Income Statement Add Back Depreciation

This 65 decrease in ni is not an actual cash outflow and.

Income statement add back depreciation. The portion of depreciation expense that is shown on the income statement is the only portion of depreciation that is considered an add back the amount varies based on the value of the company s assets their remaining life and the method of depreciation used. Depletion expense and amortization expense are accounts similar to depreciation expense as all three involve allocating the cost of a long term asset to an expense over the useful life of the asset. When a depreciation of say 100 is taken in a financial period and if the tax rate is 35 there is a net tax reduction of 35 and the income statement shows a net income reduction of 65. Depreciation expense is an income statement item.

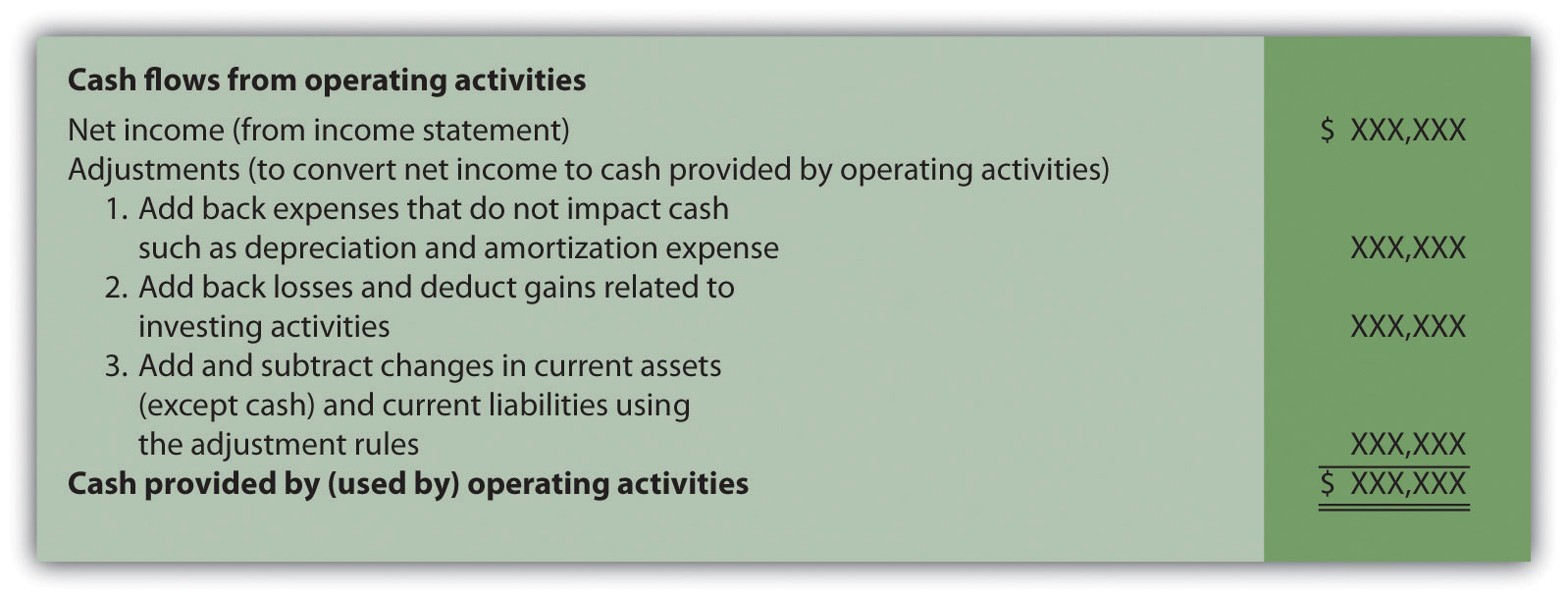

And later we include only that amount of income and expense that. There is no cash involved. Despite having no impact on cash flows when we prepare the cash flow statement using indirect method we start with net profit and add back all the non cash items included in the income statement. Deprecation is non cash expenses that is why we added back cash flow statement in indirect method.

Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally. Under the indirect method since net income is a starting point in measuring cash flows from operating activities depreciation expense must be added back to net income. The chosen depreciation method dictates whether the cost of an. When you take the net profit from the income statement as the basis to calculate the cashflow from operating activities you should add back the depreciation to the net profit.

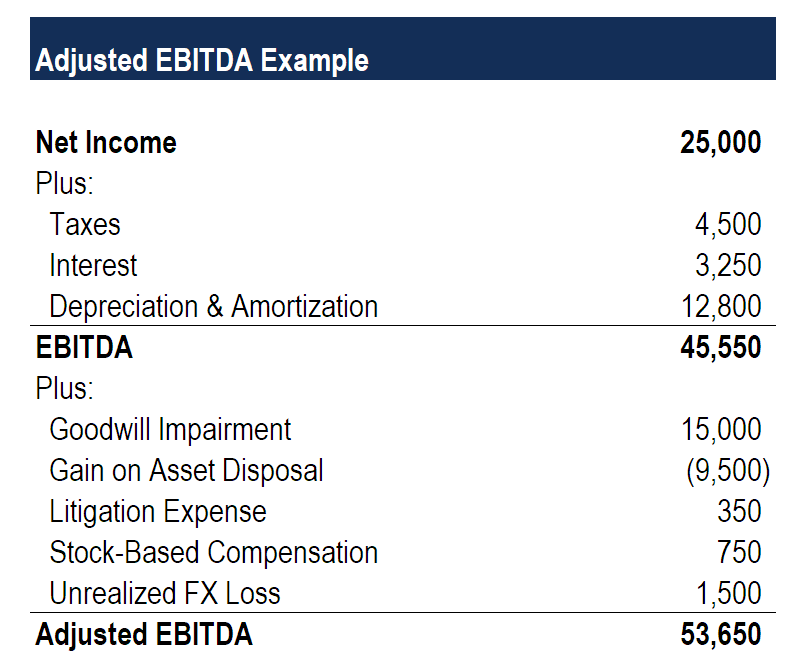

Consider the following example. Meaning that in cash flow statement we will consider only that amount of cash that actually flowed in or out of the business. On account of depreciation there as no outflow of cash and has to be added back to net income for the purpose of preparation of cash flow statement. Statement of cash flows shows the changes in cash.

Depreciation expense and accumulated depreciation. That is why we subtract interest incomes to the profit because they usually contain the accruals and we add back interest expenses for the same reasons. This artificially lowers a company s net income and skews the cash movements listed on the income statement. Company a had net income for the year of 20 000 after deducting depreciation of 10 000 yielding 30 000 of positive cash flows.

To correctly account for monthly cash flows accountants add back the depreciation expense to the net income. This is done by adding back the amount of the depreciation expense. Also be aware that the cashflow statement would have shown the cost of the fixed asset as an outflow in the inves.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)