Define Partial Income Statement

An income statement or profit and loss account also referred to as a profit and loss statement p l statement of profit or loss revenue statement statement of financial performance earnings statement statement of earnings operating statement or statement of operations is one of the financial statements of a company and shows the company s revenues and expenses during a particular period.

Define partial income statement. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. The income statement is an essential part of the financial statements that an organization releases. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business.

The income statement shows the business s income expenses gains and losses. The multiple step profit and loss statement segregates the operating revenues and operating expenses from the nonoperating revenues nonoperating expenses gains and losses. Some also call the income statement a statement of profit and loss or p l. The income statement may be presented by itself on a single page or it may be combined with other comprehensive income information.

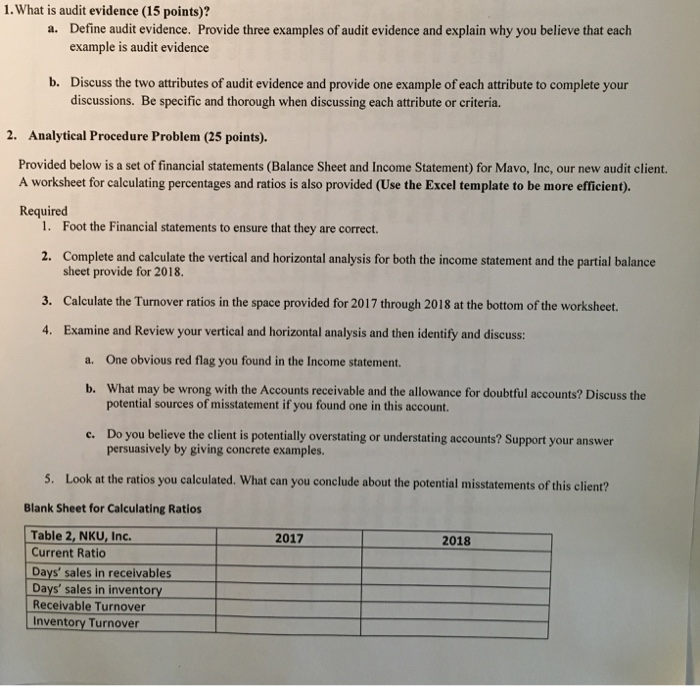

The other parts of the financial statements are the balance sheet and statement of cash flows. The income statement is an important part of a company s performance reports that must be submitted to the securities and exchange commission sec. The income statement is one of the major financial statements used by accountants and business owners. A partial income statement reports information for only part of a normal accounting period this tends to be a special purpose document that is only used once.

Normally we prepare an income statement for a single month or for a year. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. Generally accepted accounting practices gaap also refer to this report as statement of income because the income statement shows. The end product of these transactions is net income or loss.

An alternative to the single step income statement is the multiple step income statement because it uses multiple subtractions in computing the net income shown on the bottom line. A partial income statement is generally prepared by the company when there are certain or uncertain changes that affect the company s financial performance and is reported for only a part of the accounting period.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/Poverty2018Final-b00e22ebb1e146baa8028d834b593a73.jpg)