Calculate Interest Expense Pro Forma Income Statement

Cost of goods sold.

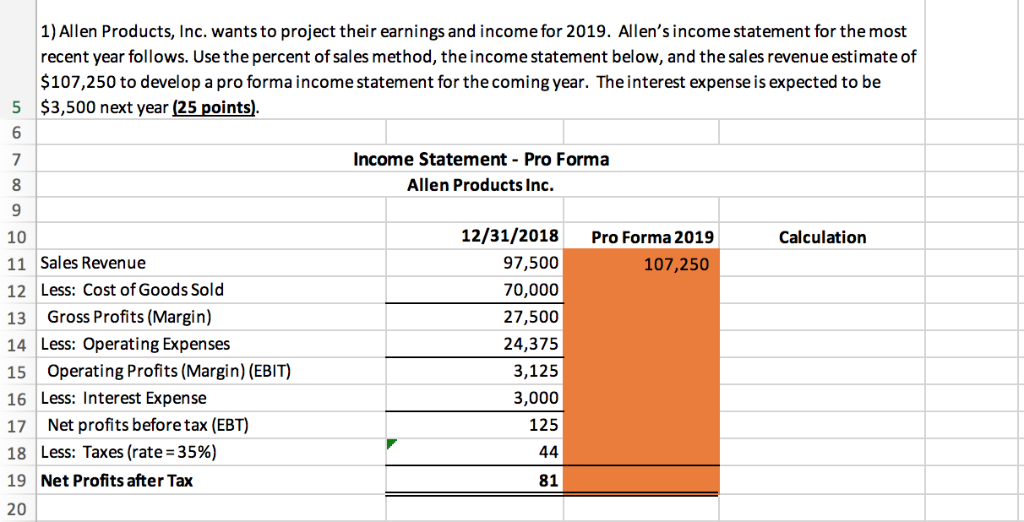

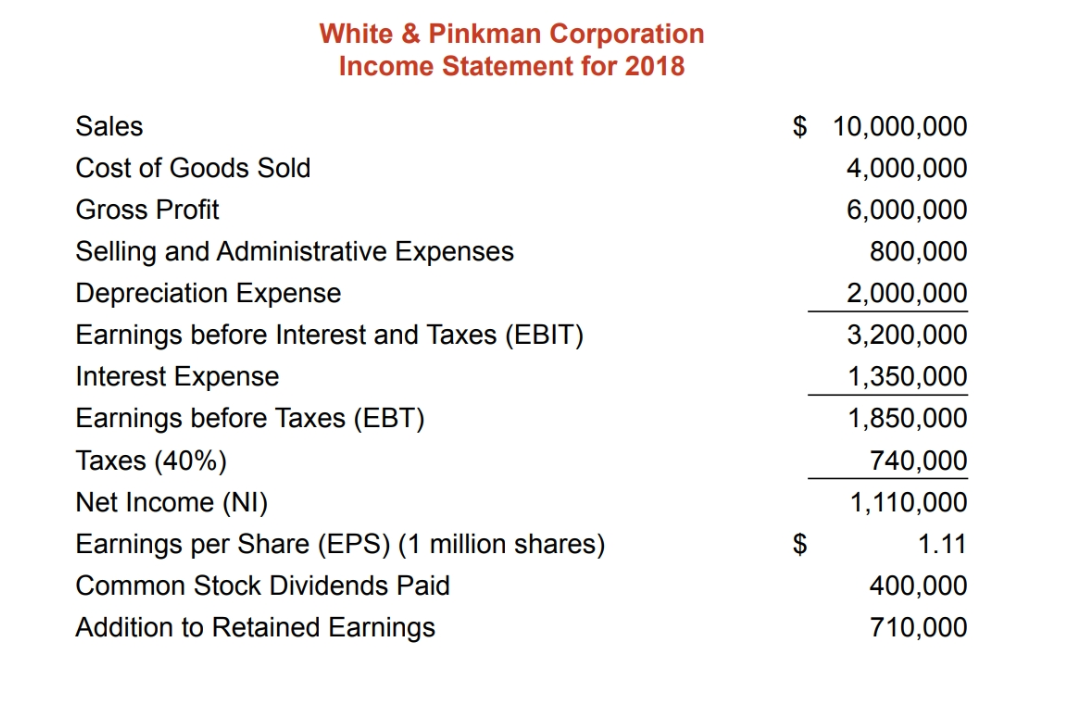

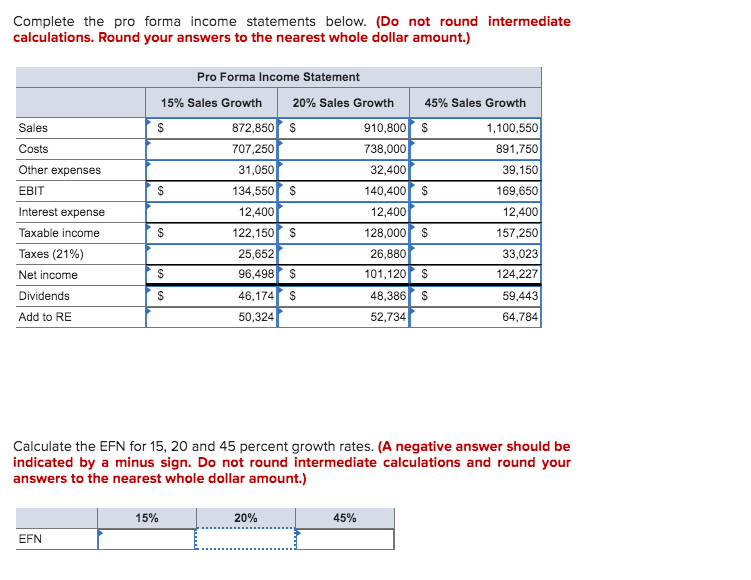

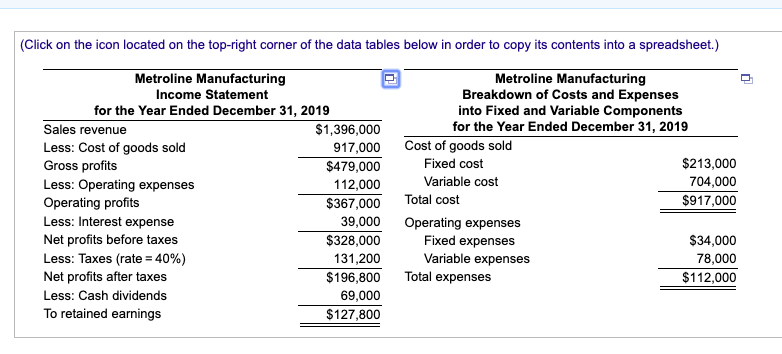

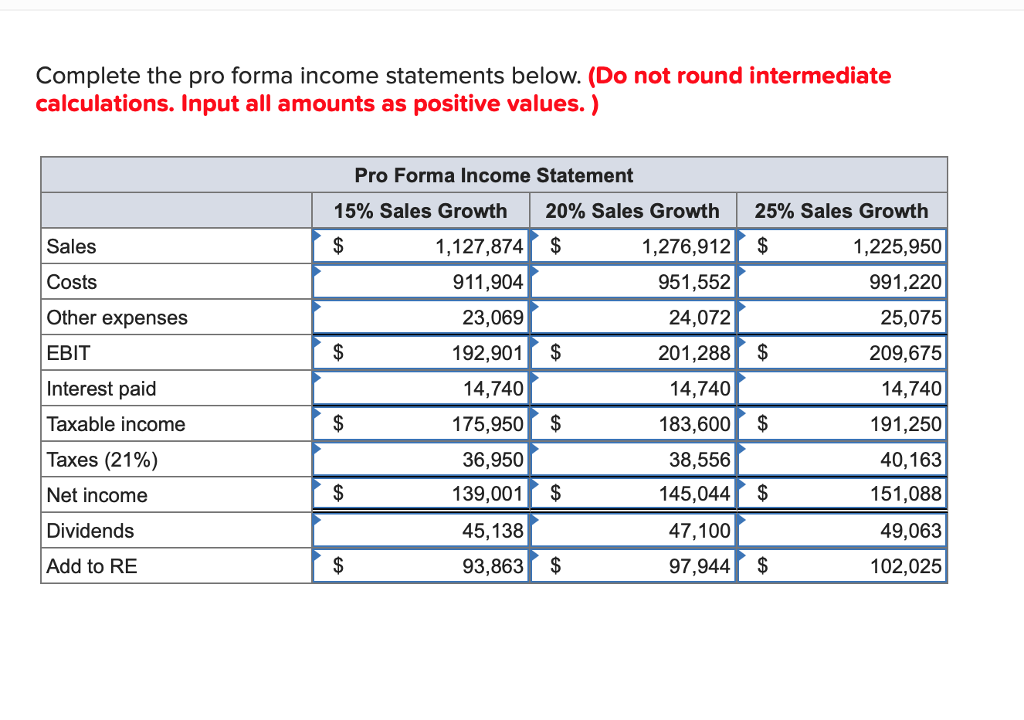

