Multiple Step Income Statement Practice Problems

Practice problem prepare a multiple step income statement.

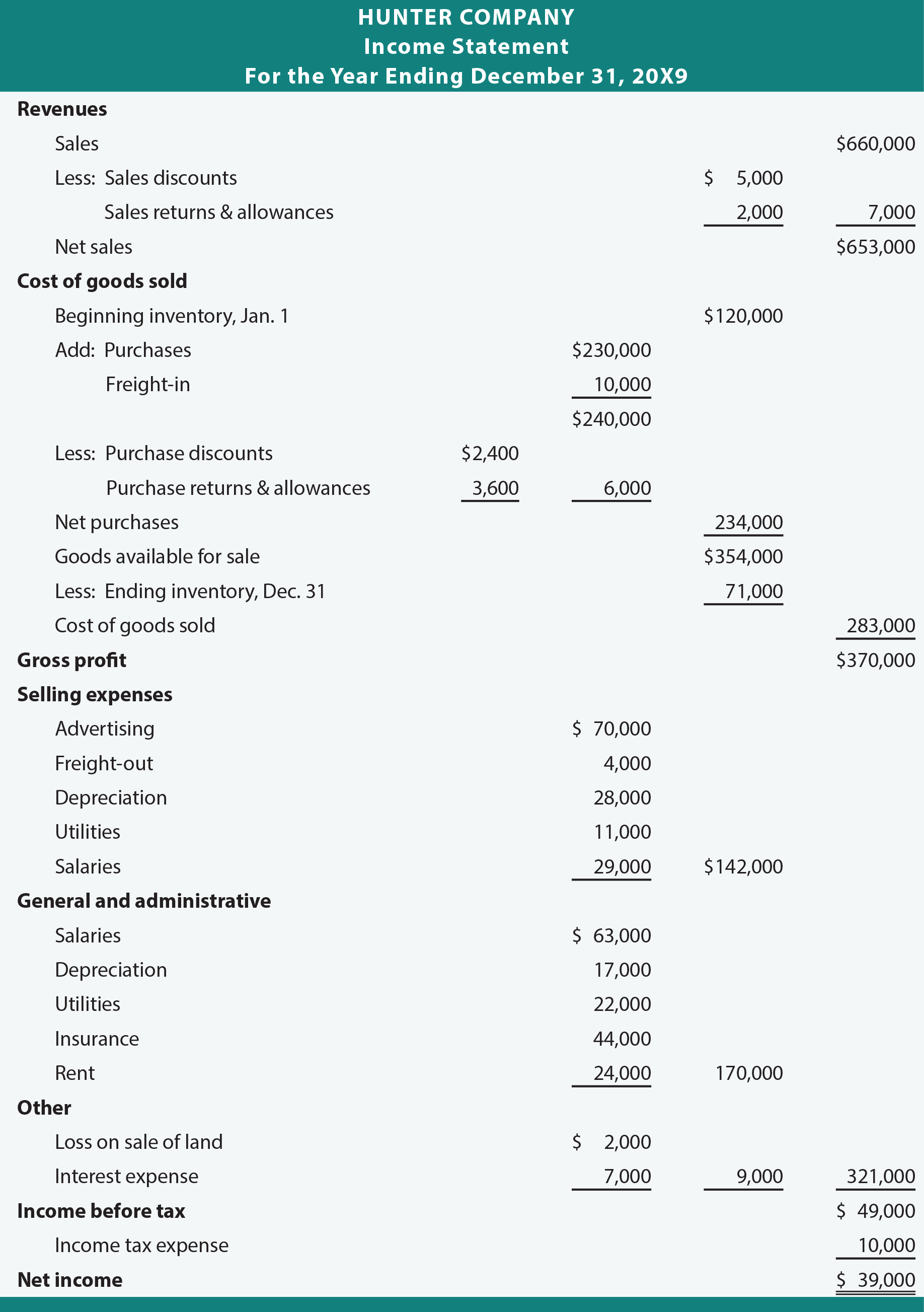

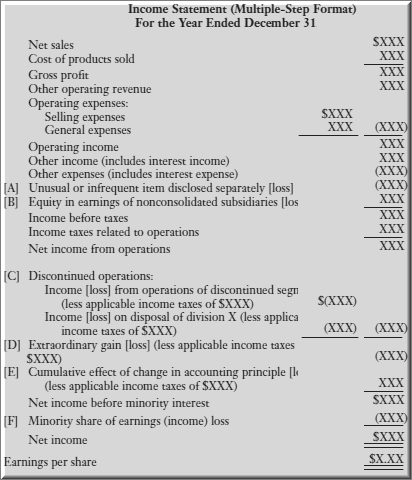

Multiple step income statement practice problems. Interest revenue is outside of a company s main operations. B prepare a single step income statement. Green as at 31 march 2015. A simple multiple step income statement separates income expenses gains and losses into two meaningful sub categories called operating and non operating.

