Income Tax Withholding Variation 2021

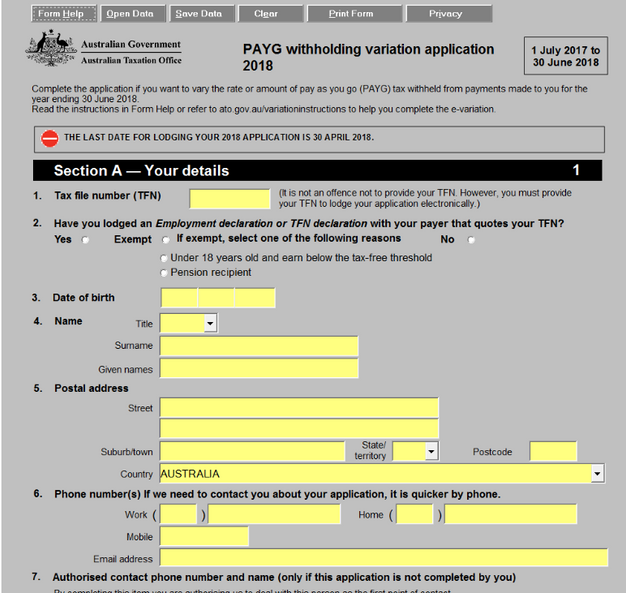

Complete the payg withholding variation application nat 2036 to vary or reduce the amount of pay as you go payg tax withheld from income paid to you in the application year.

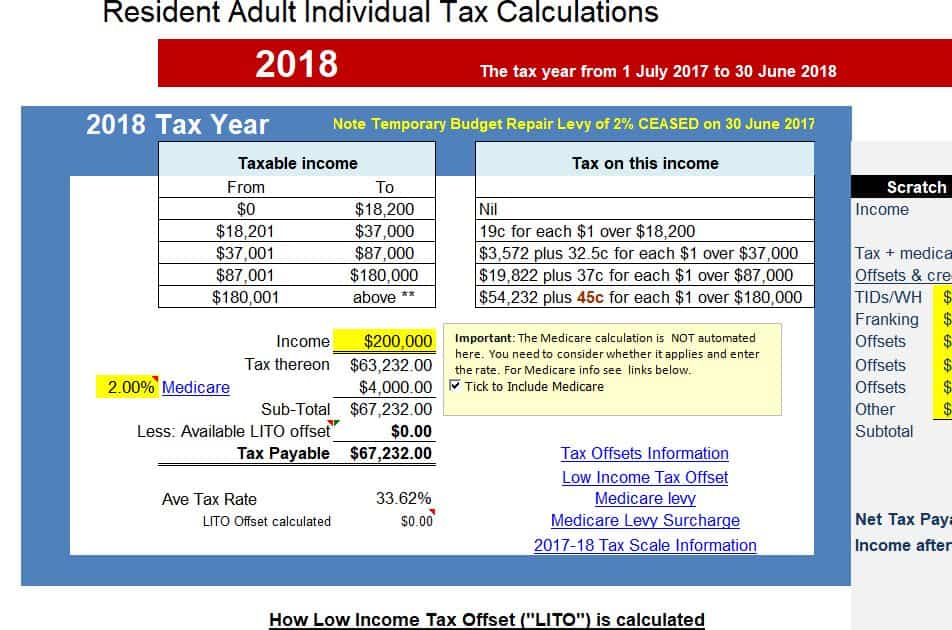

Income tax withholding variation 2021. The last date for lodgment is 30 april of the application year. The above tables do not include medicare levy or the effect of low income tax offset lito or lmito under changes outlined in budget 2020 the low income tax offset up to 700 is to apply from 1 july 2020 previously 2022 and the low and middle income tax offset up to 1 080 is retained. If you apply in may or june the variation will apply to the financial year starting from 1 july. Budget 2021 taxation 1.

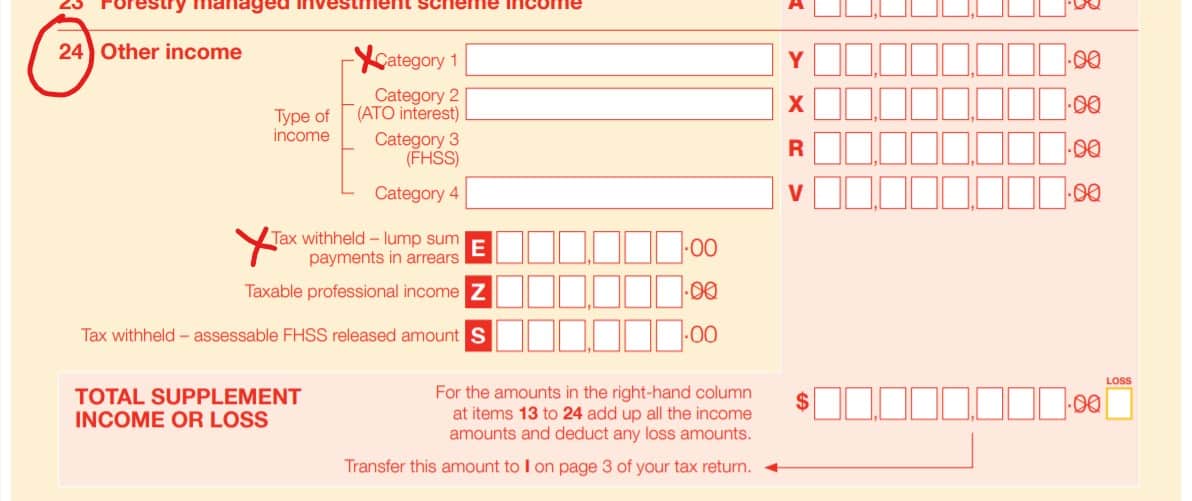

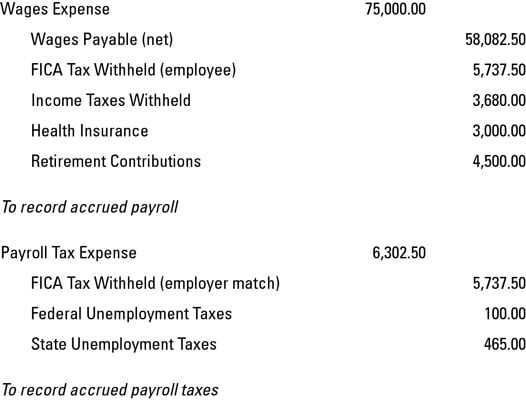

Payg income tax withholding variation itwv checklist please provide the following information to allow an application to vary tax withheld on your salary and wage. Payg withholding variation application e variation complete the payg withholding application e variation to vary or reduce the amount of pay as you go payg tax withheld from income paid to you in the application year. You cannot claim a tax loss from an earlier income year if your taxable income last year was more than zero. Individuals superannuation home.

There are low income and other full or partial medicare exemptions available. We generally do not find it worthwhile to lodge variations where your ownership is less than 10 on a property. Interest specified fees dividend charge natural resource payment rent royalty premium or retirement payments made to residents. F5 personal superannuation contributions deductible see also.

Income tax amendments to inland revenue act no. Payg withholding variation application. The main purpose of varying the amount of withholding is to make sure that the amount withheld during the income year best meets your end of year tax liability. This application is non year specific and valid for one financial year.

Tax losses of earlier income years. The e variation is a transmittable form you need to lodge online over the internet. 24 of 2017 1 1 removal of withholding tax wht following payments are exempt from withholding tax with effect from january 1 2020 i.