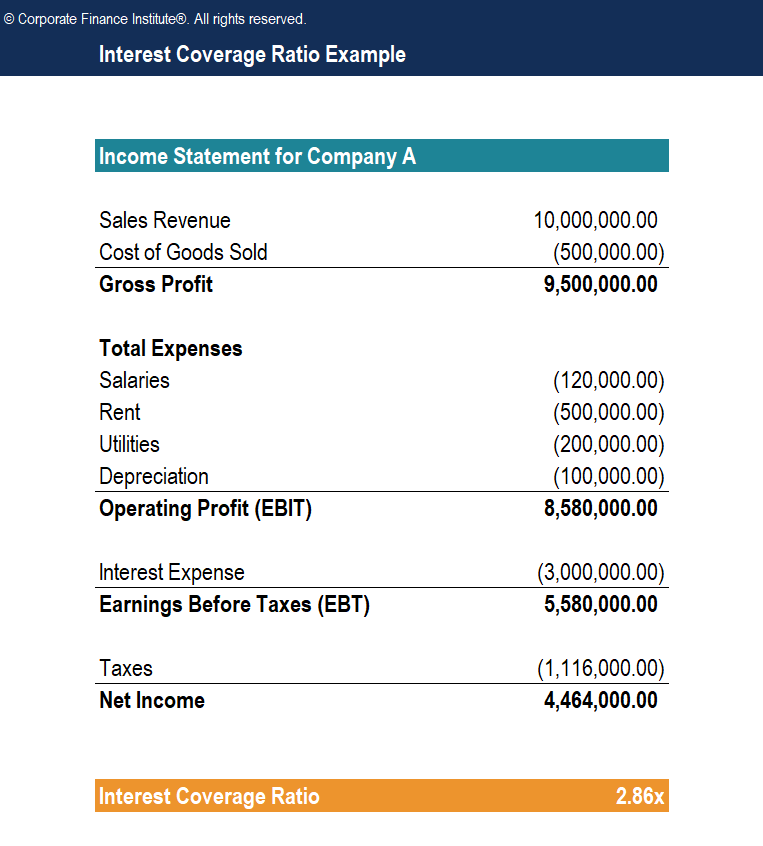

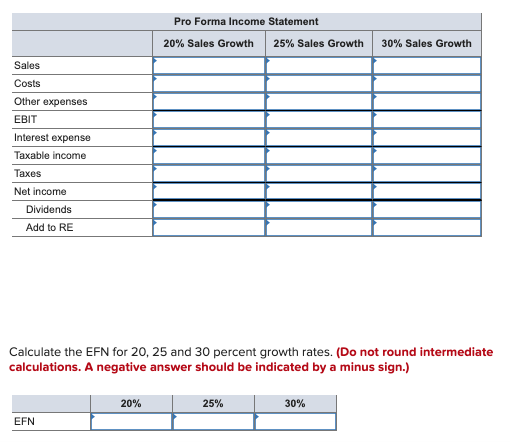

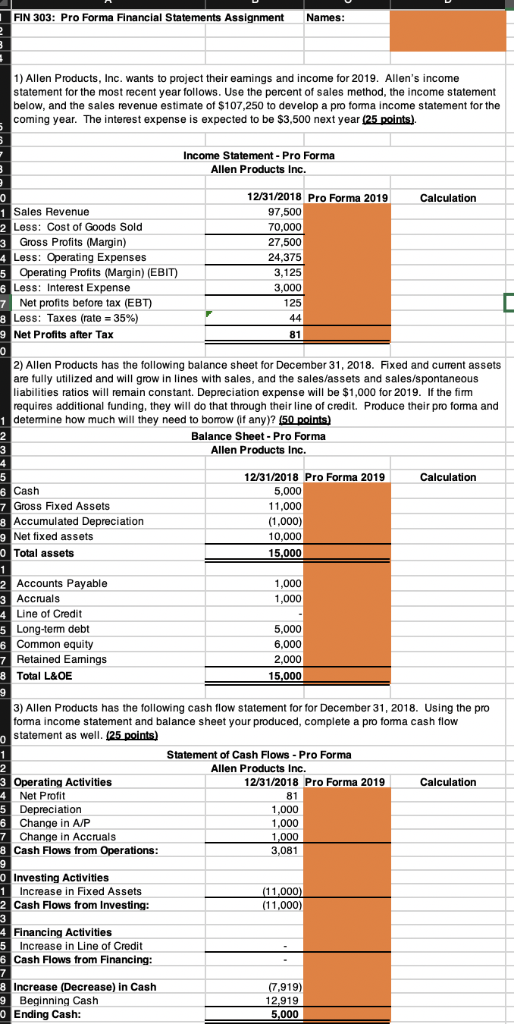

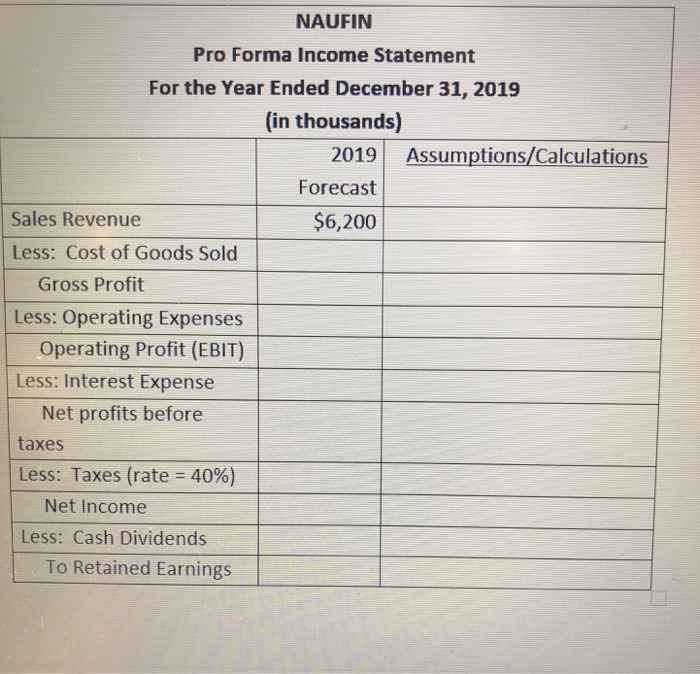

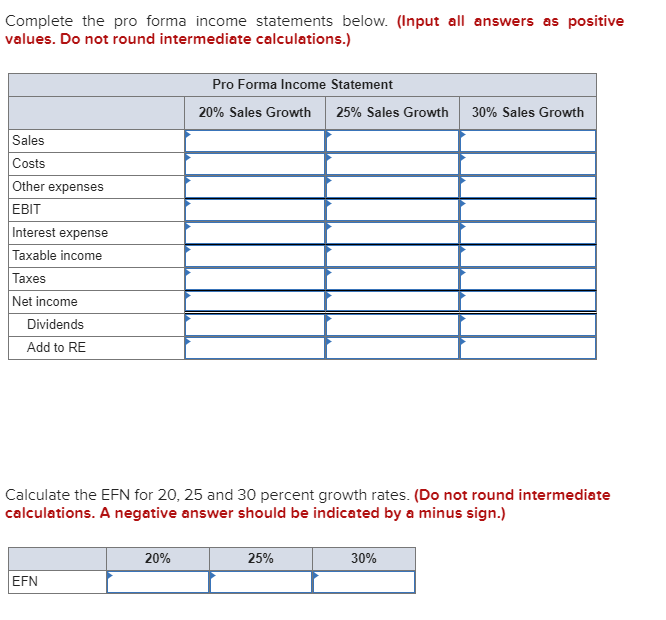

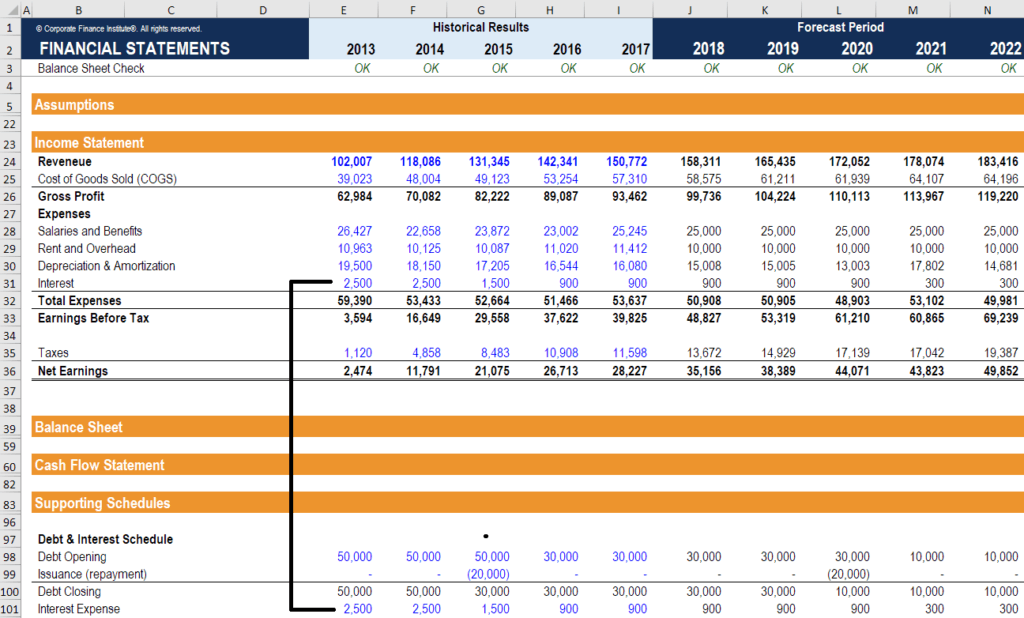

Calculate interest expense pro forma income statement. A pro forma statement is an important tool for planning future operations. Interest expense is included on the company s income statement. Interest expense is one of the core expenses found in the income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Create a pro forma income statement by using the calculated percentage change in sales.

Pro forma is a fancy word for future or projected. Our convertible bond fixed income trading fixed income trading involves investing in bonds or other debt security instruments. Like interest expense analysts can calculate interest by using either the beginning or average period approach. Your proforma income statement shows sales of 1 033 000 cost of goods sold as 503 000 depreciation expense of 103 000 and taxes of 170 800 due to a tax rate of 40.

