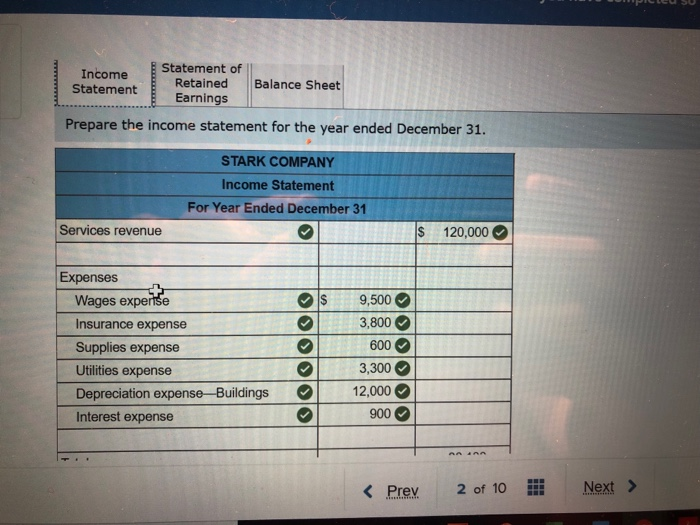

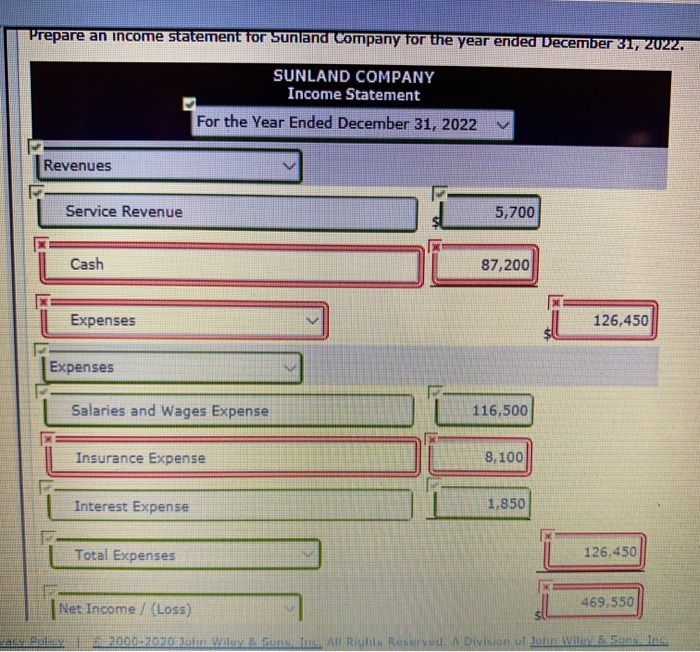

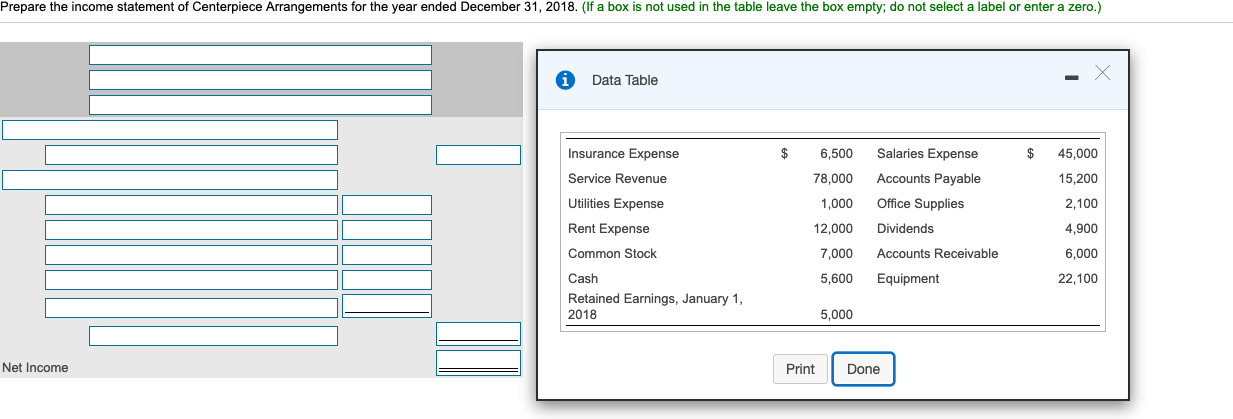

Prepare The Income Statement For The Year Ended December 31 Year 1

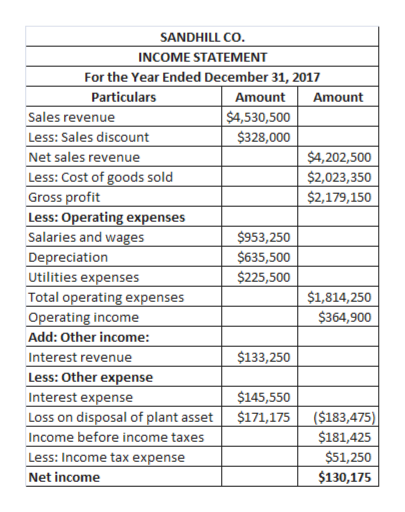

Its taxable income was 650 000.

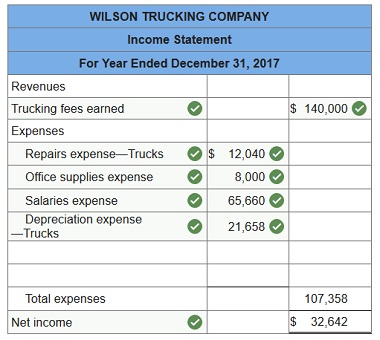

Prepare the income statement for the year ended december 31 year 1. Do not round fixed overhead rate calculation when determining fixed factory. We will be using the adjusted trial balance from this lesson. For example an annual income statement issued by paul s guitar shop inc. When you re ready let s begin.

