Bad Debt Expense Is Reported On The Income Statement As Quizlet

Bad debt expense is reported on the income statement as a.

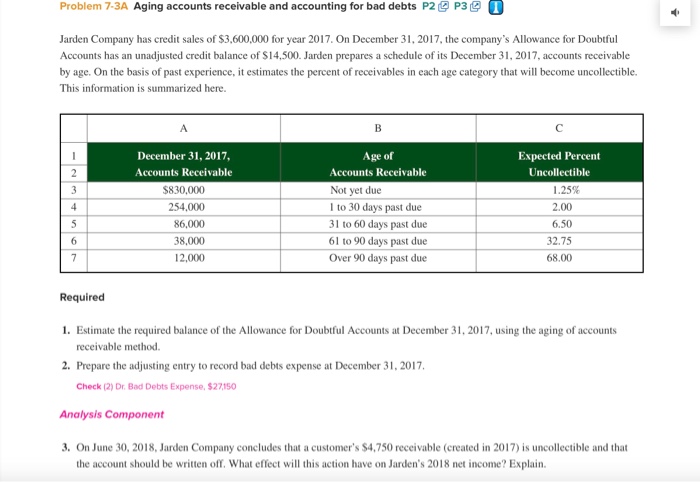

Bad debt expense is reported on the income statement as quizlet. Bad debt expense is reported on the and classified as a n. Income statement operating expense compared to other methods of estimating accounts the aging of accounts notes a sales discount is a. Part of cost of goods sold. Bad debts expense is reported on the income statement as a.

