What Is The Income Statement Approach To Estimating Bad Debts

The income statement approach for estimating bad debts uses a percentage of net credit sales sales to customers in which the customers pay within 30 to 60 days are referred to as credit sales or sales on account a is.

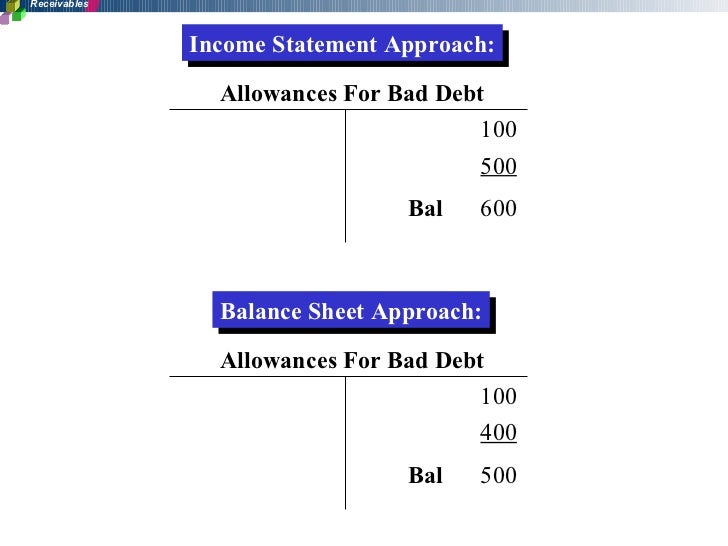

What is the income statement approach to estimating bad debts. What is the difference. It matches the revenue generated from credit sales with the expense incurred from them by recording a bad debt expense on the income statement. Income statement approach assume that based on past year experience management estimates that uncollectible debt is 3 percent of total sales. The first is an income statement approach that measures bad debt as a percentage of sales.

Estimating bad debts therefore serves two main purposes. There are two primary methods for estimating bad debt expense. This site might help you. At year end coolez corp.

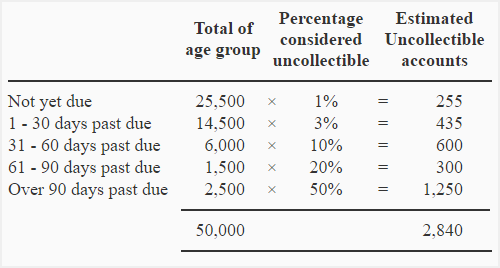

The second is a balance sheet approach that measures uncollectibles. Which of the following statements is true with respect to the percentage of credit sales method for estimating uncollectible accounts. The income statement approach for estimating bad debts uses a percentage of the amount recorded for bad debt expense does not depend on the balance of the allowance for uncollectible accounts. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement.

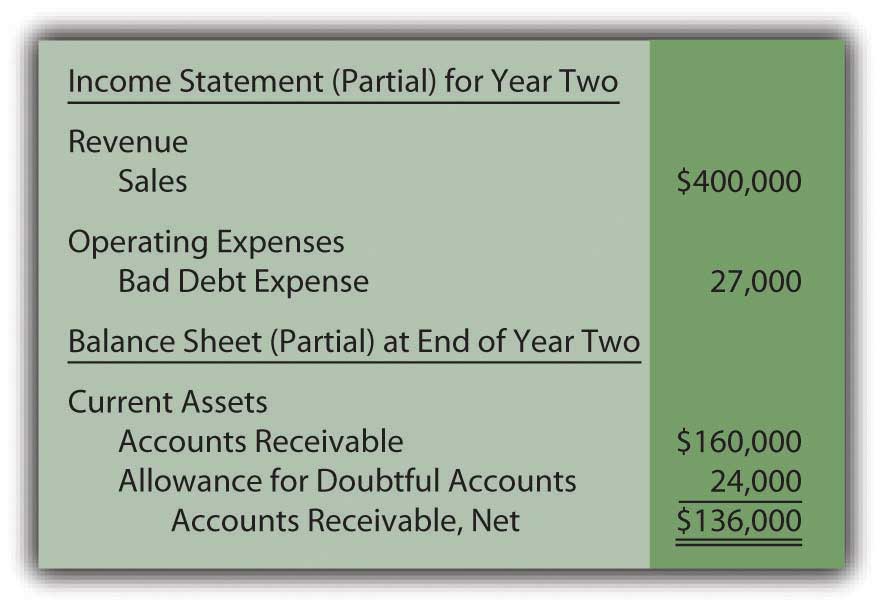

False under ifrs accounts receivable can be accounted for at fair value whenever company management wants to do so. Will record its bad loss. On the income statement bad debt expense would still be 1 of total net sales or 5 000. The income statement approach is the direct bad debt expense computation for the month period.

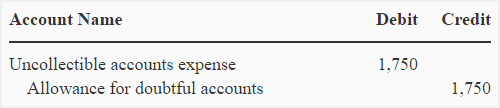

In this example estimated bad debts are 5 000. If the account has an existing credit balance of 400 the adjusting entry includes a 4 600 debit to bad debts expense and a 4 600 credit to allowance for bad debts. The income statement approach to estimating bad debts requires an adjusting entry at the end of the period to reduce receivables to net realizable value.