Bad Debt Expense Income Statement Ifrs

With both methods the bad debt expense needs to record in the income statement by a different time.

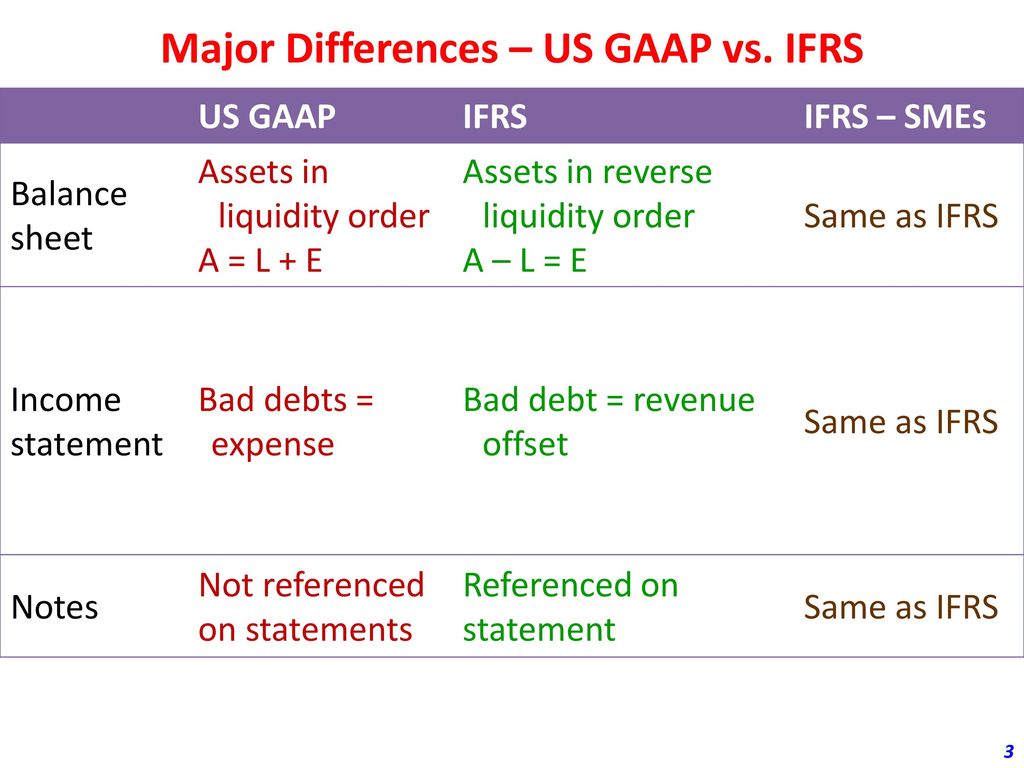

Bad debt expense income statement ifrs. A corporate accounting manager records bad debt expense at fair market value. As a result of this analysis the staff recommended the following presentation in the statement of comprehensive income. Bad debt or the total of noncollectable customer receivable amounts is an operating expense. A company s top leadership generally monitors bad debt levels in corporate financial statements to ensure that operating expenses and losses do not exceed budgeted amounts.

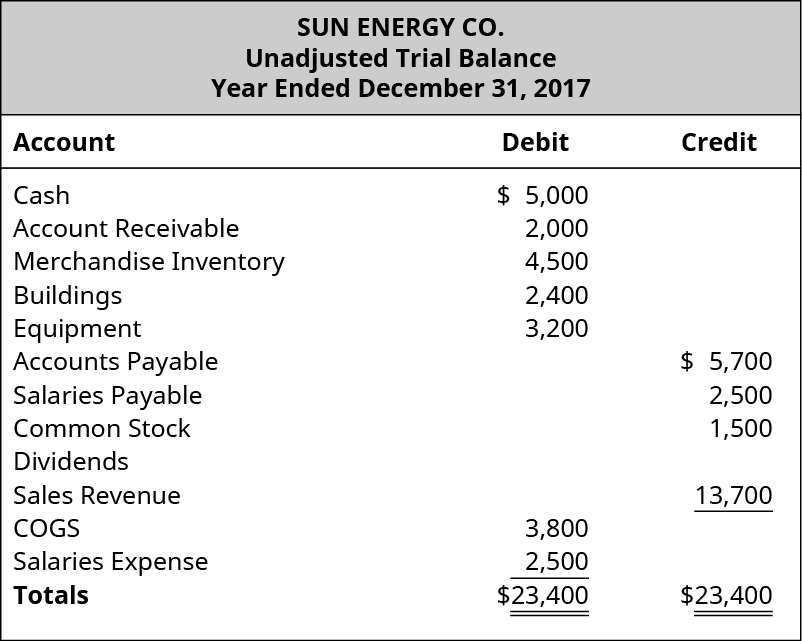

Accounts receivable aging method. The sections of a multi step income statement include. This method is based on an evaluation of the collectibility of accounts receivable. Bad debt expense is reported on the income statement bad debt is the expense account which will show in the operating expense of the income statement.

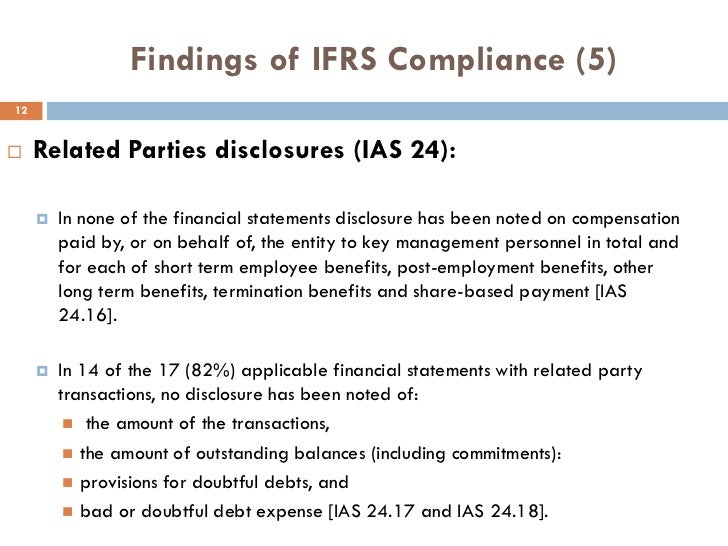

These are the expenses that are directly related to operations of the company like selling general and administrative expenses. Record the cash receipt from the bad debt recovery which is a debit to the cash account and a credit to the accounts receivable asset account. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Presenting amounts resulting from a negative interest rate on a financial asset as an expense other than interest expense and in a line item that does not roll up into the mandatory line item for finance costs.

If the original entry was instead a credit to accounts receivable and a debit to bad debt expense the direct write off method then reverse this original entry. Now luckily ifrs 9 tells us how to create bad debt provision for trade receivables and how to get these percentages. Accordingly they enter a bad debt expense of 3 000 on the company s monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet. Bad debt expense dr provision for bad debts cr this is a good practice to keep some provision of bad debts some of your receivables every year so that any future bad debts can not put bad impact on your future income statement.

This section includes total sales the cost of goods sold and the difference between the two which is gross profit. Recognizing bad debts leads to an offsetting reduction to accounts. The bad debt expense appears in a line item in the income statement within the operating expenses section in the lower half of the statement. As an example of the allowance method abc international records 1 000 000 of credit sales in the most recent month.