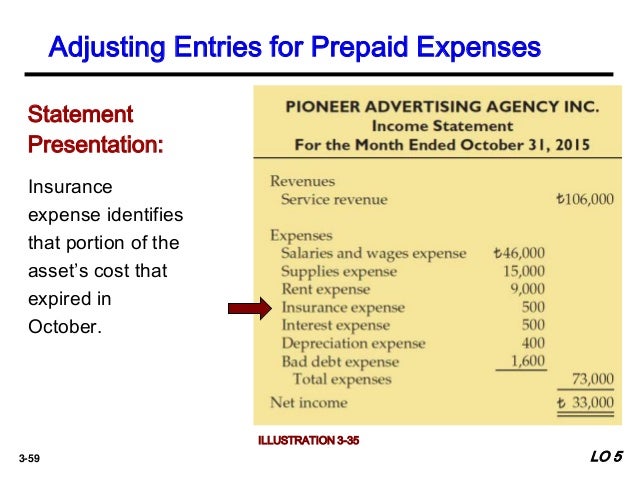

Bad Debt Expense Income Statement Presentation

Bad debts are thus included as an expense in the income statement but not included as a line item in the cash flow statement direct method.

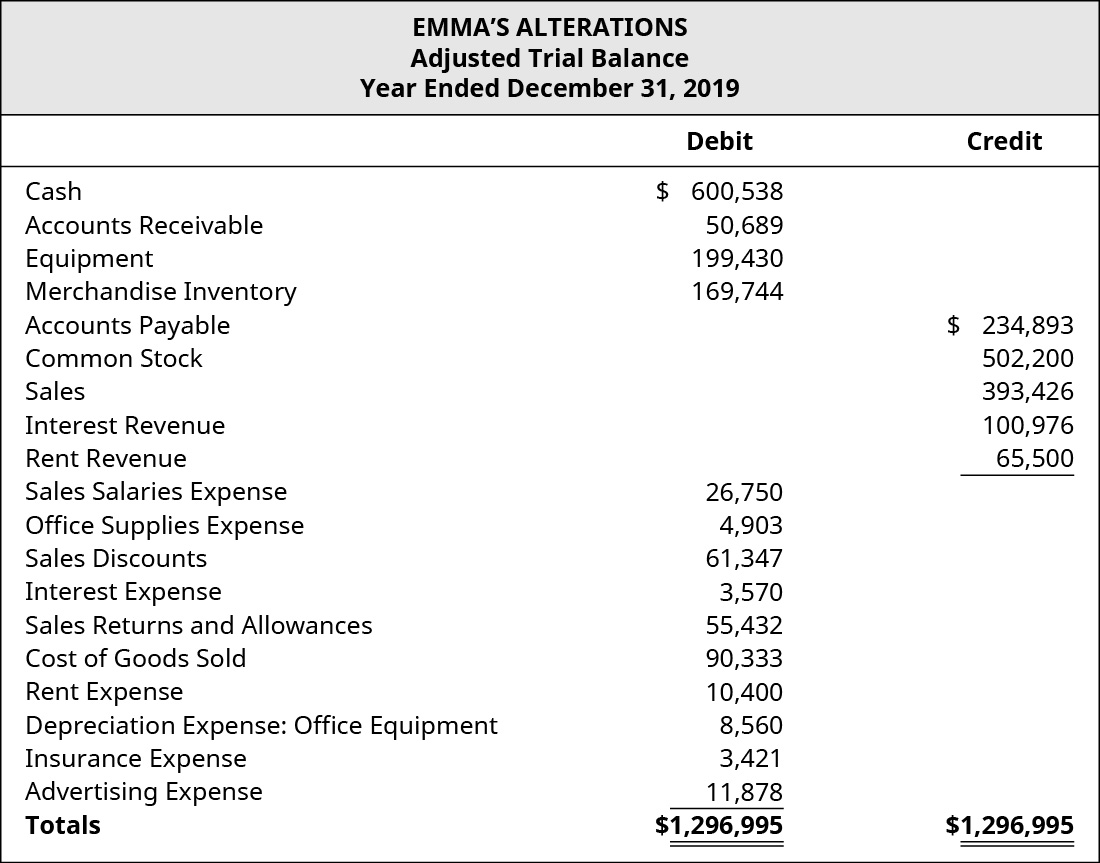

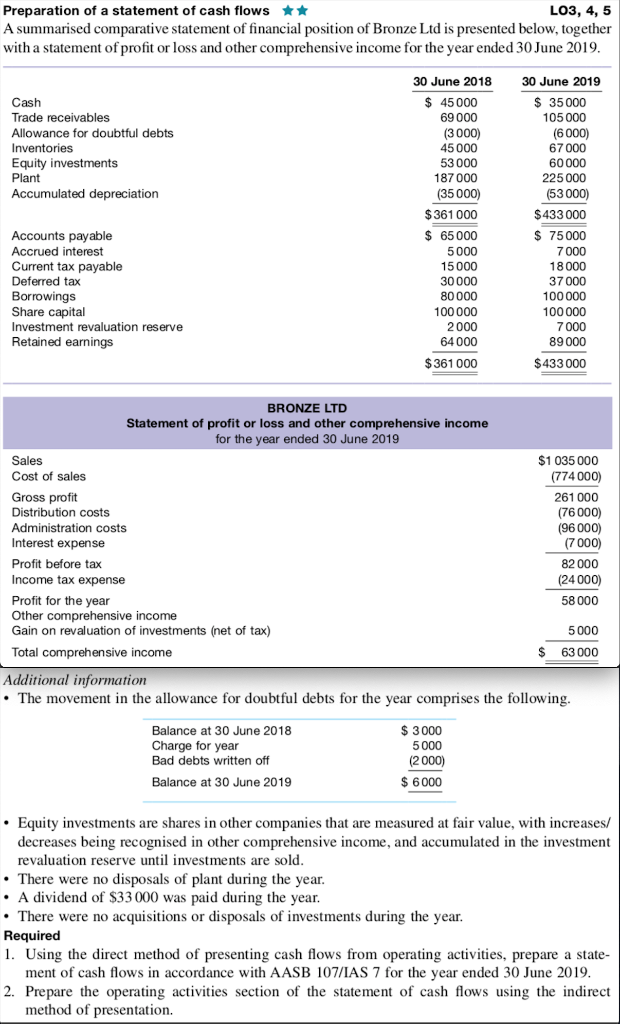

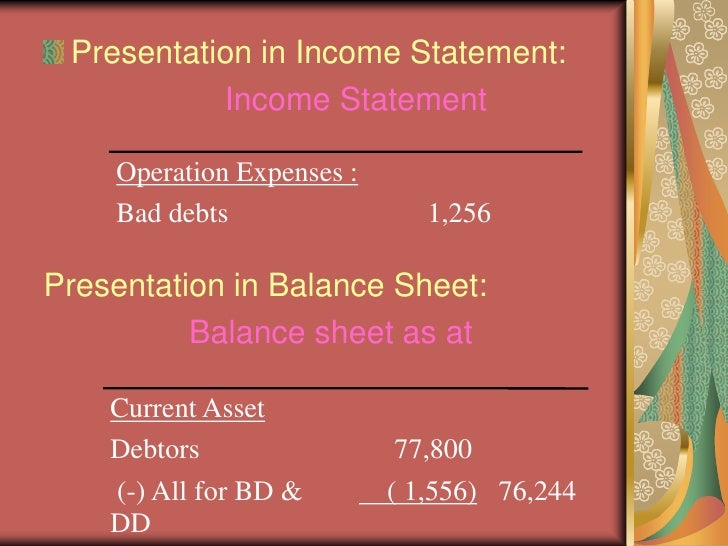

Bad debt expense income statement presentation. It should be noted that bad debts do however form part of the calculation of cash generated from operations when using the indirect cash flow statement which is the preferred method in the us. Suppose hasty hare had current accounts receivable of 160 000 and an allowance for doubtful accounts balance of 12 000. Allowance for doubtful accounts on the balance sheet. Bad debt expense is something that must be recorded and accounted for every time a company prepares its financial statements.

