Withholding Tax On Rental Income Philippines

Both owners are foreigners and non residents.

Withholding tax on rental income philippines. The tax levied on the average annual income on a rental apartment property in the country. They have no other local income. Gross rental income is us 1 500 month. Properties with rental payments exceeding php12 800 us 272 per month received by landlords whose gross annual rental income does not exceed php1 919 500 us 40 840 are not subject to 12 vat.

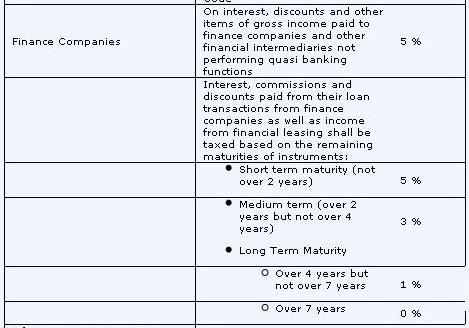

Rental income taxes. Like standard income taxes rental income tax in the philippines is also due for payment on april 15th of each year. The property is personally directly owned jointly by husband and wife. So instead of paying a sales tax for purchase of the leased equipment taxes are collected by the lessor in addition to the rentals over the lease term.

The tax collected on the average gross annual income on a rental apartment property in the country. Filing rental income tax. Rental tax is charged instead of a sales tax when equipment or properties are leased.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)