Income Statement Calculate Purchases

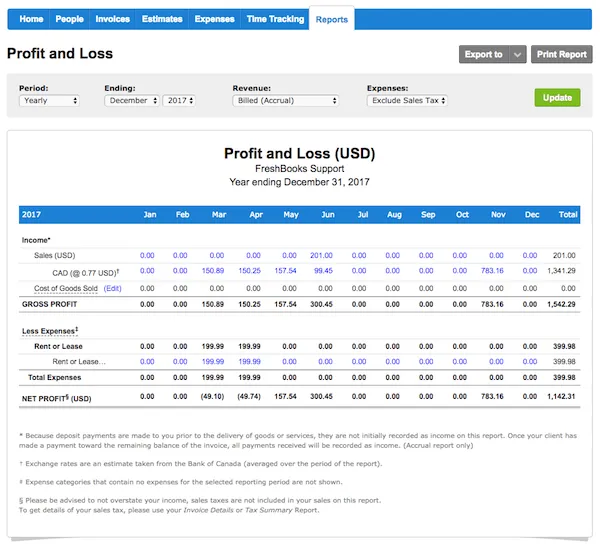

Detailed income statement for merchandise operation.

Income statement calculate purchases. Income statement showing the financial performance of a business over a period of time. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the. Each of these accounts is necessary to calculate the net purchases during a period. Example following is an illustrative example of an income statement prepared in accordance with the format prescribed by ias 1 presentation of financial statements.

Statement of financial position showing the financial position of a business at a point in time and. The calculation of inventory purchases is. There are two key elements to the financial statements of a sole trader business. Why do purchases appear as expenses on an income statement.

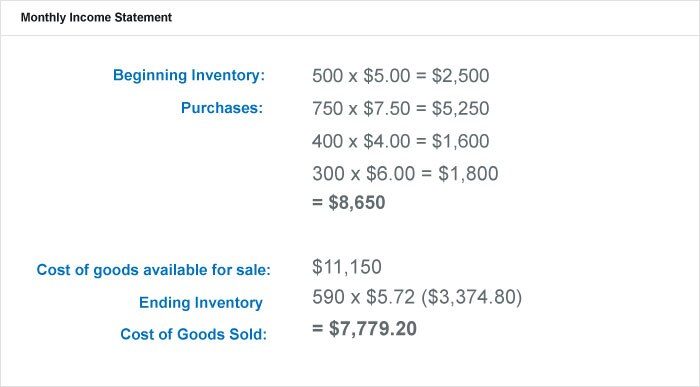

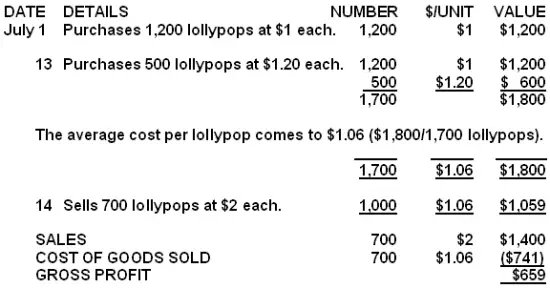

How to record cash discounts as income on a financial statement. Gross purchases are the price of the inventory you buy during an accounting period. The purchases line item on the income statement is the total invoice cost the company s suppliers billed for the inventory and net purchases is the amount the company paid excluding returns and discounts. This information appears on the income statement of the accounting period for which purchases are being measured.

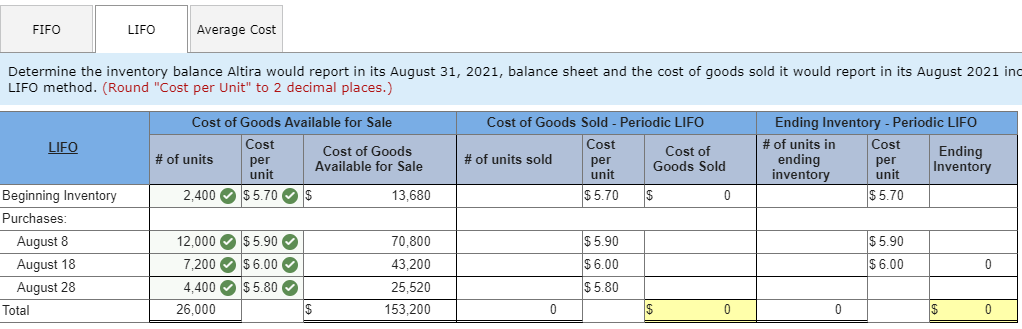

The financial statements show the effects of business transactions. Income statement also known as profit loss account is a report of income expenses and the resulting profit or loss earned during an accounting period. Purchases purchase returns and allowances purchase discounts and freight in have all been illustrated. Ending inventory beginning inventory cost of goods sold inventory purchases.

