Max Income While On Social Security

Additionally the social security administration will often want clarification on the timing of your earnings.

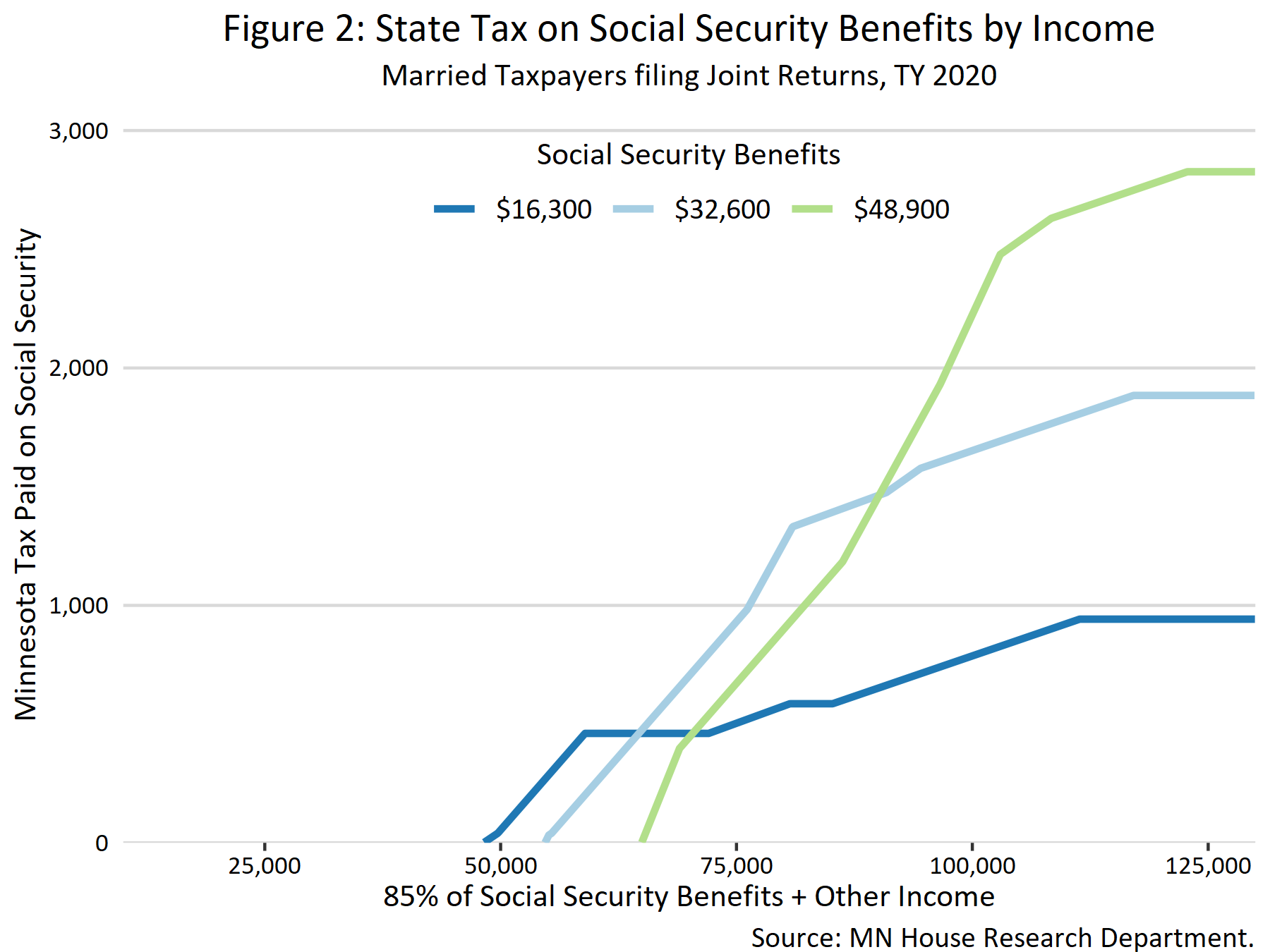

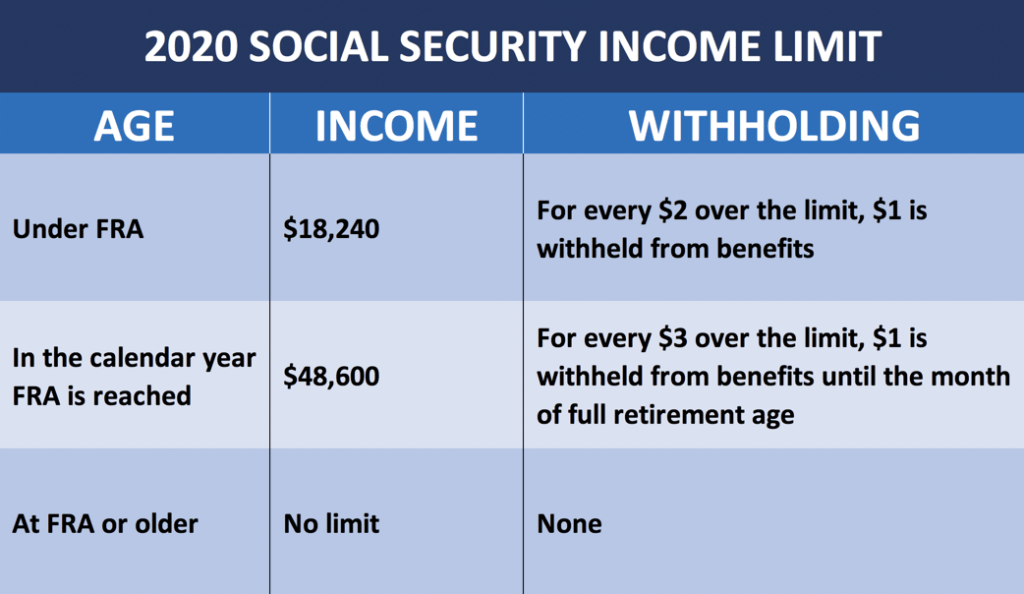

Max income while on social security. Don t get the two confused. In the year the person turns full retirement age the earnings limit becomes 41 880 and for every 3 earned thereafter benefits reduce by 1 until full retirement age is reached. Is the social security work limit gross or net income. If you will reach full retirement age during that same year it will be reduced every month until you reach full.

2020 s earnings test limits. Your 2020 guide to working while on social security the motley fool. As of 2015 for any year prior to full retirement age the earnings limit is 15 720 according to the ssa. The amount of money you can earn before losing benefits will depend on how old you are.

Find out the earnings limits that apply to those who claim social security benefits before reaching full retirement age. For every 2 earned after that the benefit reduces by 1. The answer is it depends. The earnings limit does not apply if you file for benefits at your full retirement age or beyond.

Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is currently 66 and is gradually rising to 67 over the next several years. The earnings limit on social security is not the same as income taxes on social security. If you take social security benefits before you reach your full retirement age and you earn an annual income in excess of the annual earnings limit for that year your monthly social security benefit will be reduced for the remainder of the year in which you exceed the limit. Unlike social security disability insurance ssdi supplemental security income ssi benefits are paid out of general u s.

Treasury funds not from social security taxes. In some cases you may have earned money while you were still working but didn t receive it until after you stopped working and filed for social security. If you work while receiving benefits before full retirement your benefits may be reduced based on your net. If you ve reached full retirement age you re entitled to all your social security benefits even if you re also earning a steady income.

If you re collecting social security but haven t yet reached fra and won t be. Tip how much you can earn while drawing on your social security. Therefore you do not need to have worked a certain amount years or paid fica taxes to be eligible.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)