Income Tax Authorities Definition

Below sections deal with income tax authorities wiki slug section 116 income tax authorities wiki slug section 117 appointment of income tax authorities.

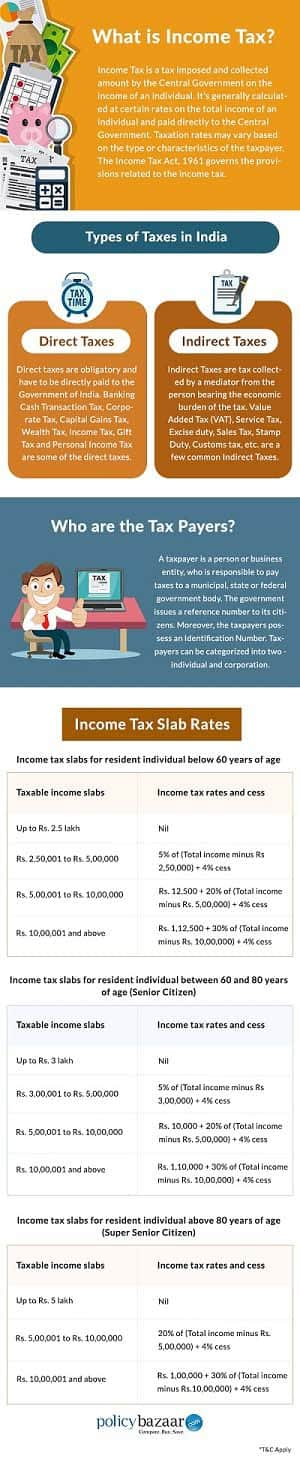

Income tax authorities definition. The only definition that has been found to be completely consistent and free from anomalies and capricious results is accrued income which is the money value of the goods and services consumed by the taxpayer plus or minus any change in net worth. Income tax income tax the meaning of income. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law. Income tax authorities and their powers the government of india has constituted a number of authorities to execute the income tax act and to control the income tax department efficiently.

The central board of direct taxes is the supreme body in the direct tax set up. Taxes have been called the building block of civilization. Iv control of income tax authorities sec. 118 the board may by notification in the official gazette direct that any income tax authority or authorities specified in the notification shall be subordinate to such other income tax authority or authorities as may be specified in such notification.

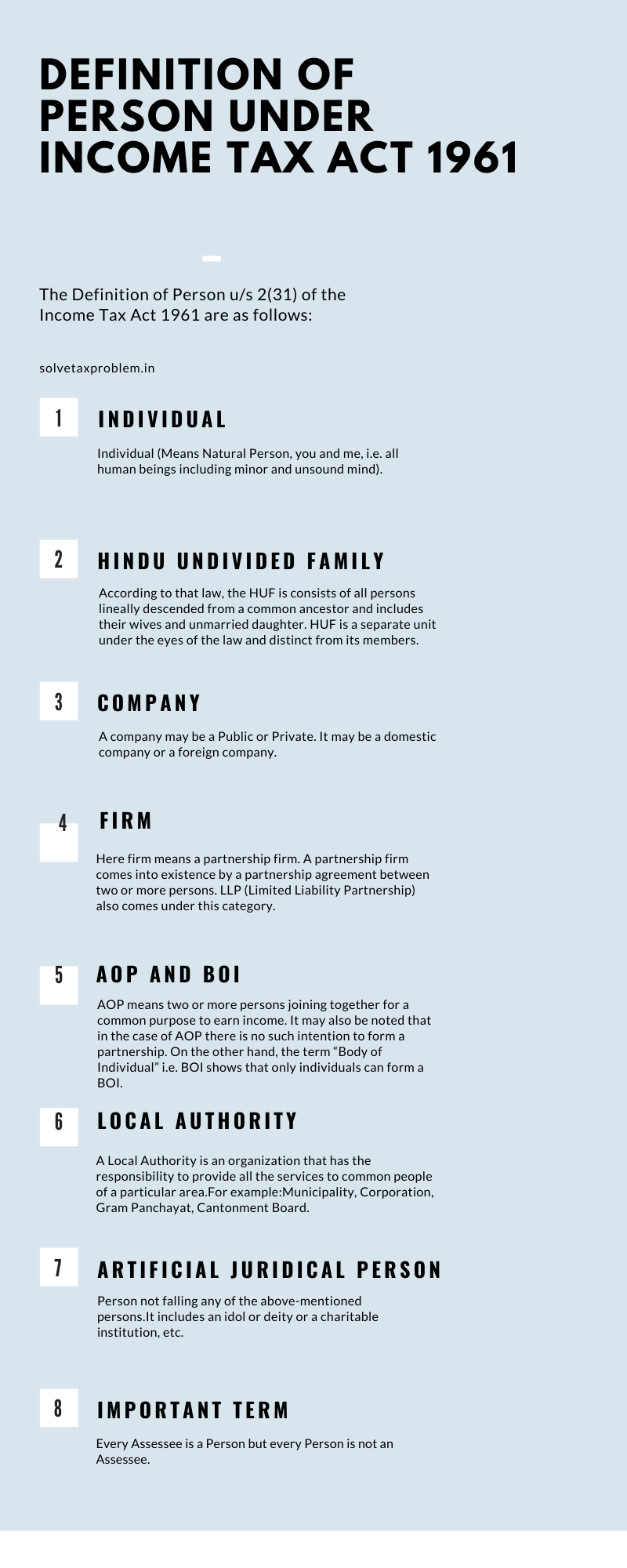

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Whether income is an accurate measure of taxpaying ability depends on how income is defined. It has to preform several statutory functions under the various acts and it is. These authorities are defined under the income tax act 1961.