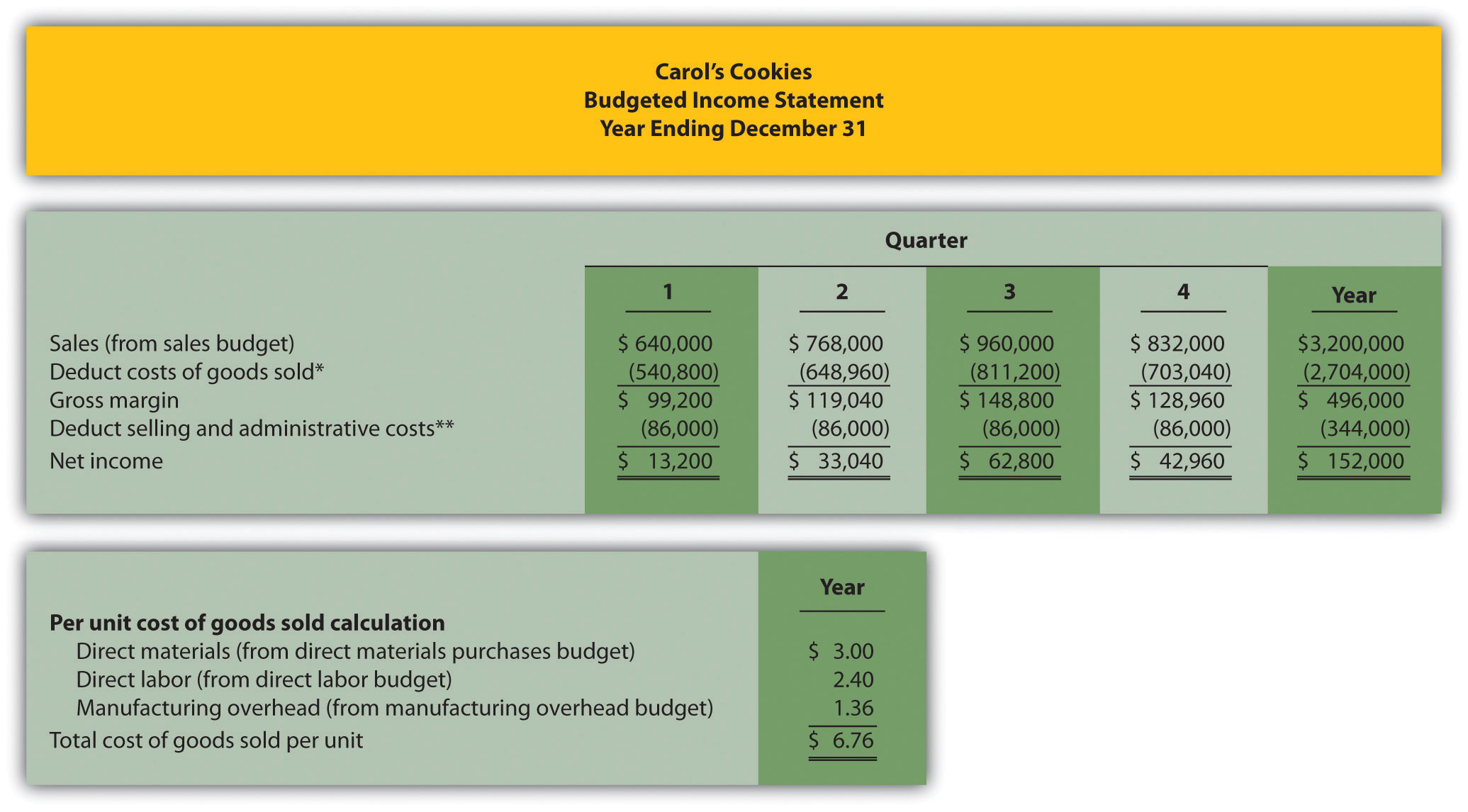

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. The income statement comes in two forms multi step and single step. Notice that the table at right reveals total purchases of 400 000 during the period. Generally the purchases of merchandise are sold in the year they are acquired.

Hence it is logical to match the current period s purchases as expenses on the same income statement that reports the current period s sales revenues. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. You can calculate net purchases using items provided on the income statement to determine how much a company paid for inventory. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually.

Thus the steps needed to derive the amount of inventory purchases are.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)