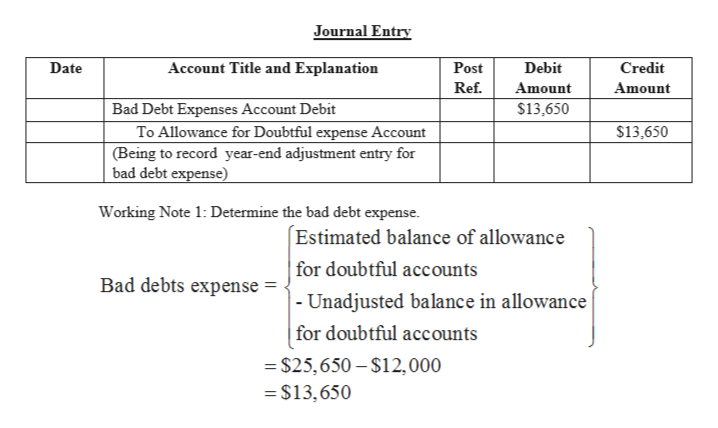

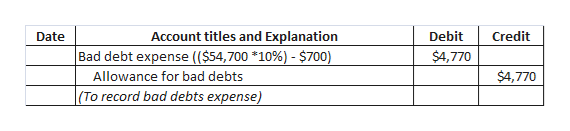

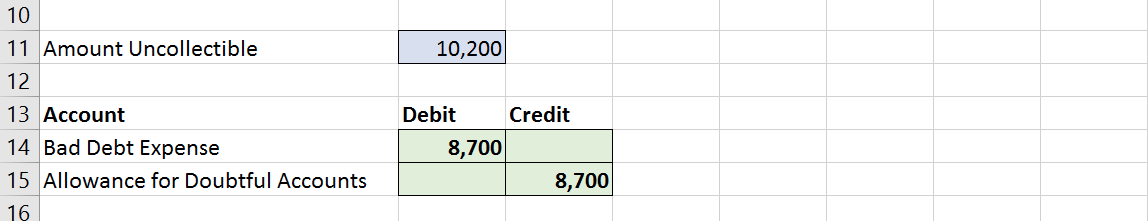

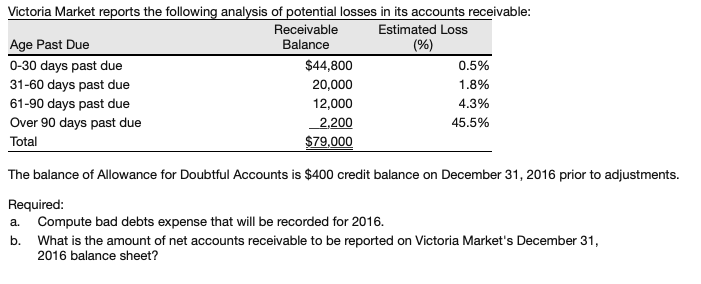

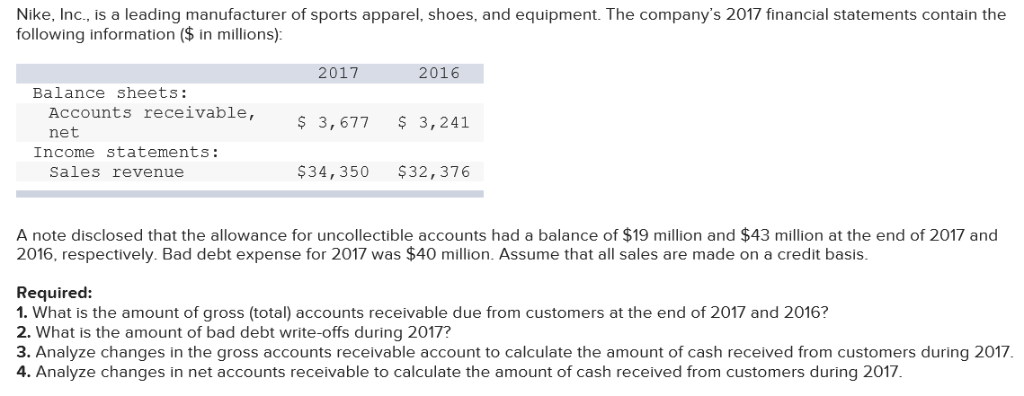

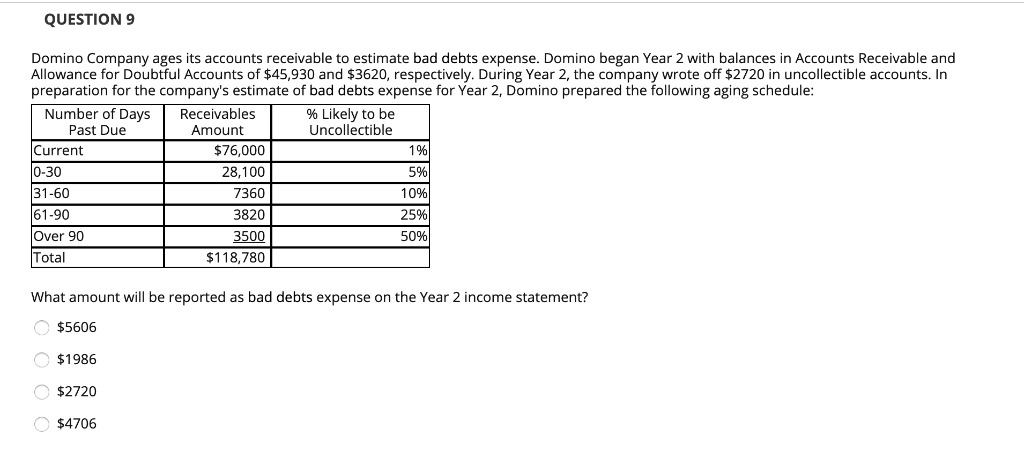

Amount reported as bad debts expense the amount reported in the income statement account bad debts expense pertains to the estimated losses from extending credit during the period shown in the heading of the income statement. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Part of cost of goods sold. Under the allowance method of accounting for uncollectible accounts the cash realizable value of accounts receivable in the balance sheet is the.

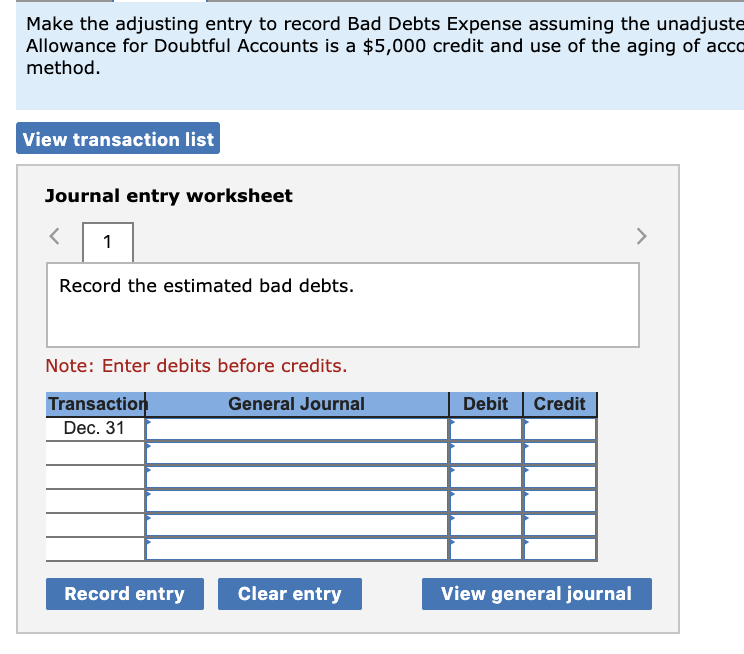

A contra revenue account. The bad debt expense appears in a line item in the income statement within the operating expenses section in the lower half of the statement. To calculate bad debt expense use the direct write off method or the allowance method. Why is there a difference in the amounts for bad debts expense and allowance for doubtful accounts.

An expense subtracted from net sales to determine gross profit. For instructor use only 8 53 solution 210 3 min. Bad debt expense is reported on the income statement as. Bad debt expense is account receivables that are no longer collectible due to customers inability to fulfill financial obligations.

A contra revenue account. Recognizing bad debts leads to an offsetting reduction to accounts. As an example of the allowance method abc international records 1 000 000 of credit sales in the most recent month. An expense subtracted from net sales to determine gross profit.

An operating expense actual uncollectible accounts are. Bad debt expense is reported on the income statement as an operating expense.