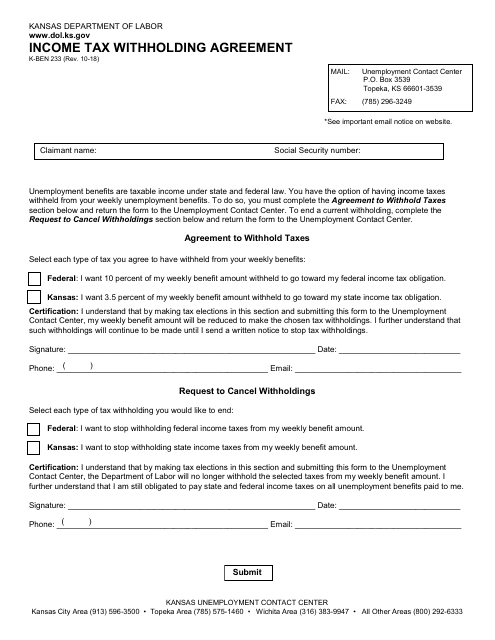

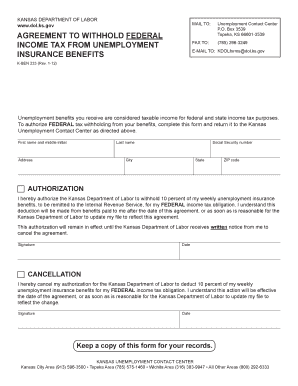

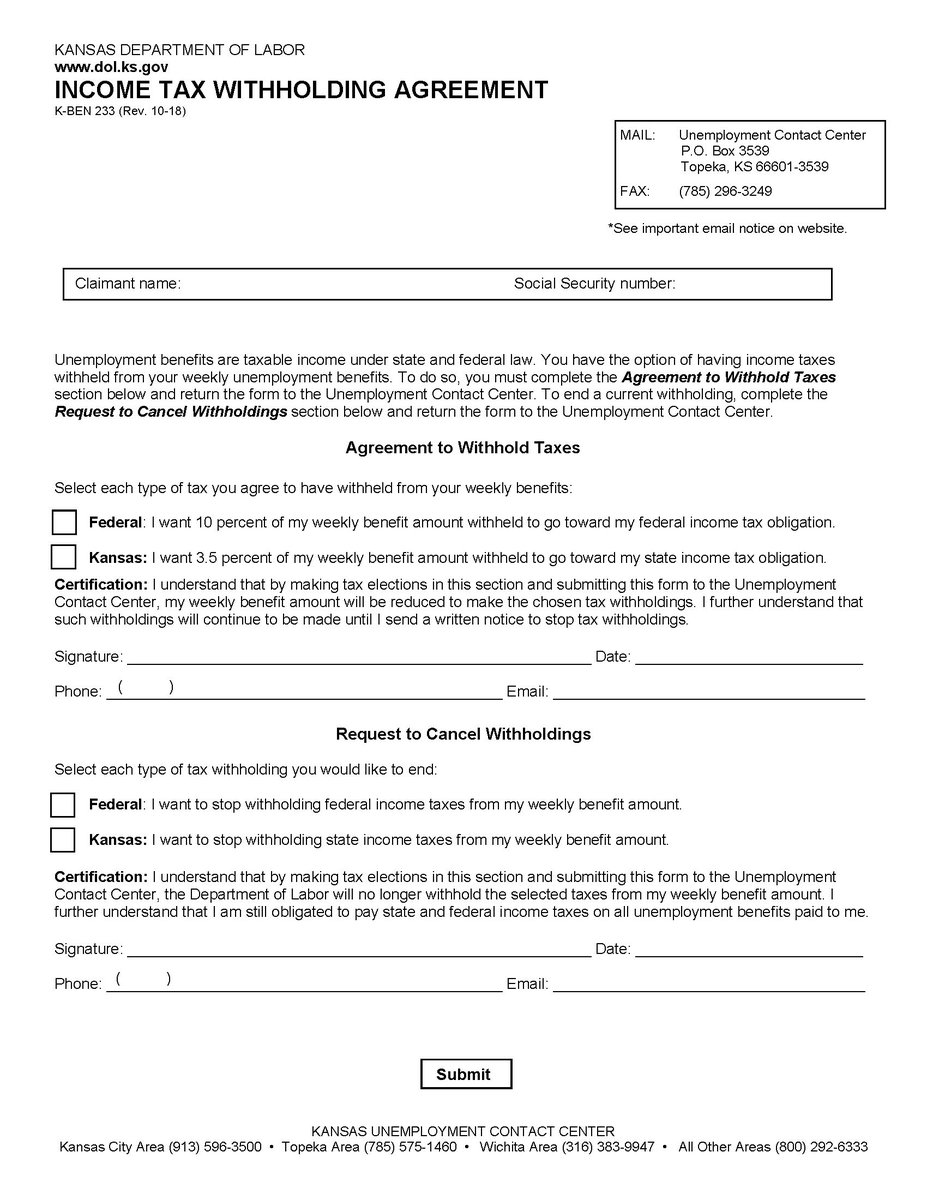

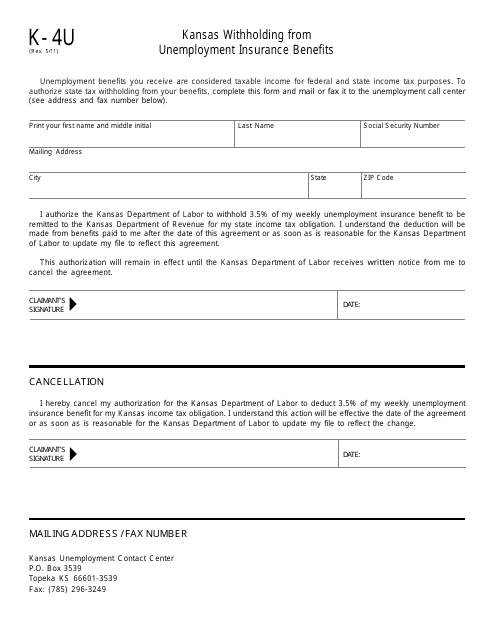

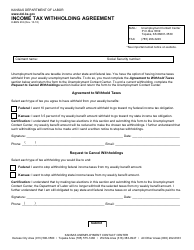

Income Tax Withholding Agreement Kansas

Any supplemental unemployment compensation annuity or sick pay payments made pursuant to a voluntary withholding agreement gambling winnings taxable payments of indian casino profits payments of any vehicle fringe benefit.

Income tax withholding agreement kansas. This form can be completed on your computer printed and then mailed or faxed to the unemployment contact center. See important email notice on website. Where can i find the forms to print off for income tax withholding. Unemployment benefits are taxable income under state and.

Income tax withholding agreement. From withholding on these payments also will apply for kansas income tax withholding purposes. An employer must withhold kansas tax if the employee is a resident of kansas performing services inside or outside of kansas or a nonresident of kansas performing services in kansas. The employer remits the withholding to the state and will issue the employee a w 2 statement indicating the amount of state income tax withheld for that employee.

The development and use of paperless formats promotes efficiency reduces processing costs and therefore aids in reducing the overall cost of government.