Kansas State Income Tax Brackets 2020

This page has the latest kansas brackets and tax rates plus a kansas income tax calculator.

Kansas state income tax brackets 2020. While living in kansas. The kansas tax calculator is designed to provide a simple illlustration of the state income tax due in kansas to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator. Kansas income tax rate 2019 2020. Tax year 2018 and all tax years thereafter taxable income not over 30 000.

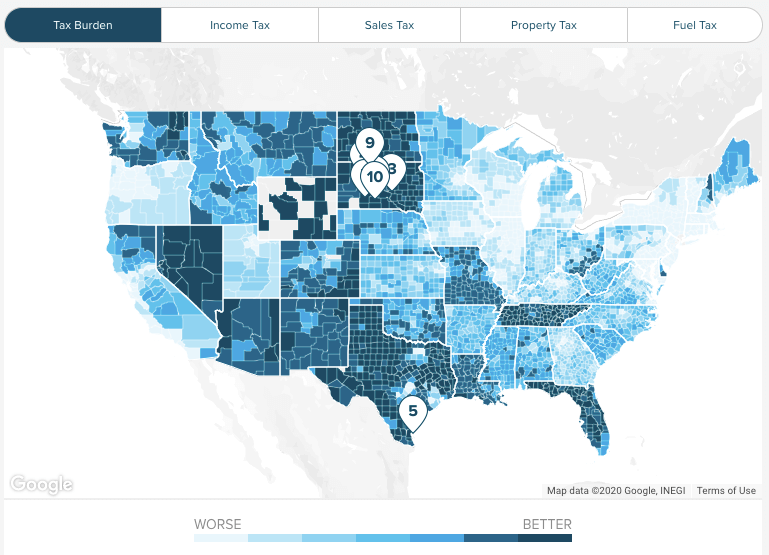

The highest kansas tax rate increased from 5 2 to 5 7 last year up from 4 6 for the 2016 income tax year. You must make estimated tax payments if your estimated kansas income tax after withholding and credits is 500 or more. Indexing of the brackets was frozen at 2018 levels for tax years 2019 and 2020 but is set to resume in 2021. You will need to complete your federal income tax return prior to completing your kansas k 40.

Income tax tables and other tax information is sourced from the kansas department of revenue. Kansas 2020 income tax ranges from 3 1 to 5 7. Individual income tax tax rates resident married joint. 79 32 110 taxable income over 30 000 but not over 60 000.

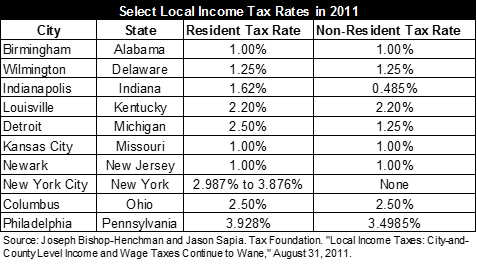

Your withholding and credits may be less than the smaller of. Start filing your tax return now. State top rate 2019 number of brackets 2019 top rate 2020 number of brackets 2020 individual income tax. The state s seven individual income tax brackets were consolidated into five with the first two brackets eliminated and each of the remaining marginal rates was reduced by 4 percent.

B 100 of the tax shown on your 2019 tax return. Detailed kansas state income tax rates and brackets are available on this page. There are 127 days left until taxes are due. 930 plus 5 25 of excess over 30 000 k s a.

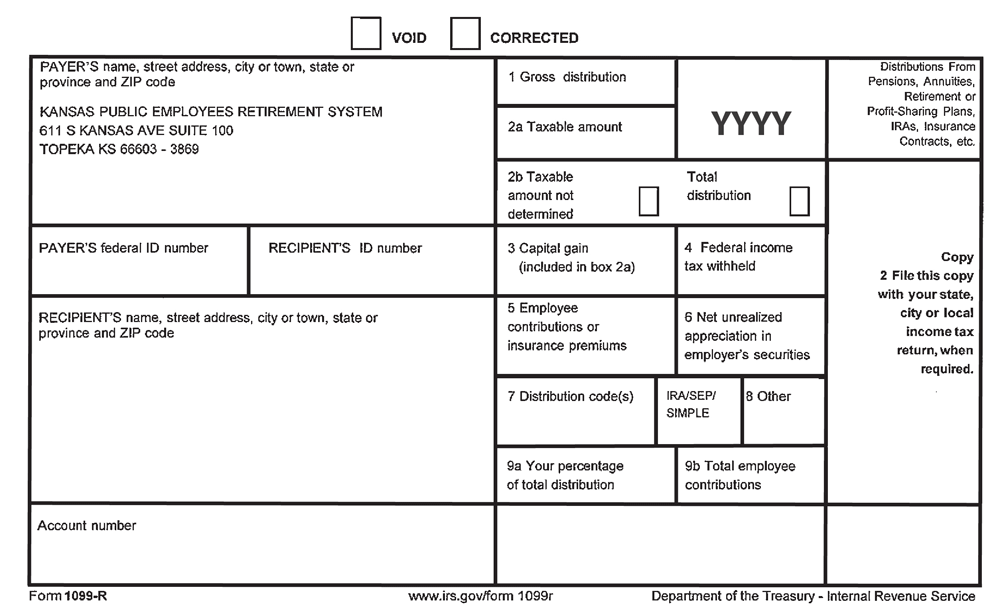

Kansas residents and nonresidents of kansas earning income from kansas sources are required to annually file an income tax return k 40. The kansas income tax has three tax brackets with a maximum marginal income tax of 5 70 as of 2020. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The corporate income and franchise tax rates in florida were set to revert back to the 2018 rate of 5 5 percent but legislation was enacted extending the 2019 rates to 2020 and 2021.

2020 kansas tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)