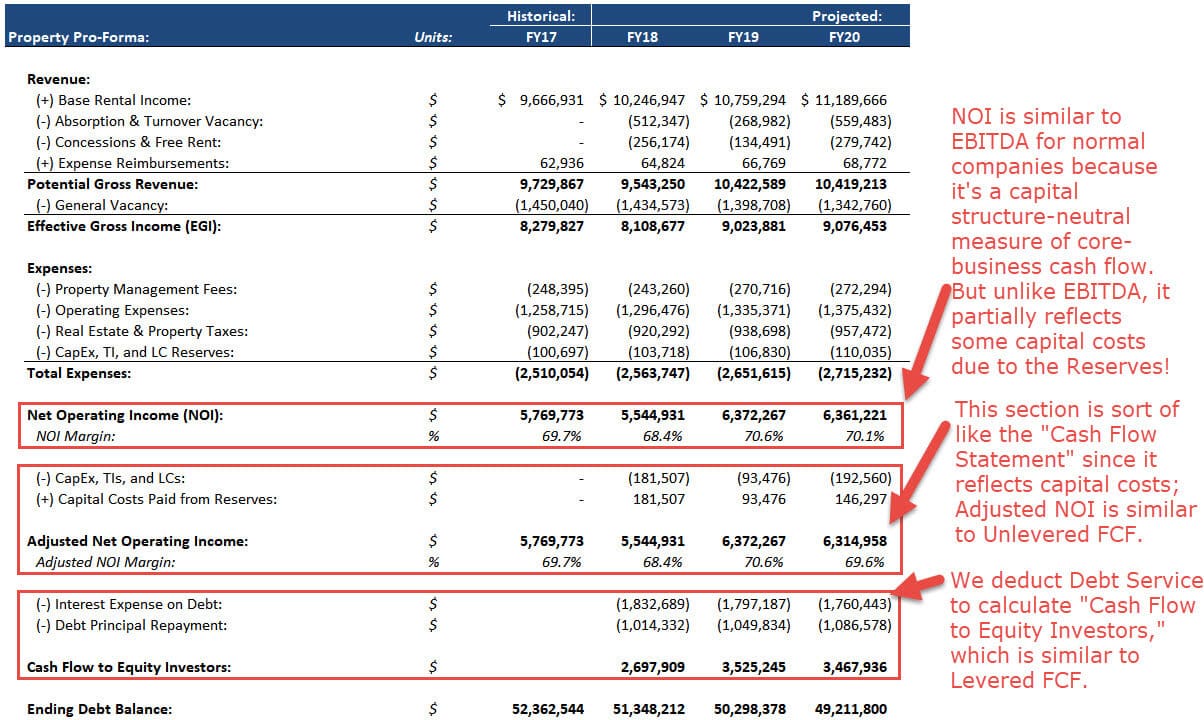

Interest income is a function of projected cash balances and the projected interest rate earned on idle cash. Fixed income securities have several unique attributes and factors that pays out a coupon of 800 000 this year. After tax interest expense interest expense x 1 tc interest tax shield example continued. For my purposes here a pro forma income statement is similar to a historical income statement except it projects the future rather than tracks the past.

What are your proforma earnings. Fazo company prepared its master budget for the first quarter march april and may of the year. So that relatively positive picture of company s financial statement can be shown. In this example you would multiply all of last year s income statement line items by 1 10 to show a 10 increase.

We can only forecast it once we complete both the balance sheet and the cash flow statement. For example if a company paid 1 million to its creditors but 200 000 went toward the principal the interest expense is 800 000. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of. What is your proforma free cash flow.

These expenses highlight interest accrued during the period and not the interest amount paid over the time period. Work the arithmetic through to the bottom to complete a pro forma income statement.