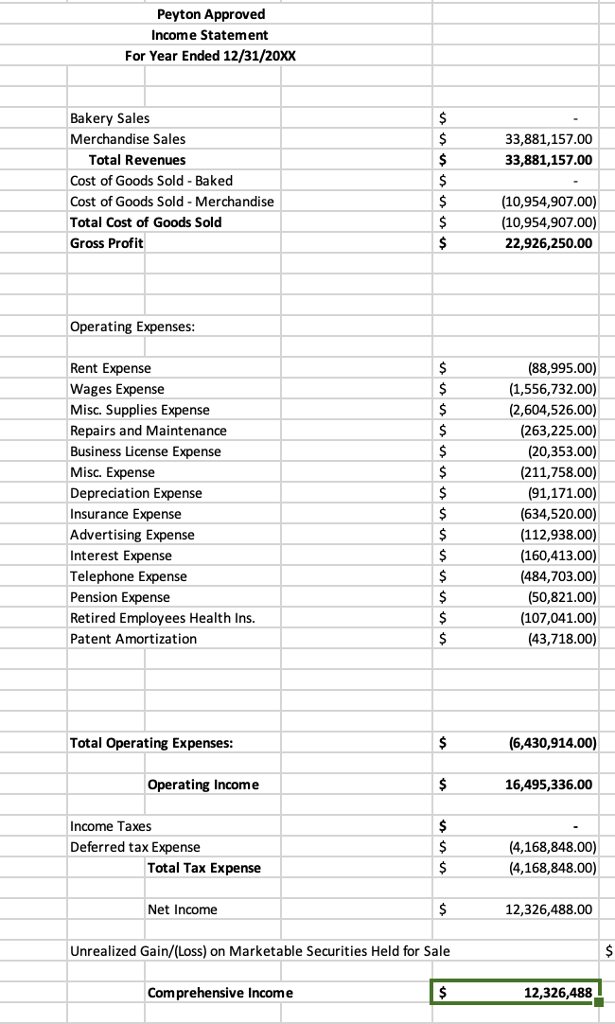

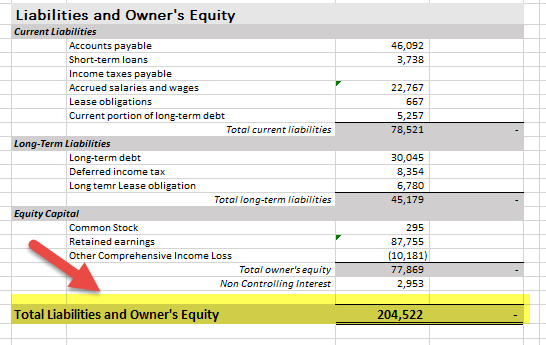

Gaap statement of comprehensive income. A standard ci statement is usually attached to the bottom of the income statement and includes a separate heading. A statement of comprehensive income is the overall income statement that consolidates standard income statement which gives details about the repetitive operations of the company and other comprehensive income which gives details about the non operational transactions such as the sale of assets patents etc. So ifrs is a more comprehensive and informative type of reporting income statement. Limitations of a statement of comprehensive income.

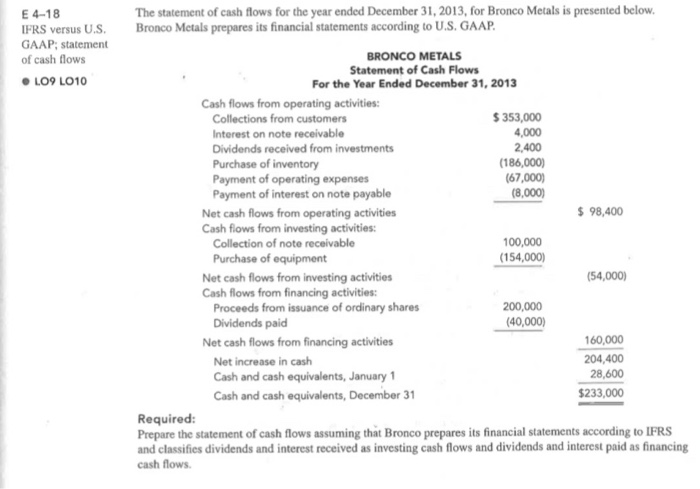

Income and other amounts of current period other comprehensive income. Example 3 ifrs based income statement. Statement of comprehensive income. 4 2 ifrs supplement 3if a company prepares a statement of comprehensive income then disclosure is required for 1 other comprehensive income classified by nature 2 comprehensive income of associates and joint ventures and 3 total comprehensive income the statement of comprehensive.

Although the income statement is a go to document for assessing the financial health of a company it falls short in a few aspects. A statement of comprehensive income that begins with profit or loss bottom line of the income statement and displays the items of other comprehensive income for the reporting period ias 1 p 81 so the statement of comprehensive income aggregates income statement profit and loss statement and other comprehensive income which isn t. 2 scope of section 5. Example 1 single step income statement.

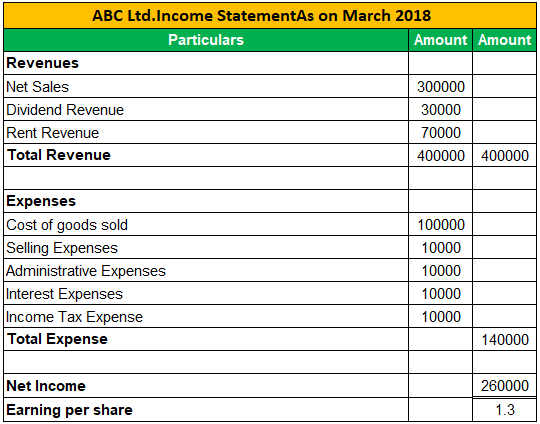

Whenever ci is listed on the balance sheet the statement of comprehensive income must be included in the general purpose financial statements to give external users details about how ci is computed. Income statement example gaap generally accepted accounting principle has two classifications. Schedule reflecting a statement of income statement of cash flows statement of financial position statement of shareholders equity and other comprehensive income or other statement as needed. B5 statement of comprehensive income and income statement.

But don t depend solely on it. 3 presentation of total comprehensive income. The income statement encompasses both the current revenues resulting from sales and the accounts receivables which the firm is yet to be paid. Both before tax and net of tax presentations are permitted provided the entity complies withthe requirements in paragraph 220 10 45 12 correspond to the components of other comprehensive income in the statement in which other comprehensive income for the period is presented.