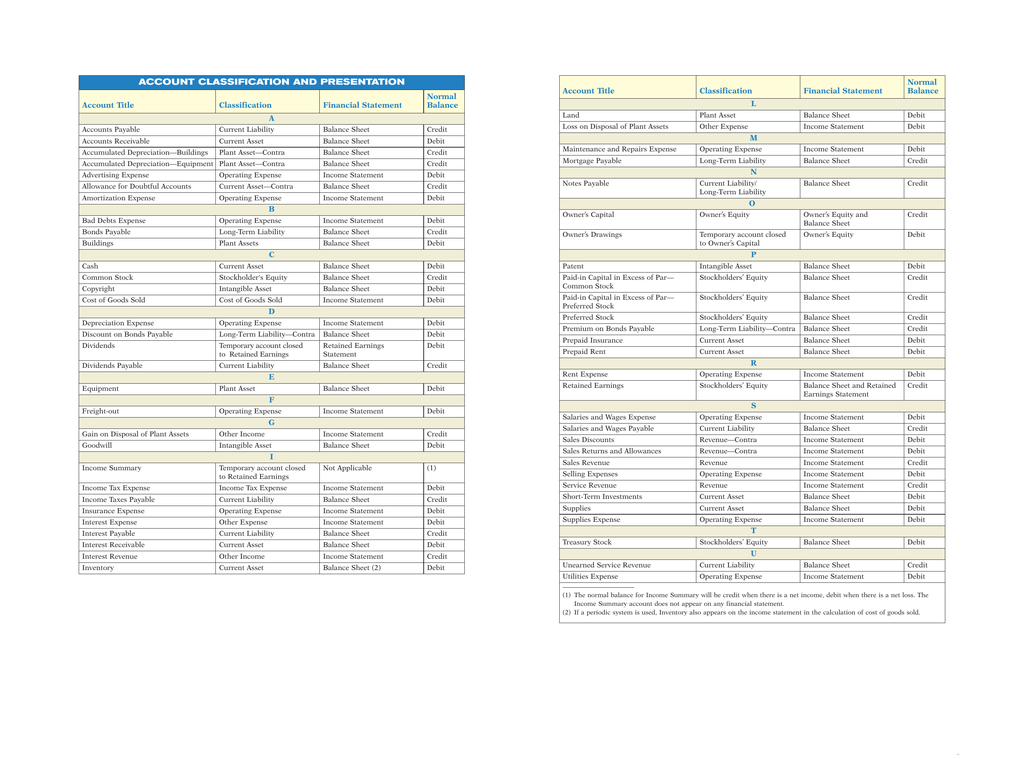

2014 09 revenue from contracts with customers eliminates these types of industry specific presentation rules leading to a major change to how health care organizations present their revenues. Recognizing bad debts leads to an offsetting reduction to accounts. This bad debts expense account will be shown separately under operating expenses on the income statement. Bad debt expense is reported on the income statement bad debt is the expense account which will show in the operating expense of the income statement.

The difference is recorded in the income statement as a provision for bad debt expense and helps calculate net revenue. Bad debt expense is the amount of an account receivable that cannot be collected. Non interest income condensed for presentation purposes non interest expense condensed for presentation purposes 24 income before income taxes income tax expense net income net income available to common 25 26. Bad debt expense also helps companies identify which customers default on payments more often than others.

Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Accounting standards update asu no. Under the allowance for doubtful accounts method bad debt expense is recorded based on monthly sales. Revenue recognition guidance alters presentation of bad debt for healthcare organizations hospitals clinics and other healthcare organizations should prepare for big changes when implementing fasb s sweeping new rules to calculate the top line in their income statements.

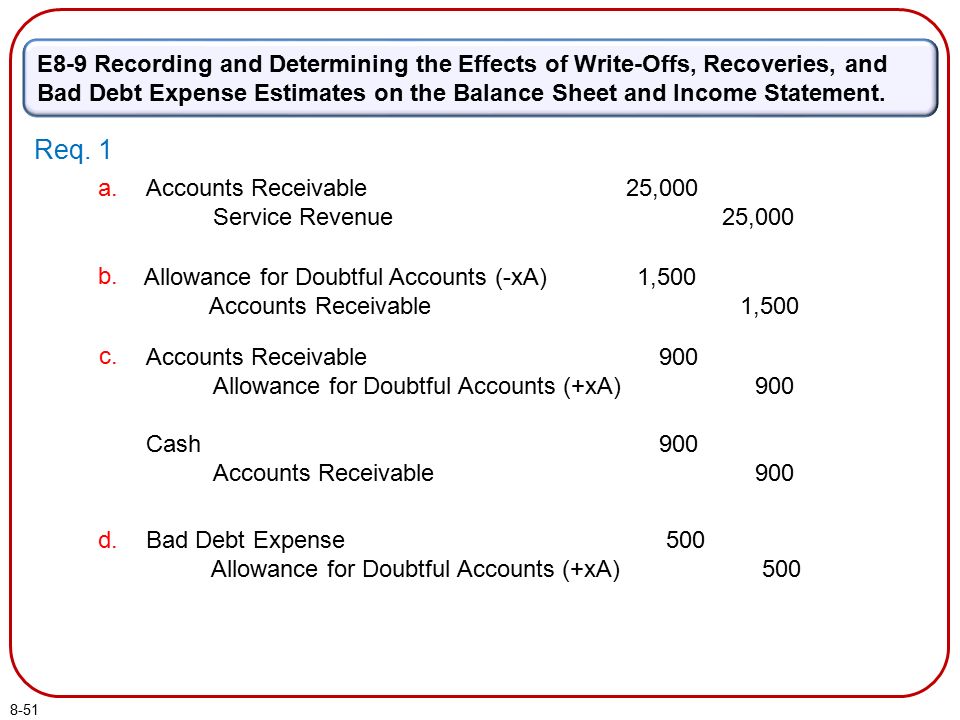

The monthly bad debt expense is added to the allowance for doubtful accounts as a contra account to accounts receivable. An amount that will never be collected is considered a bad debts expense. The customer has chosen not to pay this amount either due to financial difficulties or because there is a dispute over the underlying product or service sold to the customer.