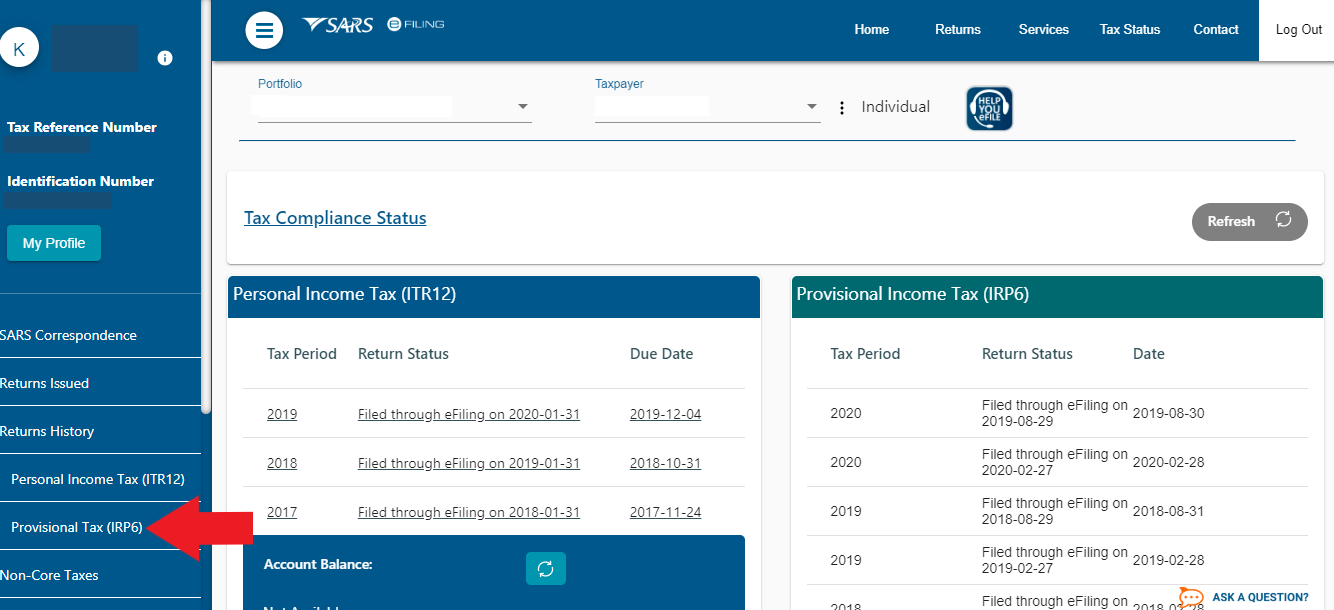

Income Tax Brackets 2020 South Africa

2020 1 march 2019 29 february 2020.

Income tax brackets 2020 south africa. The current tax year 1 march 2020 to 28 february 2021 in south africa is called the 2021 tax year because the tax year is named by the year in which it ends. You are viewing the income tax rates thresholds and allowances for the 2020 tax year in south africa. Medical tax credit rates. 18 of taxable income.

The income tax brackets in south africa for 2020 1 march 2019 29 february 2020 are as follows. Income tax brackets in south africa are progressive like elsewhere where you pay a higher income tax rate the more you earn. Income tax rates in south africa. Subsistence allowances and advances.

2017 2018 tax tables 2018 2019 tax tables 2020 2021 tax tables 2021 2022 tax tables. 445 101 584 200. Foreign tax credits are generally given where a south african tax resident is taxed on income that has already been taxed in another country under a source principle and where any double tax agreement between south africa and that. 18 of taxable income.

155 505 39 of taxable income above 584 200. The tax threshold is the amount above which income levy becomes payable and according to the south african tax tables 2020 anyone below 65 years of age has up to r83 100 before they can pay any levy. The south african tax year differs from a normal calendar year which runs from 1 january to 31 december. The below table shows the tax rates from 1 march 2020 to 28 february 2021 for individuals and trusts in south africa.

67 144 31 of taxable income above 321 600. See the 2020 2021 tax tables for south africa. 0 195 850. 2021 1 march 2020 28 february 2021.

2019 2020 tax rates 1 march 2019 29 february 2020 south african individual taxpayers. South africa s income tax bands for the 2020 tax year are as follows. For comparison purposes the below table shows the current tax rates for. 205 901 321 600.

Earnings received from employment income self employed trade rental income investment income and pension income are subject to income tax. 37 062 26 of taxable income above 205 900. If you are looking for an alternative tax year please select one below. Income tax rates in south africa.

Taxable income r rates of tax r 1 205 900. Self employed people pay income tax at the same levels as employees in south africa. Tax rates year of assessment ending 28 february 2020 taxable income rates of tax.