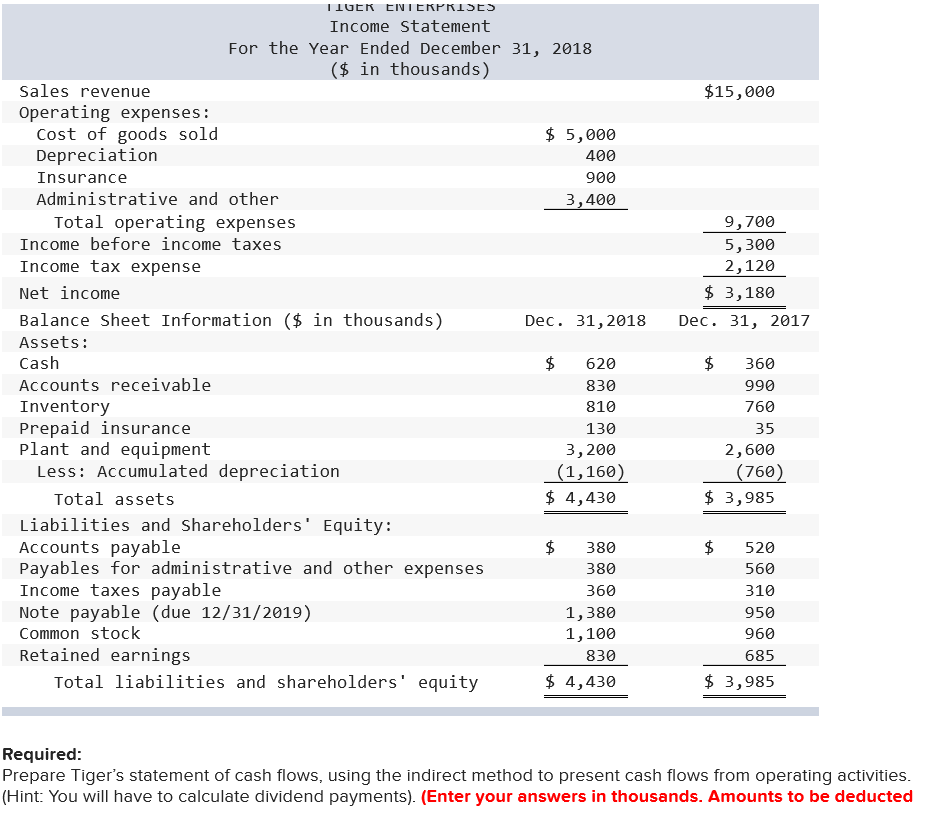

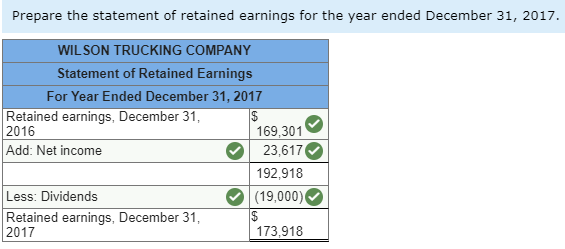

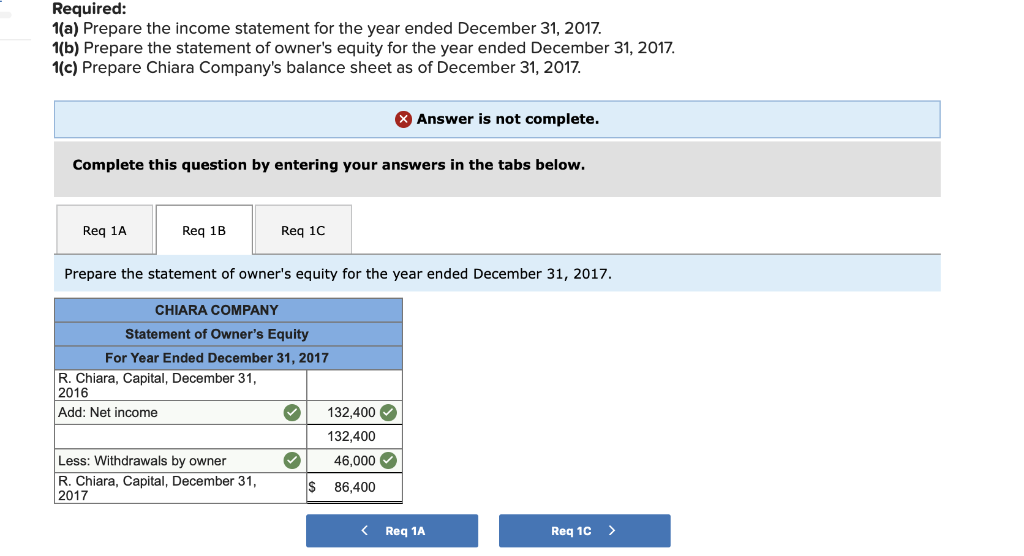

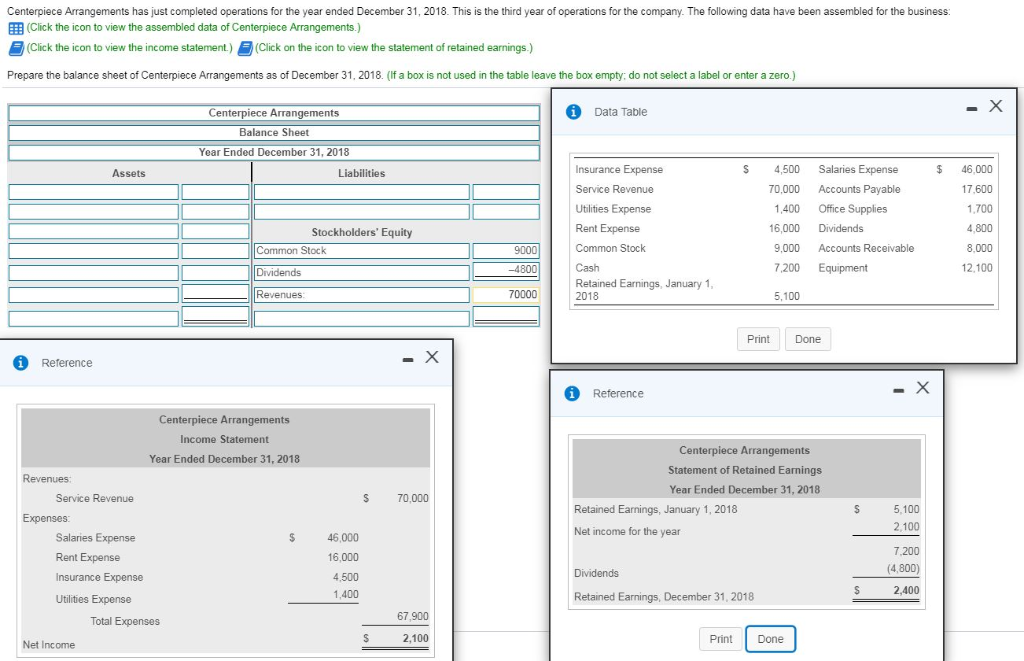

All income statements have a heading that display s the company name title of the statement and the time period of the report. Normal production is 9 000 units. Assume that no common stock was issued during the year and that 5 000 in cash dividends were paid to shareholders during the year. What item appears on both the statement of owner s equity and the balance sheet.

