When An Income Statement Shows Data

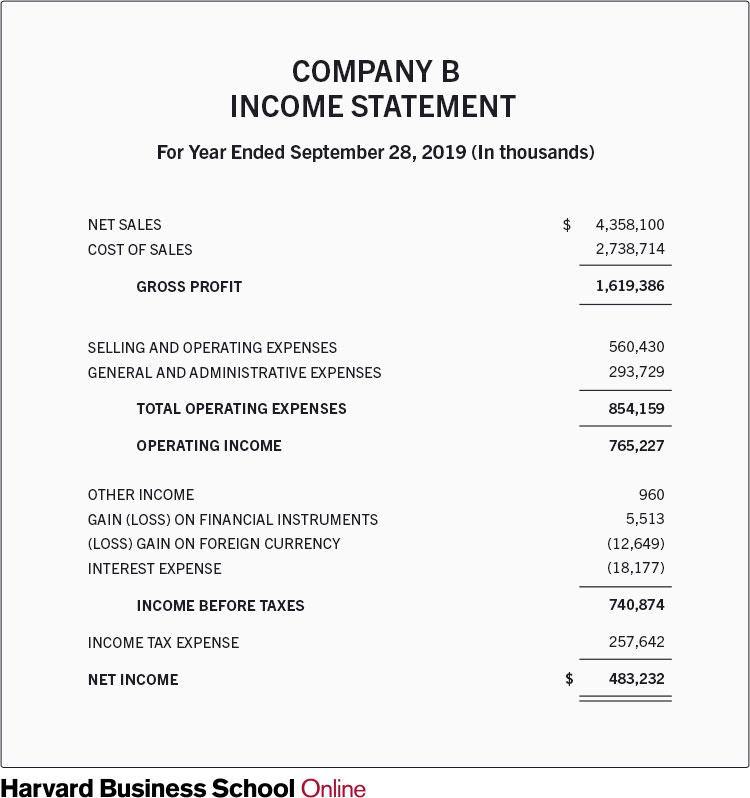

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

When an income statement shows data. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. The first line on any income statement or profit and loss statement deals with revenue. The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period. With the help of a comparative income statement format in one snapshot the performance of a company over different periods can be.

Common fixed expenses should be allocated to the segments. All expenses should be allocated to the segments. The income statement comes in two forms multi step and single step. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually.

Not surprisingly the income statement is also known as the profit and loss statement. The income statement also known as the profit and loss p l statement is the financial statement that depicts the revenues expenses and net income generated by an organization over a specific. The exact wording may vary but you can look for terms like gross revenue gross sales or total sales this figure is the amount of money a business brought in during the time period covered by the income statement. Comparative income statement shows absolute figures changes in absolute figures absolute data in terms of percentages and also as an increase or decrease in terms of percentages over the different periods.

The income statement is a report showing the profit or loss for a business during a period as well as the incomes and expenses that resulted in this overall profit or loss. When you show the items of the income statement as a percentage of the sales figure it is easy to compare the income and expenses and understand the financial position of the company. Common size analysis is an excellent tool to compare companies of different sizes or to compare different years of data for the same company as in the example. When an income statement shows data for segments of the organization and data for each segment are added together to get totals for the whole organization.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)