Income Statement Shows Two Classes

Green as at 31 march 2015 in both horizontal and vertical style.

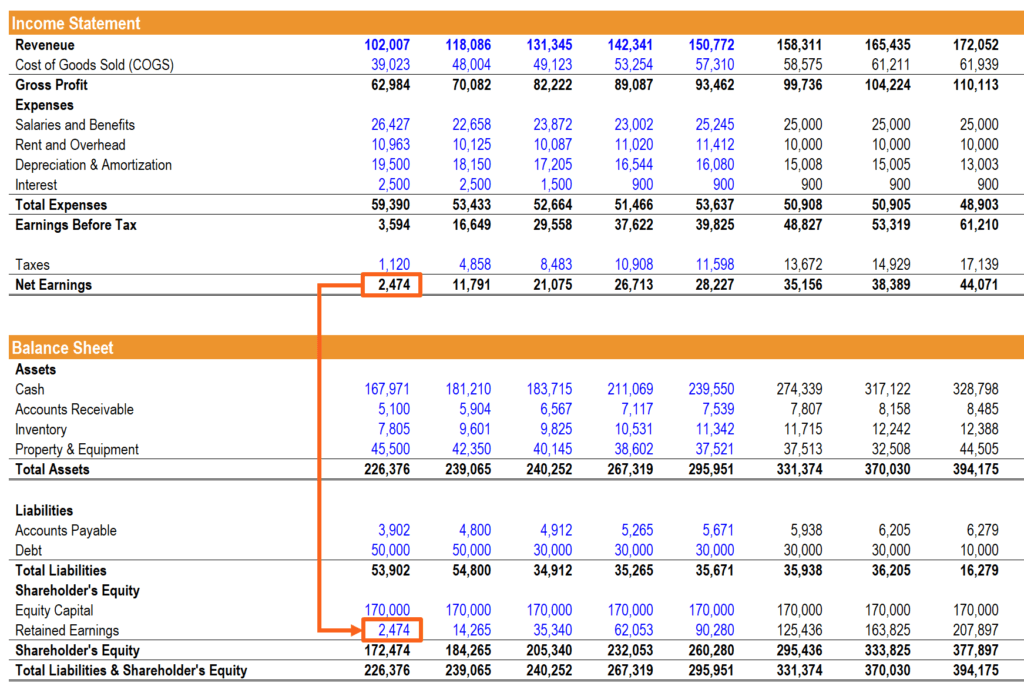

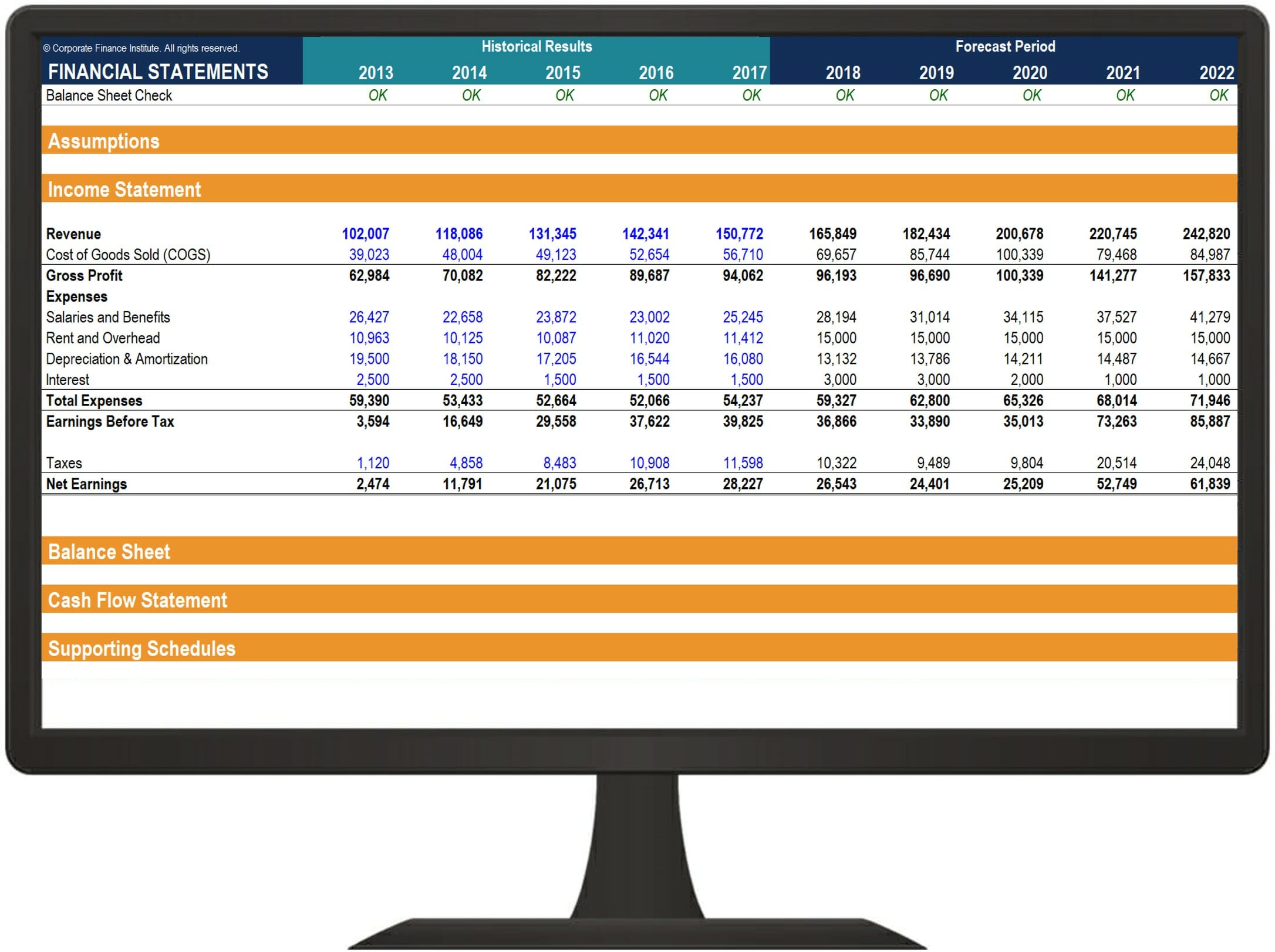

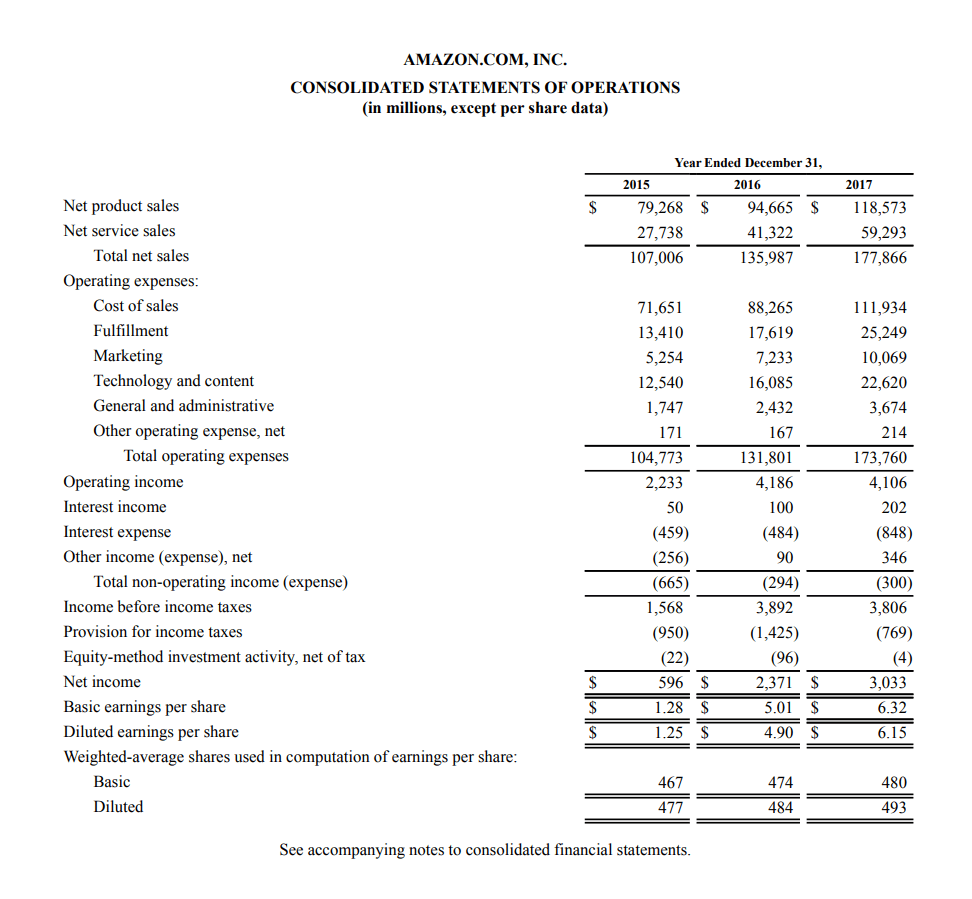

Income statement shows two classes. In reality companies often use more complicated multiple step income statements where key expenses are separated into groups or categories. Income statements are 2 types single step income statement and multiple step income statement for finding net profit or loss an accounting period. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances. In the absence of information about the date of repayment of a liability then it may be assumed.

What the business has earned over a period e g. While becoming familiar with the statement of cash flow and statement of owner s equity is also valuable the balance sheet and income statement. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. Single step income statement the single step statement only shows one category of income and one category of expenses.

An income statement is one of the three important financial statements used for reporting a company s financial performance over a specific accounting period with the other two key statements. This format is less useful of external users because they can t calculate many efficiency and profitability ratios with this limited data. There are two income statement formats that are generally prepared. A major expense shown in our first income statement example above is tax.

The single step income statement takes a simpler approach totaling revenues and subtracting expenses to find the bottom line. Income statement displays the revenues recognized for a specific period and the cost and expenses charged against these revenues including write offs and taxes. Preparation of balance sheet horizontal and vertical style. In multiple step income statements tax is shown on.

Income statement shows net profit or net loss arising out of activities of a particular accounting period of any business organization. Income statement also known as the profit and loss statement reports the company s financial performance in terms of net profit or loss over a specified period income statement is composed of the following two elements. Green as at 31 march 2015. The following trial balance is prepared after preparation of income statement for f.

The income statement totals the debits and credits to determine net income before taxes the income statement can be run at any time during the fiscal year to show a company s profitability. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Sales revenue dividend income etc. Tax or taxation is actually shown in a simplified way in that income statement as it is a single step income statement.

The income statement can be prepared in two methods. The cost incurred by the business over a period e g.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)