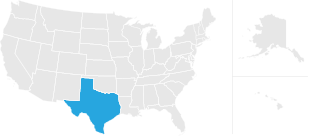

Us Income Tax Calculator Texas

Texas has no state income tax.

Us income tax calculator texas. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return intexas the net effect for those individuals is a higher state income tax bill in texas and a higher federal tax bill. Us income tax calculator 2020. The calculator takes your gross income along with the other information you provided it with and uses it to calculate the final amount that you take home. Using our texas salary tax calculator.

More information about the calculations performed is available on the about page. Government websites us census bureau 2018 american community survey mit living wage study bureau of labor statistics. Overview of texas taxes. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Only the federal income tax applies. For example if you are a filing your taxes as single have no children are below the age of 65 and you are not blind with the consideration of the standard tax deduction your calculation would look like this. Texas has no state income tax. Smartasset s texas paycheck calculator shows your hourly and salary income after federal.

Taxable income in texas is calculated by subtracting your tax deductions from your gross income. To use our texas salary tax calculator all you have to do is enter the necessary details and click on the calculate button. The tax calculator uses tax information from the tax year 2020 to show you take home pay. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

See where that hard earned money goes with federal income tax social security and other deductions. However revenue lost to texas by not having a personal income tax may be made up through other state level taxes such as the texas sales tax and the texas property tax. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Texas has never had a personal income tax and restrictions in article 8 of. Texas is one of seven states that do not collect a personal income tax. Your household income location filing status and number of personal exemptions.