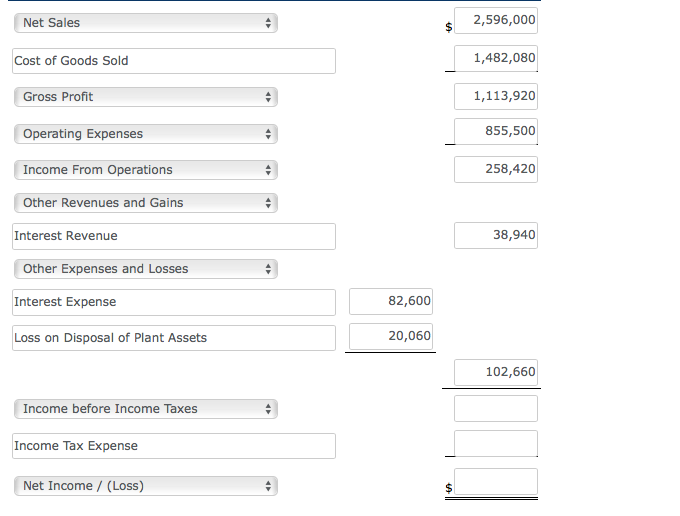

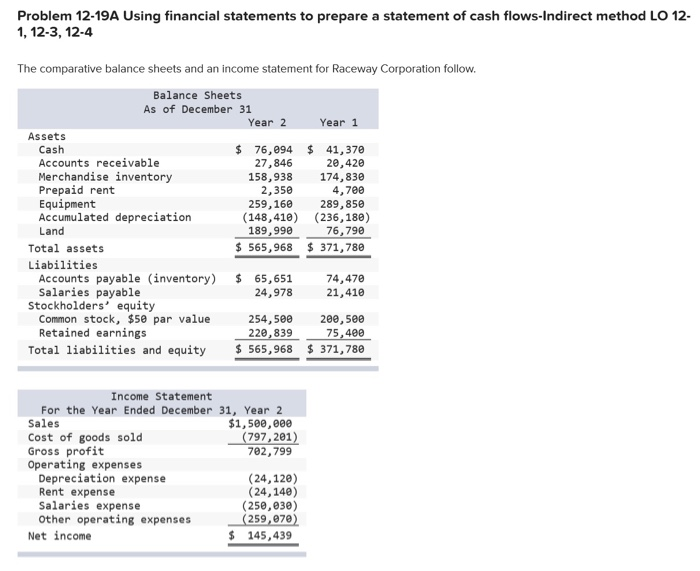

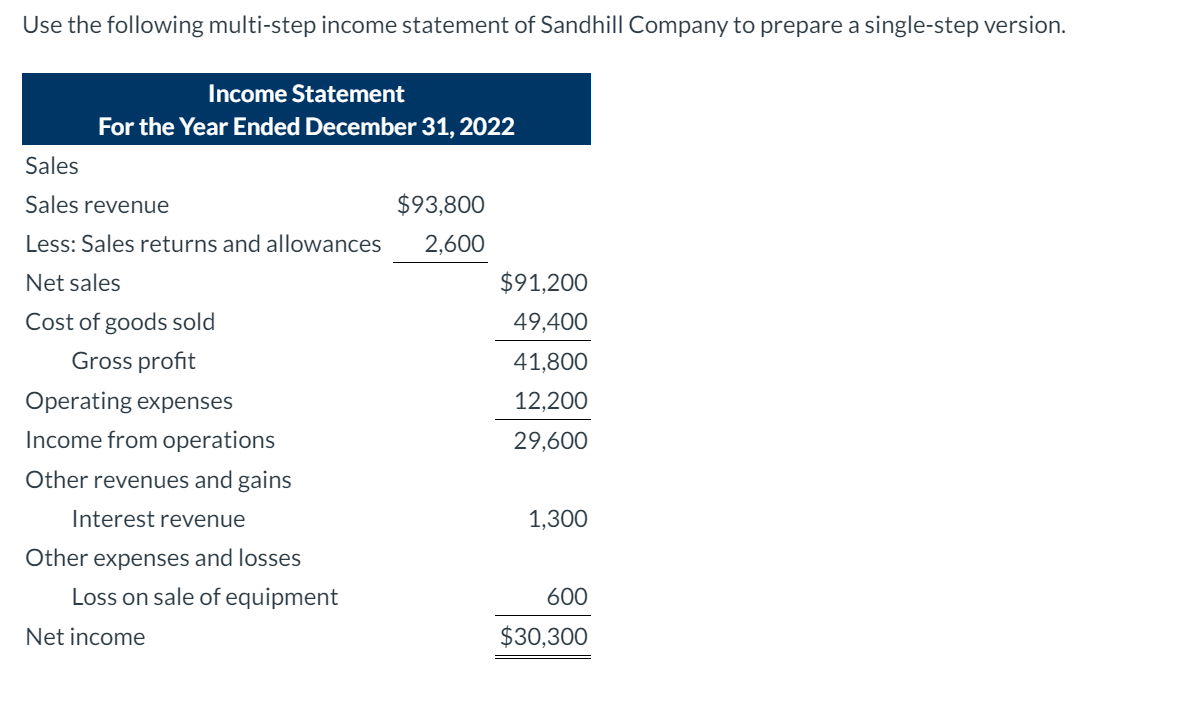

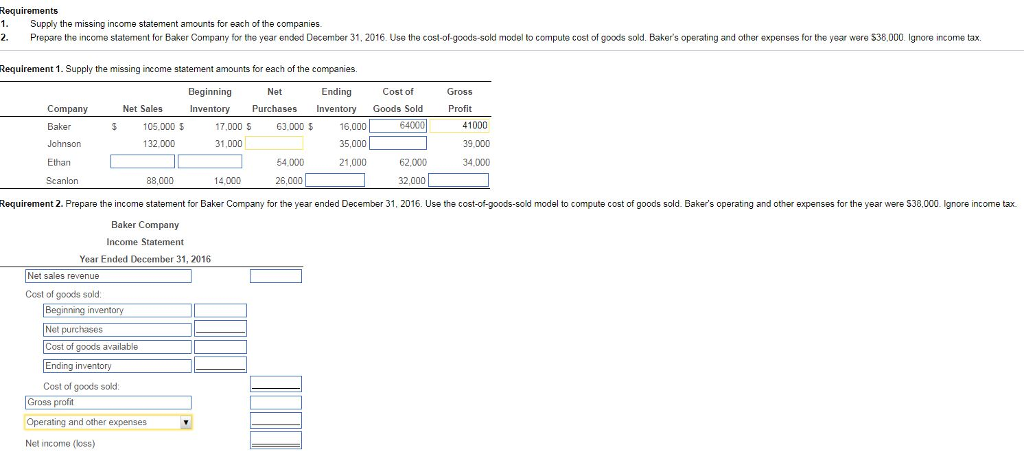

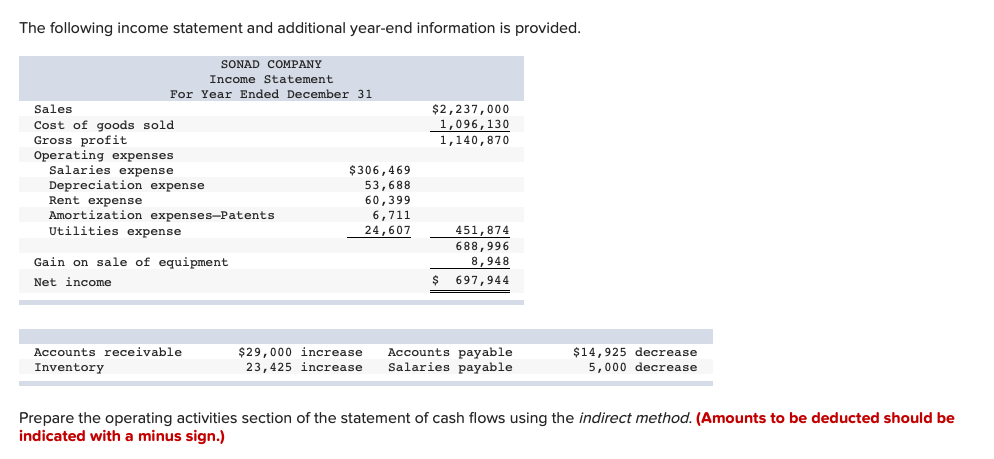

Prepare a balance sheet as of december 31 2019. Prepare a multi step income statement for the year ended december 31. Prepare an income statement for the year ended december 31 2019. For the year ended december 31 year 1 tyre co.

