Bank Income Statement Explained

Income statement cheat sheet https accountingstuff co shop the income statement or profit and loss statement p l is one of the three major financ.

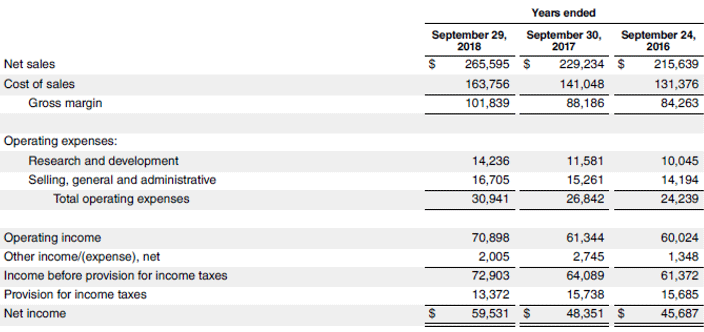

Bank income statement explained. The income statement comes in two forms multi step and single step. Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. Total interest earned was 57 5 billion in green.

Here s how an income statement is usually. It also demonstrates the impact a flattening yield curve can have on a bank s net interest income. The best place to start is with the net interest income line item. What is an income statement.

Here are the key areas of focus. Each step down the ladder in an income statement involves the deduction of an expense. The bank experienced lower net interest income even though it had grown average balances. Fee income to operating.

This example financial report is designed for you to read from the top line sales revenue and proceed down to the bottom line net income. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. Income statement non interest revenue. Financial statements for banks.

Identifies the business the financial statement title and the time period summarized by the statement. Interest related income or expense item and the average yield for the time period. The income statement summarizes a company s revenues and expenses over a period either quarterly or annually. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

Understanding a bank s income statement icici bank s income statement for fy13. Net interest margin and interest spread. Again i take figures from the icici bank annual report for fy2013. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

Also sometimes called a net income statement or a statement of earnings the income statement is one of the three most important financial statements in financial accounting. Non interest revenues consist of ancillary revenue the bank makes in supporting its services. It shows your revenue minus your expenses and losses.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)