Realized Gains And Losses Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

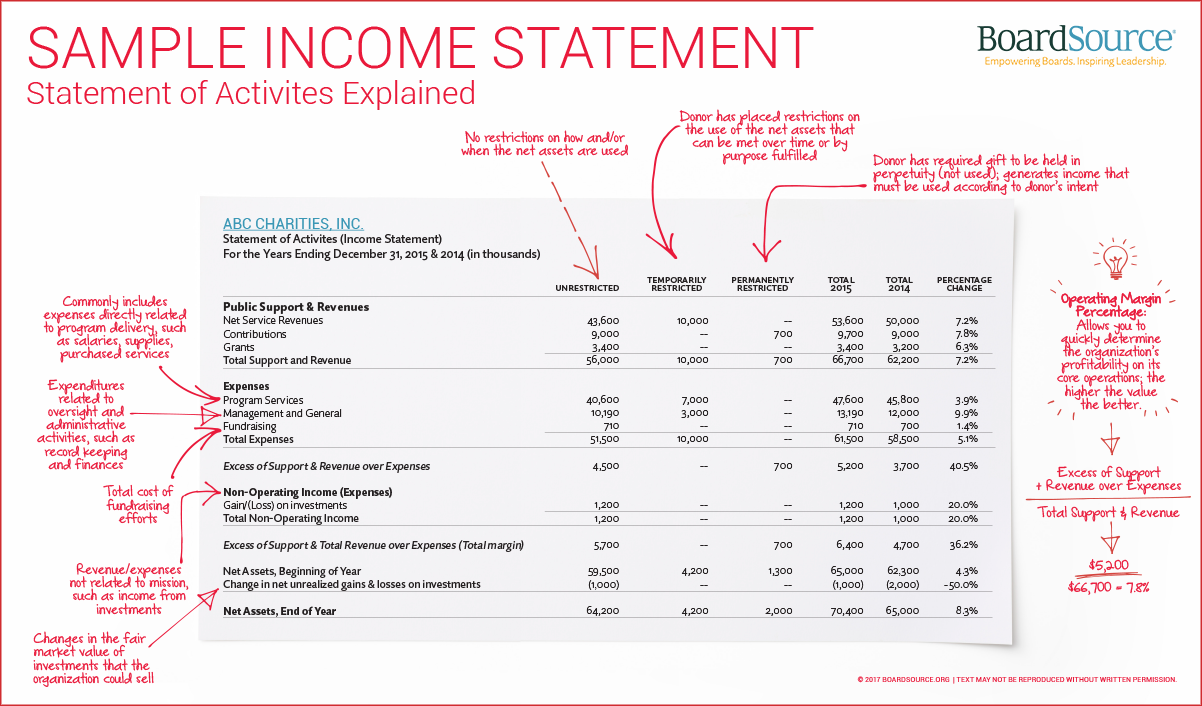

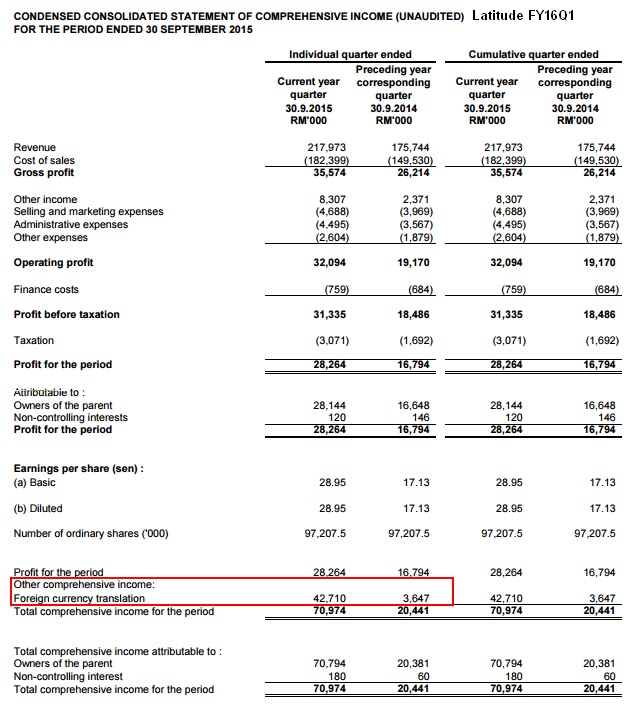

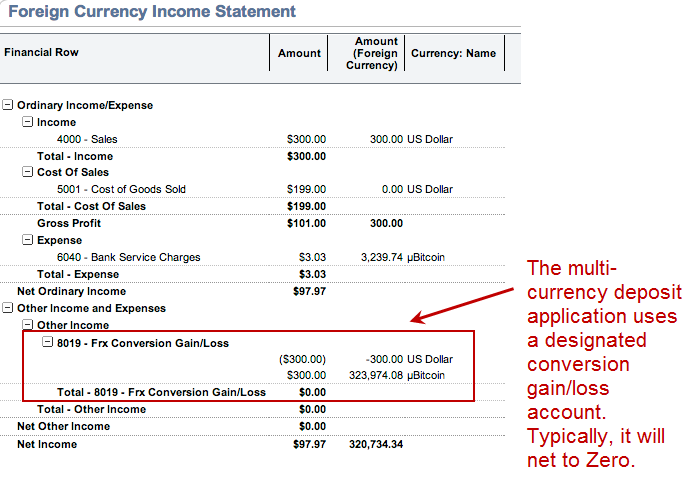

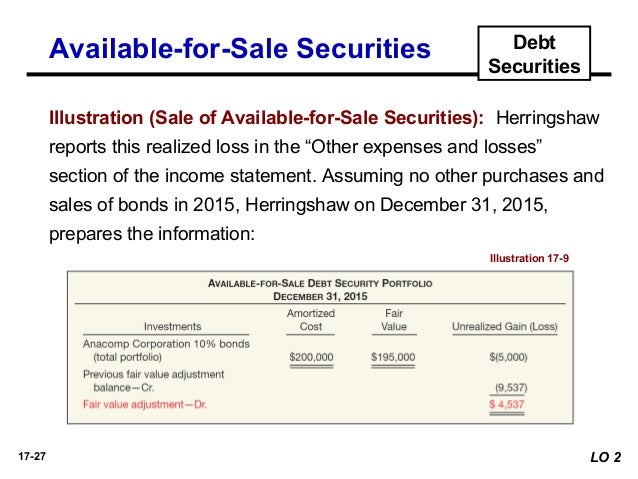

Unrealized income or losses are recorded in an account called accumulated other comprehensive income which is found in the owner s equity section of the balance sheet.

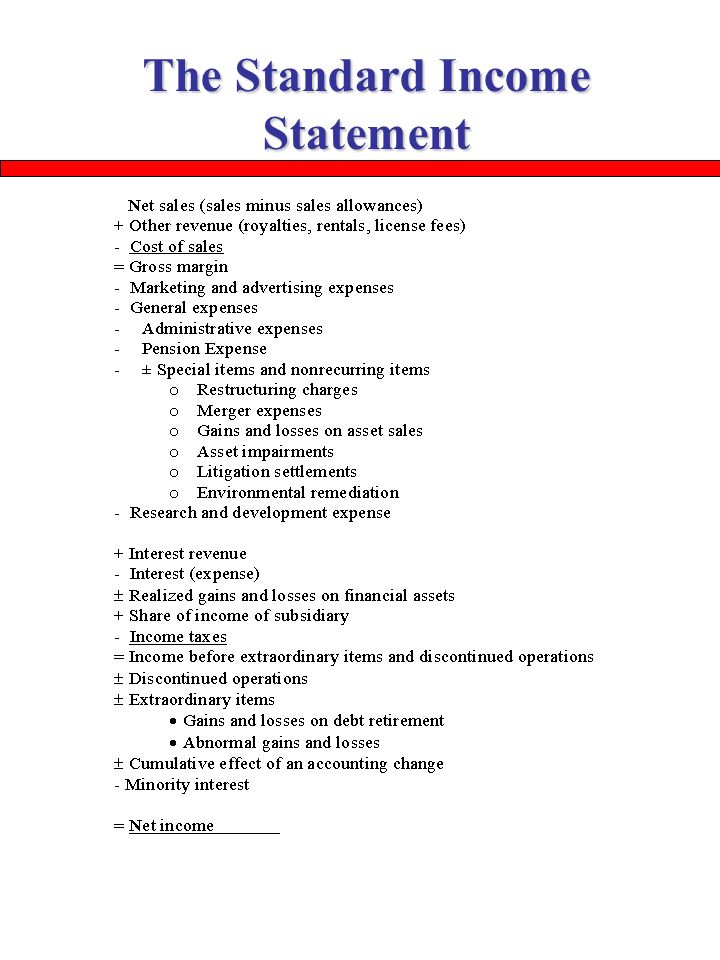

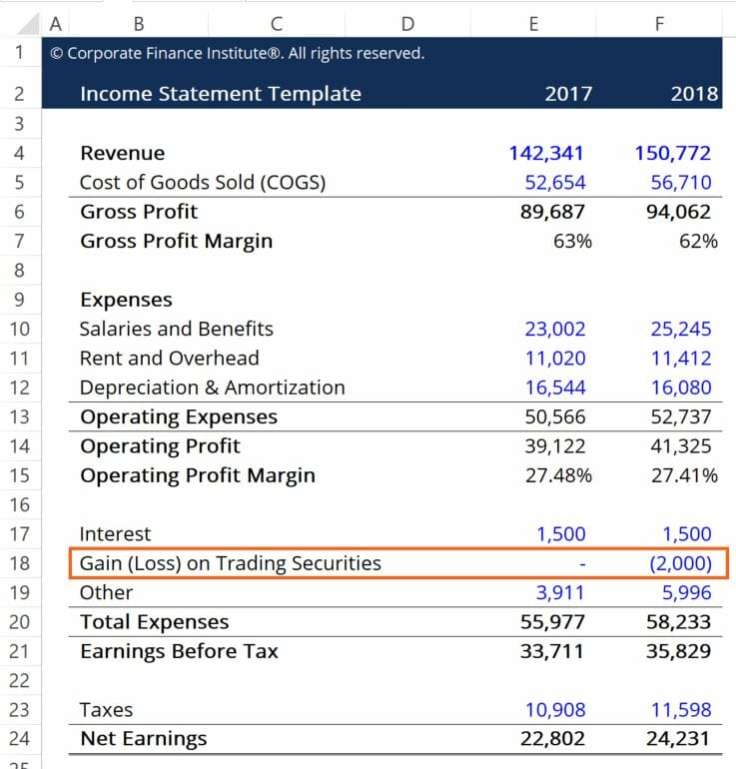

Realized gains and losses income statement. These represent gains and losses. If you sell an asset at a loss stock a car a building a subsidiary you report it as a realized loss on the income statement. Record realized income or losses on the income statement. And if your net losses.

The realized gain from the sale of the asset may lead to an increased tax burden since realized gains from sales are typically taxable income while unrealized gains are not taxable income.

Source : pinterest.com

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)