Are Income Statement Accounts Permanent

A permanent accounts are reported on the balance sheet.

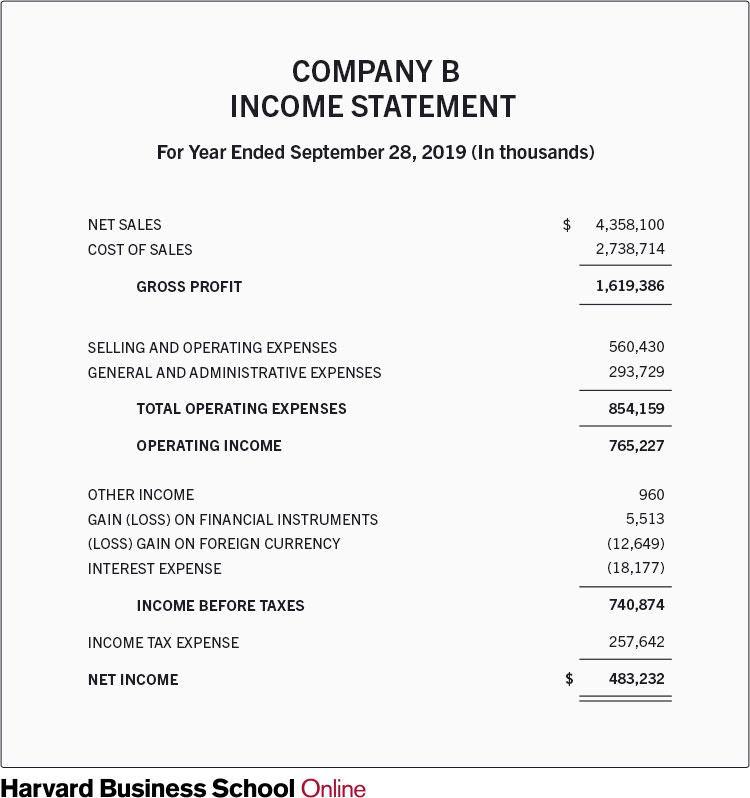

Are income statement accounts permanent. The process of transferring the balances from the temporary accounts to the permanent account i e the retained earnings account is referred to as closing the accounts or closing the books. Similar terms permanent accounts are also known as real accounts. All accounts that are aggregated into the income statement are considered temporary accounts. At the end of the accounting cycle the income summary account is closed to the retained earning account.

Retained earnings however isn t closed at the end of a period because it is a permanent account. When you close a temporary account at the end of a period you start with a zero balance in the next period. These are mostly income statement accounts except for a distribution account that is an equity statement account. Permanent accounts balance sheet permanent accounts should be actively managed to ensure the correct dollar amount is present.

Temporary accounts are also called nominal accounts. Permanent accounts which are also called real accounts are company accounts whose balances are carried over from one accounting period to. An income summary is a temporary account that closes out entries for an accounting period and reports retained earnings. B permanent accounts will appear on a post closing trial balance.

Every year the income and expense accounts are reported on the income statement and then closed out to the income summary account. The income statement accounts are called temporary accounts because at the end of the year these accounts are closed. Temporary accounts are also called nominal accounts. All income statement accounts are considered temporary accounts.

You must close temporary accounts to prevent mixing up balances between accounting periods. These are the revenue expense gain and loss accounts.