Yearly Income Tax Brackets Canada

Annual income taxable tax brackets tax rates maximum taxes per bracket maximum total tax.

Yearly income tax brackets canada. Individuals resident in canada for only part of a year are taxable in canada on worldwide income only for the period during which they were resident. For 2018 and previous tax years you can find the federal tax rates on schedule 1 for 2019 and later tax years you can find the federal tax rates on the income tax and benefit return you will find the provincial or territorial tax rates on form 428 for the. In tax year 2020 canada s income tax brackets are. In other words the last dollar you earn during the year is taxed at a higher rate than the first unless your income is very low.

The federal personal income tax rates and brackets refer to taxes payable on your taxable income which is your gross income minus deductions tax credits and other adjustments. Every year taxpayers in canada have to go through the rigorous task of figuring out how much tax to pay to the government. Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year. In canada we use a progressive income tax system.

The federal income tax rates and brackets for 2020 are. Personal income tax rates. To make it a little easier we present you all the relevant information to go through the tax paying period easily. The tax rate varies by how much income you declare at the end of the year on your t1 general income tax return the form with the exciting sounding name that you fill out at tax time and where you live in canada.

15 on the first 48 535 of taxable income plus. Personal tax credits miscellaneous tax credits and the dividend tax credit are subtracted from tax to determine the federal tax liability. 20 5 on the next 48 534 of taxable income on the portion of taxable income over 48 535 up to 97 069 plus. 26 on the next 53 404 of taxable income on the portion of taxable income over 97 069 up to 150 473 plus.

2020 federal tax bracket rates. The following are the federal tax rates for 2020 according to the canada revenue agency cra. Up to 48 535. This whole process can be tiresome and time taking.

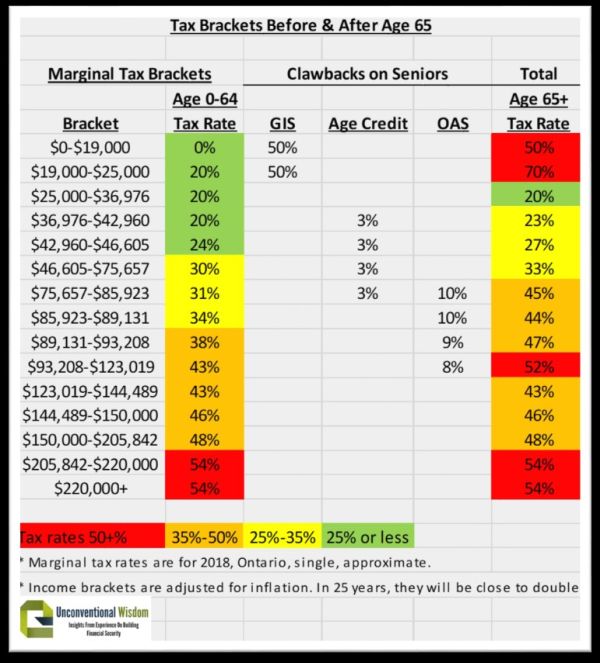

The different rates are separated into different tax brackets with each one covering a specific income range. 33 these amounts are adjusted for inflation and other factors in each tax year. Canadian income tax 101.