United States Korea Income Tax Treaty

The complete texts of the following tax treaty documents are available in adobe pdf format.

United states korea income tax treaty. If you have problems opening the pdf document or viewing pages download the latest version of adobe acrobat reader for further information on tax treaties refer also to the treasury department s tax treaty documents page. Income taxes on certain items of income they receive from sources within the united states. The main purpose of a tax treaty is to ensure proper tax treatment of monies earned by us citizens s. The 1992 version of the treaty included a 5 rate but only with regard to corporate recipients of dividends when such corporate recipients owned at least 25 of the capital.

Income taxes on certain income profit or gain from sources within the united states. Us taxes for expats in korea. Taxes on certain items of income they receive from sources within the united states. Korean citizens ex pats and residents of each other s country.

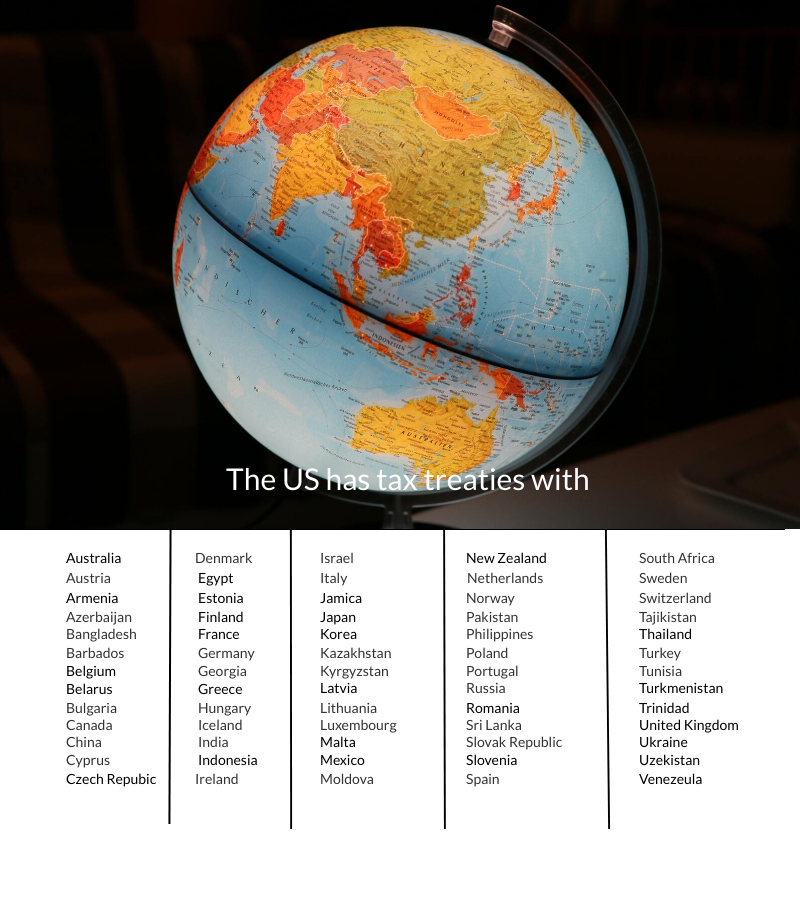

If you use assistive technology such as a screen reader and need a version of this document in a more accessible format please email different format hmrc gov uk please tell us what format you. These reduced rates and exemptions vary among countries and specific. The united states has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from u s. The convention between the united states of america and the republic of korea for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and the encouragement of international trade and investment was signed at seoul on june 4 1976.

United states and s. Korea have an income tax treaty in place. The us korea tax treaty was signed in 1976 and ratified in 1979. The purpose of the treaty is to prevent double taxation for americans living in korea and koreans living in the us however it doesn t prevent us citizens living in korea from having to file us taxes.

These reduced rates and exemptions vary among countries and specific items of income. In all other cases the withholding tax rate was 10. Under the new changes foreign workers except for foreign workers who have a special relationship with the employing entity initially starting work in south korea before 31 december 2021 can elect to have the 19 percent flat tax rate 20 9 percent including local income tax apply for 5 consecutive tax years from the initial commencement of employment assignment in korea on the income earned while working in south korea. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or.

Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from u s.