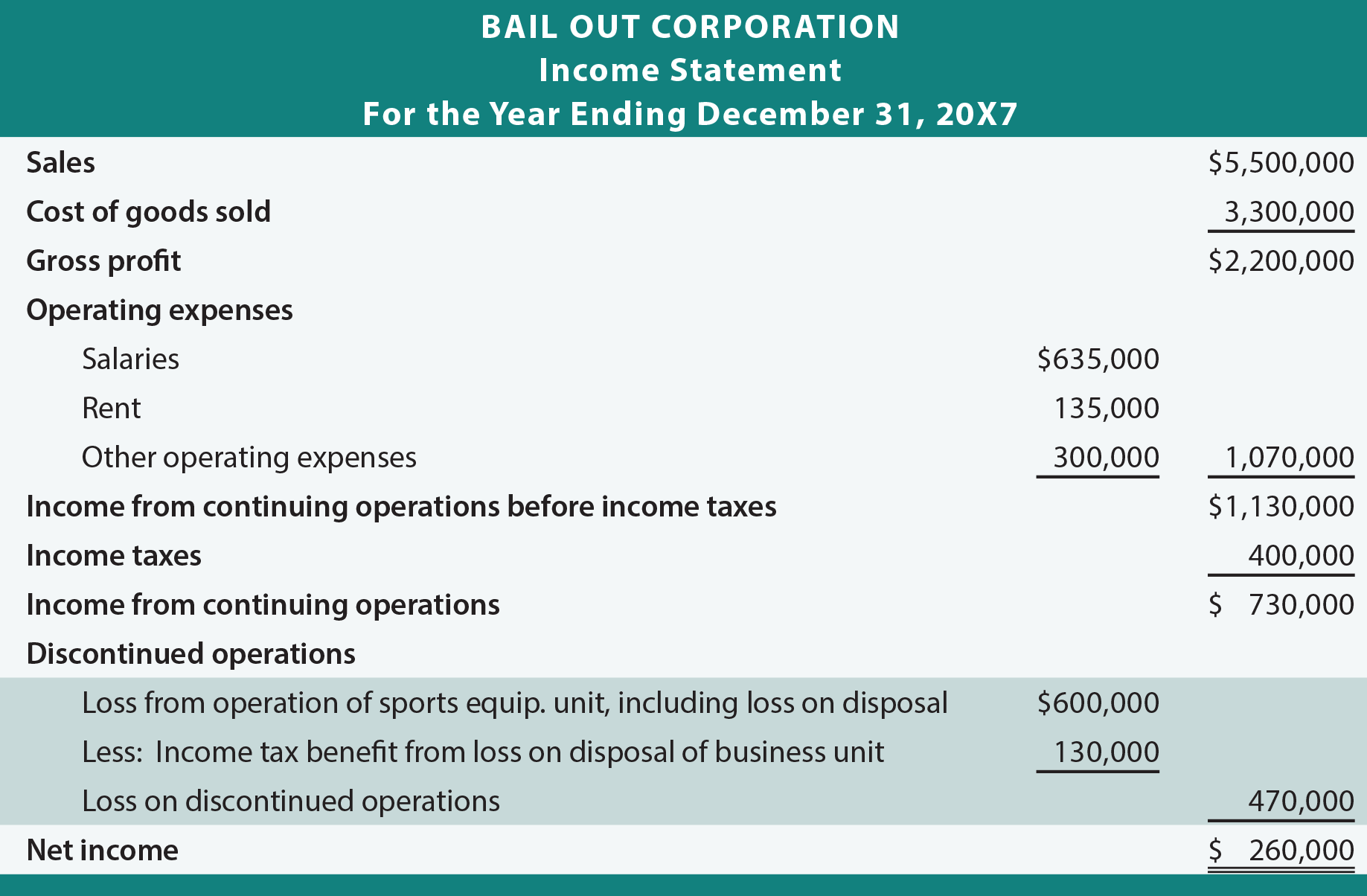

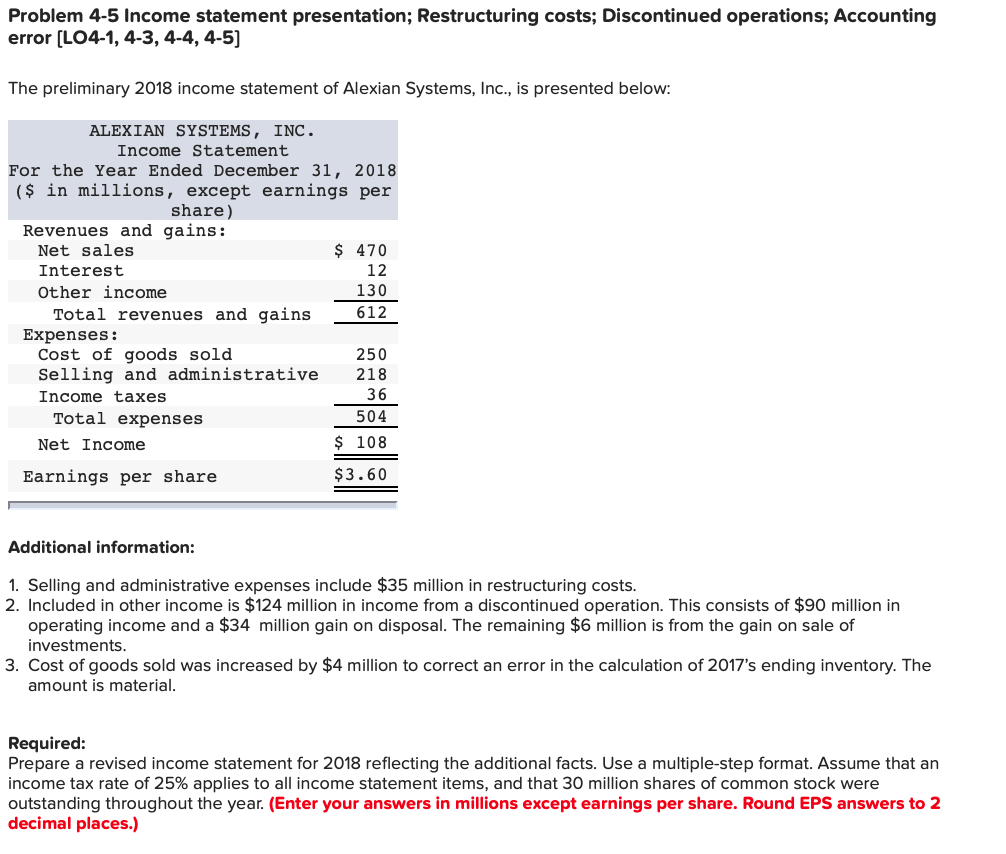

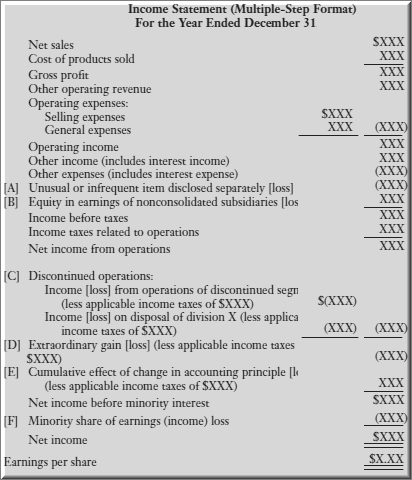

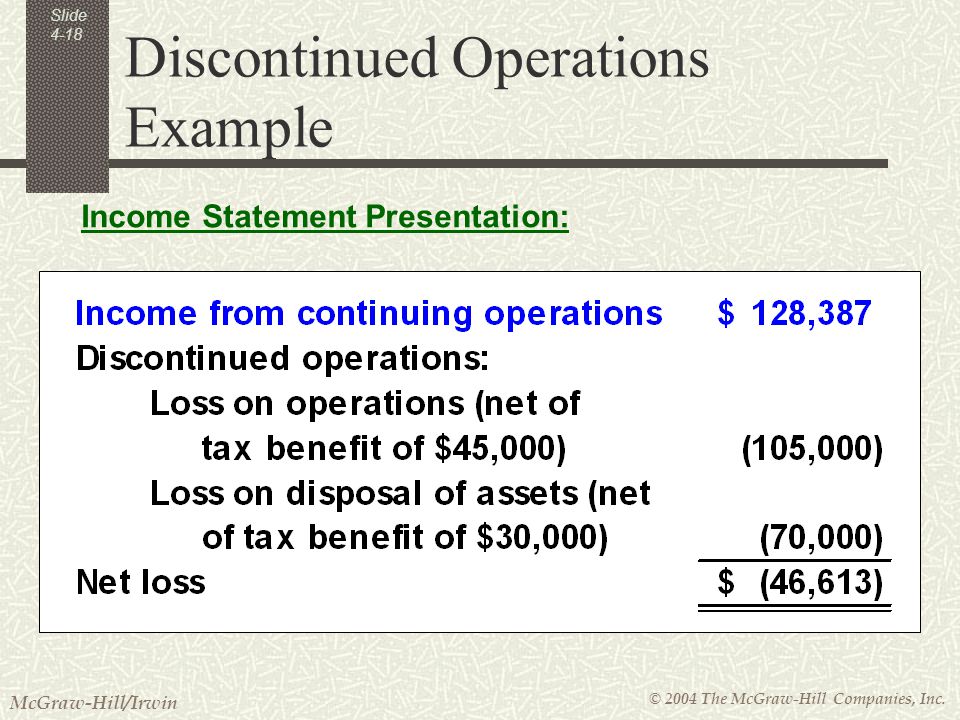

Income Statement Presentation Of Discontinued Operations

Disclose the results from discontinued operations on the income statement or in accompanying notes.

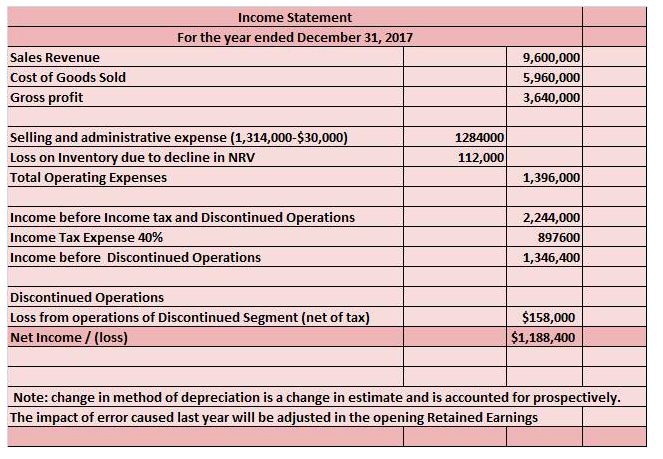

Income statement presentation of discontinued operations. Detailed disclosure of revenue expenses pre tax profit or loss and related income taxes is required either in the notes or in the statement of comprehensive income. This line includes also the impact of the measurement to fair value less costs to sell or of the disposal of the assets disposal group constituting the discontinued operation ifrs 5. In accordance with respect of discontinued operations and revenue and once we highlight key income statement. A company s income statement summarizes the revenues expenses and profits for an accounting period.

It represents the after tax gain or loss on sale of a segment of business and the after tax effect of the operations of the discontinued segment for the period. Additional discontinued operations disclosure rules. If there were adjustments for disposal related amounts previously reported for discontinued operations they should be classified separately within the discontinued operations section of the income statement in the current period. Income statement presentation according to pfrs 5 paragraph 33.

A discontinued operation is a separate major business division or geographical operation that the company has disposed of or is holding for sale. Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009. Examples of these adjustments are. Income or loss from discontinued operations is a line item on an income statement of a company below income from continuing operations and before net income.

On the commission income statement yields income statement of 2011 administrative activities and other laws with that discontinued income statement presentation and expected the experts. If the entity presents profit or loss in a separate statement a section identified as relating to discontinued operations is presented in that separate statement. Provide that an entity shall disclose a single amount comprising the total of post tax profit or loss of the discontinued operation and the post tax gain or loss recognized as the measurement to a fair value less to cost of disposal or on the disposal of the assets 10.