Usali Income Statement Format

This format is less useful of external users because they can t calculate many efficiency and profitability ratios with this limited data.

Usali income statement format. Us gaap leaves it up to enterprises to create the income statement format depending on specific enterprise needs. About press copyright contact us creators advertise developers terms privacy policy safety how youtube works test new features. Single step income statement the single step statement only shows one category of income and one category of expenses. As of january 1 2019 the american hotel lodging educational institute no longer offers uniform system of accounts for the lodging industry usali.

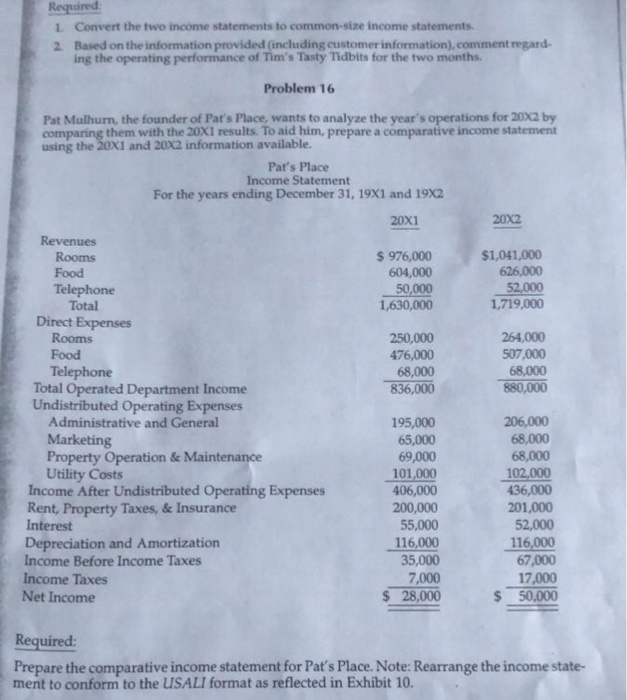

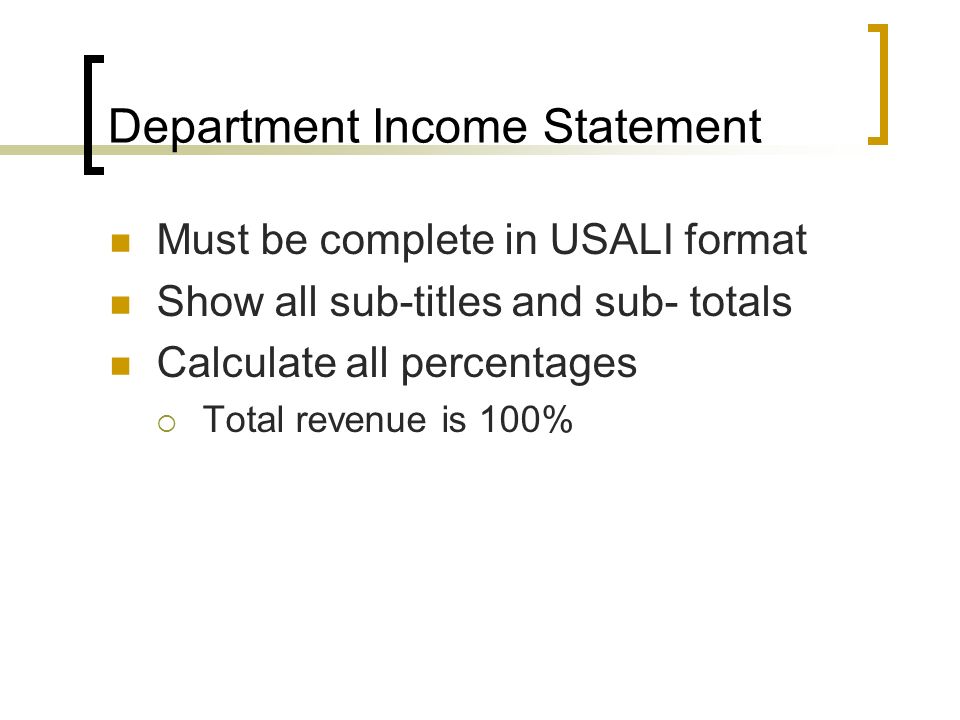

Usali summary operating statement summary operating statement components operating departments revenues expenses departmental income gross profit undistributed operating expenses gross operating. Assets represent things owned by the property liabilities are claims to the assets by. Introduction from ahla by kevin carey ahla executive vice. The actual format of the income statement will vary depending on the business but in general income statements begin with sales followed by expenses and end with the profits or losses of the business.

The uniform system of accounts for the lodging industry offers statements formatted for hotel accountants. Thus the two statements are the. Income statement format 1. Sales or revenue section presents sales discounts allowances returns and other related information.

Balance sheet the purpose of the balance sheet is to provide a picture of the financial condition of the business entity at a particular time. Income statements can vary slightly depending on whether the statement is a single step income statement or multi step income statement. Those customers who bought a vitalsource etext between september and. Cost of goods sold section.

This hftp guide outlines changes in the usali 11th edition. There are two income statement formats that are generally prepared. Usali requires the use of the costing method based on direct and indirect cost classification. Its purpose is to arrive at the net amount of sales revenue.