Income Tax Withholding Rules Pakistan

Updated up to june 30 2020.

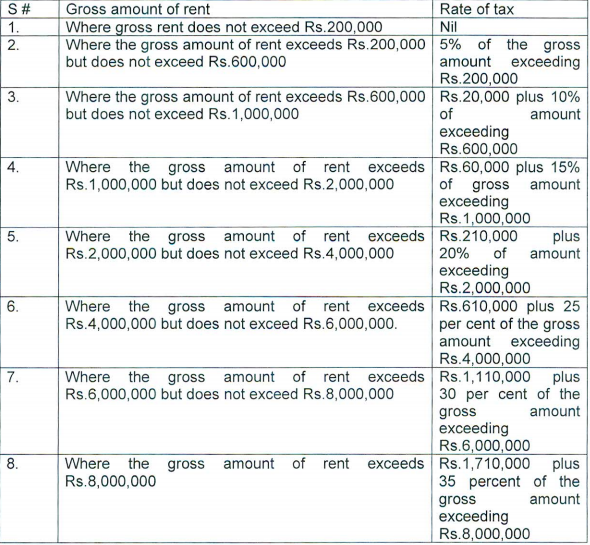

Income tax withholding rules pakistan. Main source of revenue by govt. Withholding tax rates applicable withholding tax rates. If a reduced rate is available in a tax treaty such rate would be applicable. Explains the provisions of the income tax ordinance 2001 governing withholding tax in a simple and concise manner.

Almost 70 percent revenue source as reported in 2017. Inherited from income tax act 1922 in which withholding concept of salary and interest was present only. Section 165 filing of income tax biannual withholding statement itrp services pakistan january 08 2020 every person collecting tax under division ii of this part 1 or chapter xii 2 or the tenth schedule or deducting tax from a payment under division iii of this part 3 or chapter xii 4 or the tenth schedule shall 5 furnish to the. The tax withheld is deemed to be the final tax liability of the non resident.

O persons from whom tax is to be deducted or collected. In general payments made on account dividend interest royalties and fee for technical services income derived from pakistan sources are subject to a 15 withholding tax wht which tax has to be withheld deducted from the gross amount paid to the recipient. In the case of a non resident where royalty or fts is attributable to a pe in pakistan the amount of royalty fts shall be chargeable to tax as normal income. Tax laws amendment ordinance 2016 8 ordinance no xv of 2015 the exemption of withholding tax under sub section 4 of section 236p of the income tax ordinance 2001 available to pakistan real time interbank settlement mechanism prsm has been withdrawn.

Withholding income tax regime wht rates card guideline for the taxpayers tax collectors withholding tax agents as per finance act 2020 updated up to june 30 2020 disclaimer this withholding tax rates card is just an effort to have a ready reference and to facilitate all the stakeholders of withholding tax regime. It mainly revolves around the obligations of the withholding agents as to collection or deduction of tax at source i e.