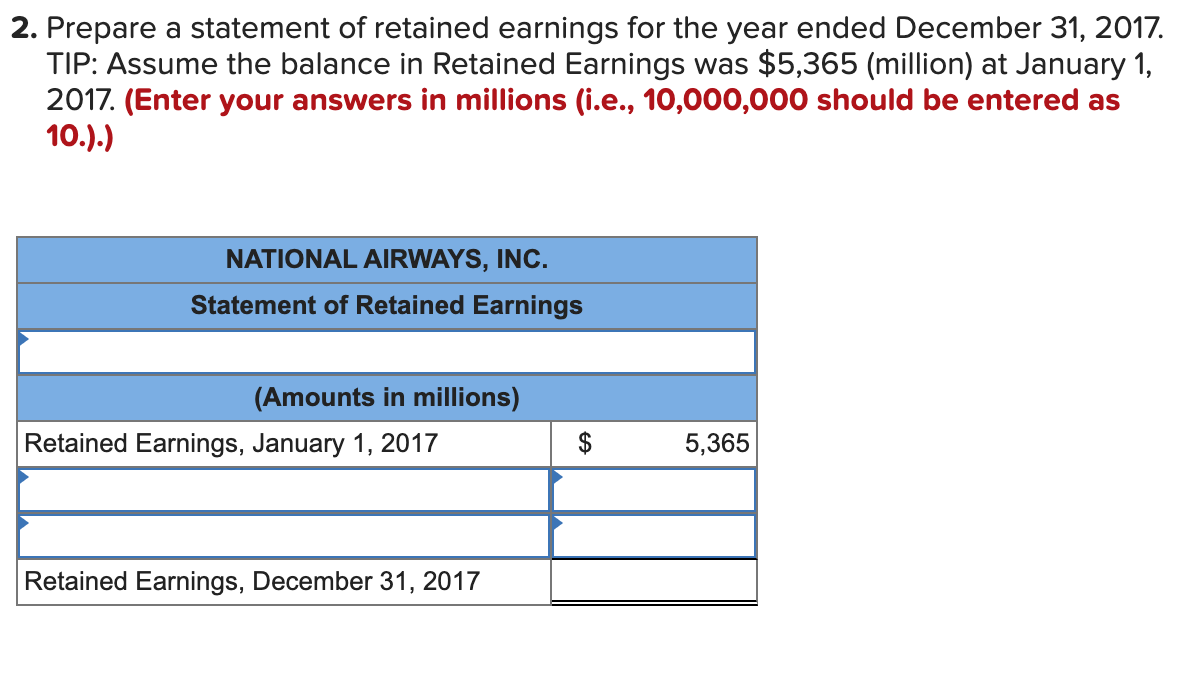

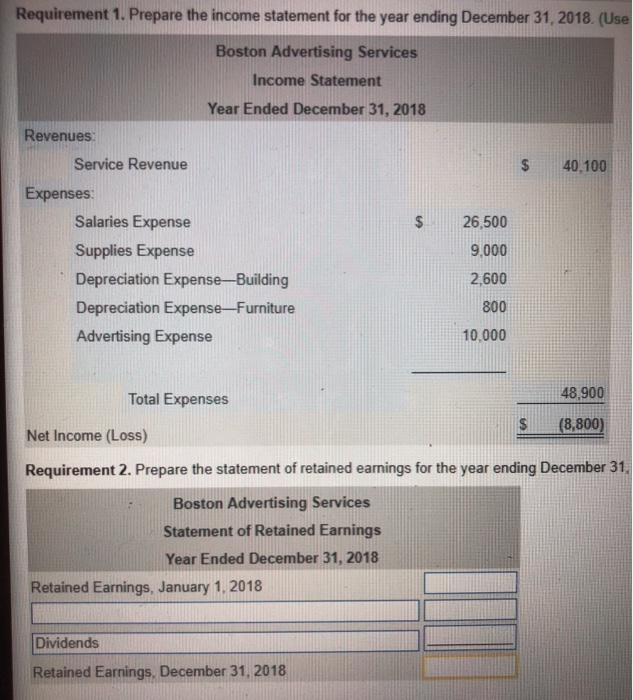

Prepare a retained earnings statement for the year ended december 31. 1 answer to prepare an income statement for the year ended december 31 through the gross profit for baxter company using the following information. Reported pretax financial statement income of 750 000. Combine all the operating expenses into one line on the income statement for selling general and administrative expenses.

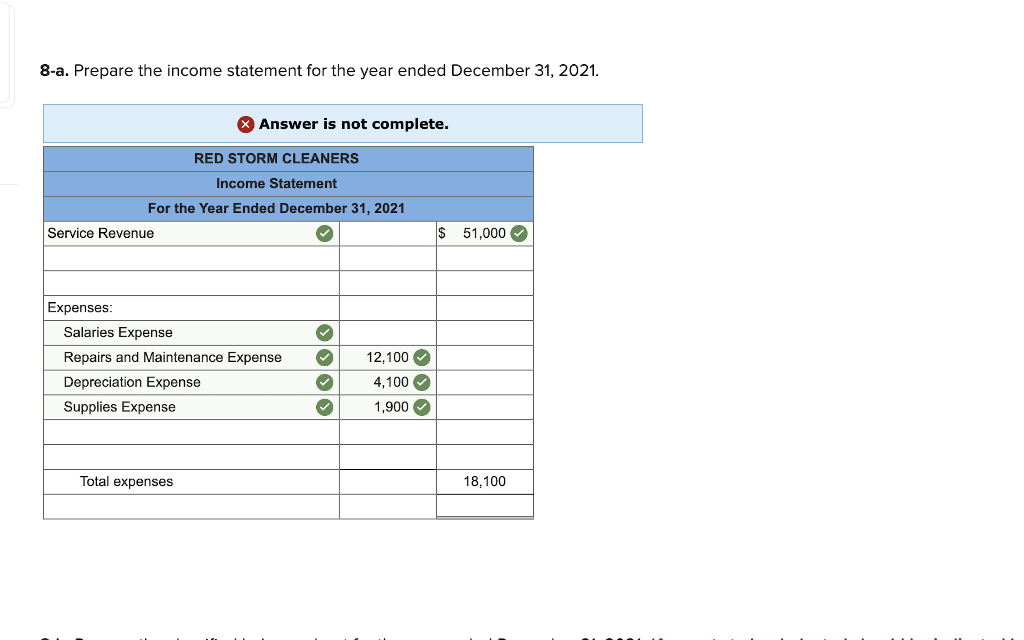

Baxter company sold 8 600 units at 125 per unit. Prepare an income statement and a statement of shareholders equity for the year ended december 31 2021 and a classified balance sheet as of december 31 2021. Prepare a statement of owner s equity for the year ended december 31 2019. Prepare an income statement for the year ended december 31.

Lamp light prepared the following end of period spreadsheet at december 31 2018 the end of the fiscal year. Would have the following heading. Prepare a balance sheet as of december 31. For the year ended december 31 2015.

Adjusted trial balance if you want you may take a look at how an income statement looks like here before we proceed. Pr epare the income statement for the year endoo dec mb r 31 2013. The difference is due to accelerated depreciation for income tax purposes. Do not use negative signs with your answers.

Tyres effective income tax rate is 30 and tyre made estimated tax payments during year 1 of 90 000.