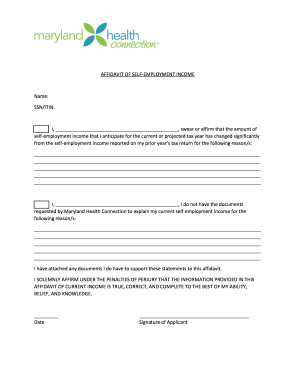

Income Verification Form Maryland Health Connection

Calculating your projected yearly income report changes in your income and household size you should report changes in your household size and income to maryland health connection at 1 855 642 8572 tty.

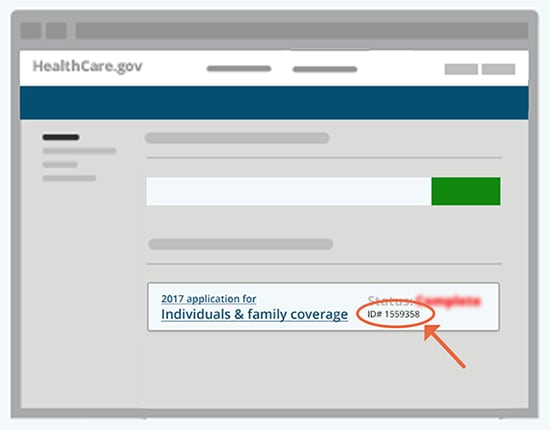

Income verification form maryland health connection. Affidavit of self employment income. I know that if i lie on this form my health coverage might end and i might have to repay massachusetts for any tax credits or health benefits i got. Time is running out. When you apply through maryland health connection you may be requested to provide documentation to verify information you provided in your application.

I understand if i am determined eligible for medicaid or a qualified health plan i must report any and all changes including changes in income address household members or pregnancy status within 10 days to the maryland health connection or my local health department or social services or i can do this by logging into my online account at. For more information on reporting your income see irs publication 525. We need to verify your income so you can keep any help you get with marketplace premiums and cost sharing. Signed affidavit for individuals with no income applicants who do not currently have any income can submit a signed affidavit of current income to verify their self attestation of 0 income.

Requested by maryland health connection to explain my current self employment income for the following reason s. I have attached any documents i do have to support these statements to this affidavit. Dhs fia 491 change report form 2 2020 pdf. The affidavit of current income is an acceptable form of.

1 855 642 8573 to be sure you are receiving the right amount of tax. This form is available on the maryland health connection website here. Affidavit for frequently changing monthly income. The following types of documents are accepted at marylandhealthconnection gov for verifications related to income identity residency social security number citizenship or immigration status.

If you have operated your business for at least a year and have a signed copy of the most recent year s federal tax return including all schedules and attachments and you do not anticipate your income will change by more than 10 percentin the coming year supply your. Other evidence could include a signed contract. Use this affidavit if you or a household member has income that changes from month to month for example due to seasonal or contractual work and you do not have any other evidence to provide. Applicant or member signature date mm dd yyyy step 3 return this signed form in one of these 3 ways.

1 fia change report form. Taunton ma 02780.