Income Tax Losses Definition

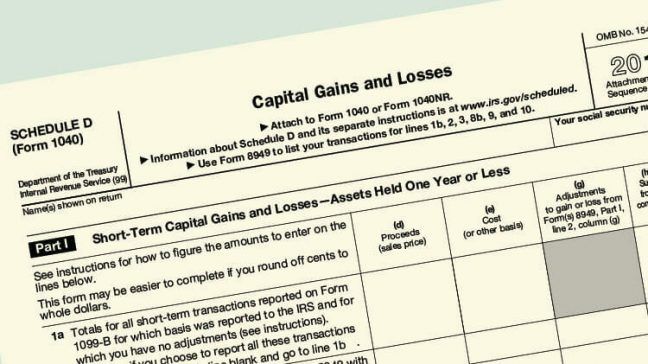

Tax loss harvesting is the selling of securities at a loss to offset a capital gains tax liability.

Income tax losses definition. This strategy is typically employed to limit the recognition of short term capital gains. To be globally competitive canada should implement a formal loss transfer system or otherwise provide for group tax loss relief 5 the adoption of a formal loss sharing mechanism in the income tax act would complement the administrative concessions and provide much needed clarity certainty of result and greater stability in the law. Any loss can be netted against any capital gain realized in the same tax year but only 3 000 of capital loss can be deducted against earned or other types of income in the year. 31 2017 the net operating loss carryover is limited to 80 of taxable income determined without regard to the deduction.

A tax loss carry forward carries a tax loss from a business over to a future year of profit. Tax losses synonyms tax losses pronunciation tax losses translation english dictionary definition of tax losses. You generally make a tax loss when the total deductions you can claim for an income year exceed your assessable and net exempt income for the year. Foreign residents calculate a tax loss on the basis of their australian income and deductions incurred in earning that income.

When an asset is sold. For losses arising in taxable years beginning after dec.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)