The Income Statement Gives Company S Revenues And Expenses For One Particular Day Of The Year

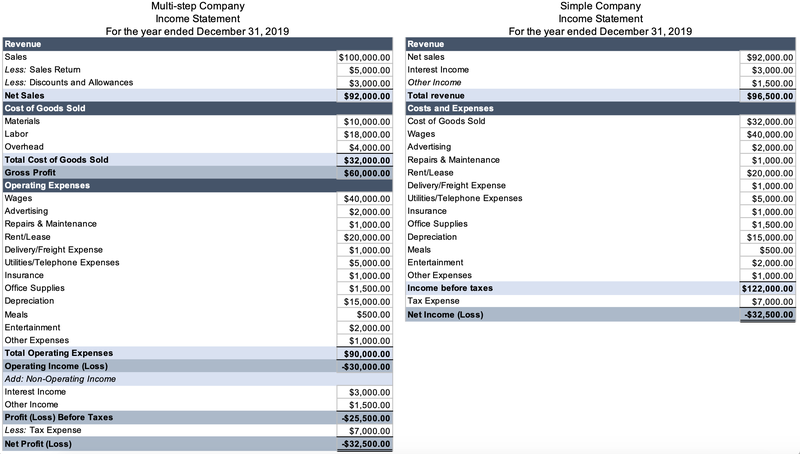

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

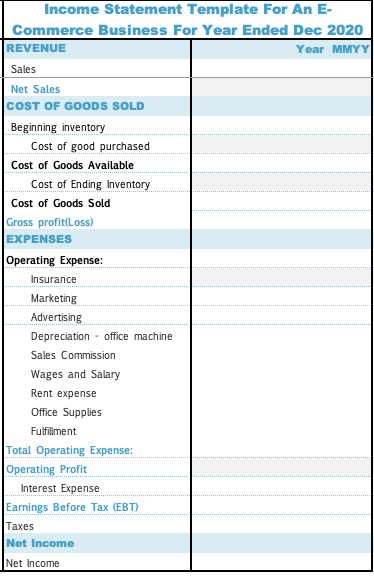

The income statement gives company s revenues and expenses for one particular day of the year. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. A business reports a retained earnings balance of 156 00. The other important documents are the balance sheet the cash flow statement and the statement of shareholder s equity. An increase in the net assets of a business that results from the sale of inventory is reported as a gain.

While a balance sheet provides the snapshot of a company s financials as of a particular date the income statement reports income through a particular time period and its heading indicates the. The income statement shows investors and management if the firm made money during the period reported. 4 8 21 contents1 revenue definition 2 revenue examples 3 operating revenue definition 4 operating revenue examples 5 non operating revenue definition 6 non operating revenue examples 7 expenses definition 8 expenses examples. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities.

The p l formula is revenues expenses net income. The income statement reports a company s revenues and expenses for one particular day of the year. In financial accounting an inflow of money usually from sales or services thru business activities is called as revenue. Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc.

Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the. An income statement also known as a profit and loss statement provides detailed information about business revenues and expenses for a particular accounting period. This figure represents the monetary amounts contributed to the. The income statement is one the major financial statements used to analyze a company.

If revenue is lower than expenses the company is unprofitable. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. The operating section of an income statement includes revenue and expenses. The income statement is used to calculate the net income of a business.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)