Wileyplus brief exercises do it. Lo 4 the adjusted trial balance for the year ended december 31 2017 for dykstra company is shown below. Exercises exercises problems and many. Interest earned is a non operating revenue.

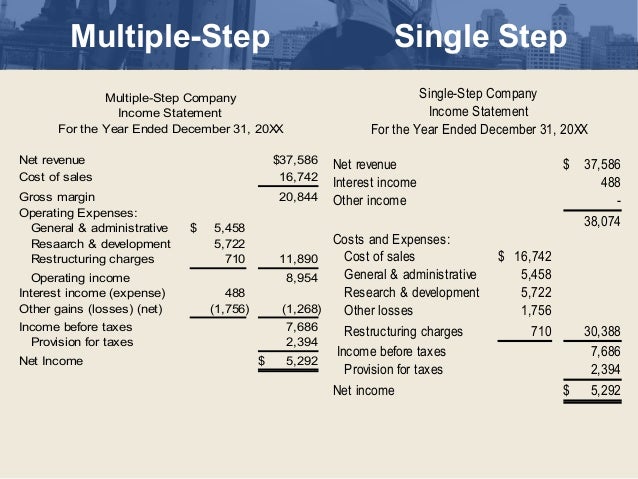

Distinguishing differences compare and contrast single step and multi step income statements problem solving use what you ve learned to calculate an organization s earnings per share in a. Green as at 31 march 2015 in both horizontal and vertical style. Interest earned on investments would appear in which section of a retailer s multiple step income statement. The following trial balance is prepared after preparation of income statement for f.

A major expense shown in our first income statement example above is tax. Unlike the single step income statement format where all revenues are combined in one main income listing and all expenses are totaled together the multiple step statement lists these. In the absence of information about the date of repayment of a liability then it may be assumed. Tax or taxation is actually shown in a simplified way in that income statement as it is a single step income statement.

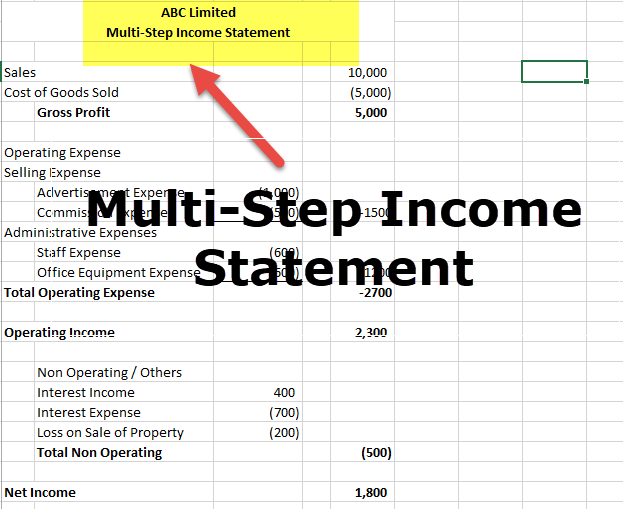

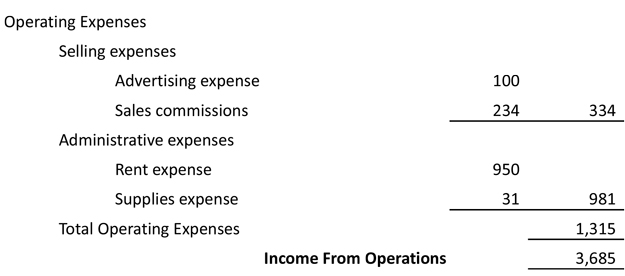

Instructions prepare a multiple step income statement for dykstra company. The multiple step profit and loss statement segregates the operating revenues and operating expenses from the nonoperating revenues nonoperating expenses gains and losses. Preparation of balance sheet horizontal and vertical style. A multi step income statement contains four measures of profitability and a single step income statement contains one measure of profitability.

Start studying multi step income statement practice. In multiple step income statements tax is shown on. Prepare balance sheet for f. Assume a tax rate of 30.

Multi step income statement is the income statement of the company which segregates the total operating revenue of the company from non operating revenue and total operating expenses of the company from non operating expenses thereby separating the total revenue and expense of a particular period into two different sub categories i e operating and the non operating. When you have completed the practice exam a. Learn vocabulary terms and more with flashcards games and other study tools.