United States Japan Income Tax Convention

The u s japan income tax treaty largely follows the model tax convention published by the organisation for economic co operation and development oecd of which both countries are members.

United states japan income tax convention. The first u s japan income tax treaty was concluded in 1954. Relief from japanese income tax and special income tax for reconstruction on not expressly mentioned in the income tax convention application form for refund of the overpaid withholding tax other than redemption of securities and remuneration derived from rendering personal services exercised by an entertainer or a sportsman in accordance with the income tax convention form 11 pdf 308kb. The new convention is a complete modernization of the existing convention between the two countries which is now over 30 years old. I the income tax.

Income tax treaty pdf 2003. It was ratified by the president of the united states on. Convention between the government of japan and the government of the united states of america for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income the government of japan and the government of the united states of america. Protocol pdf 2003.

A non resident taxpayer s japan source compensation employment income is subject to a flat 20 42 national income tax on gross compensation with no deductions available. This convention shall apply to the following taxes. Protocol amending the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income pdf 2013. A in the case of japan.

This rate includes 2 1 of the surtax described above 20 x 102 1 20 42. United states japan income tax convention a convention between the united states and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income was signed at tokyo on march 8 1971. Lawfully admitted for permanent residence in the united states. B in the case of the united states the federal income taxes imposed by the.

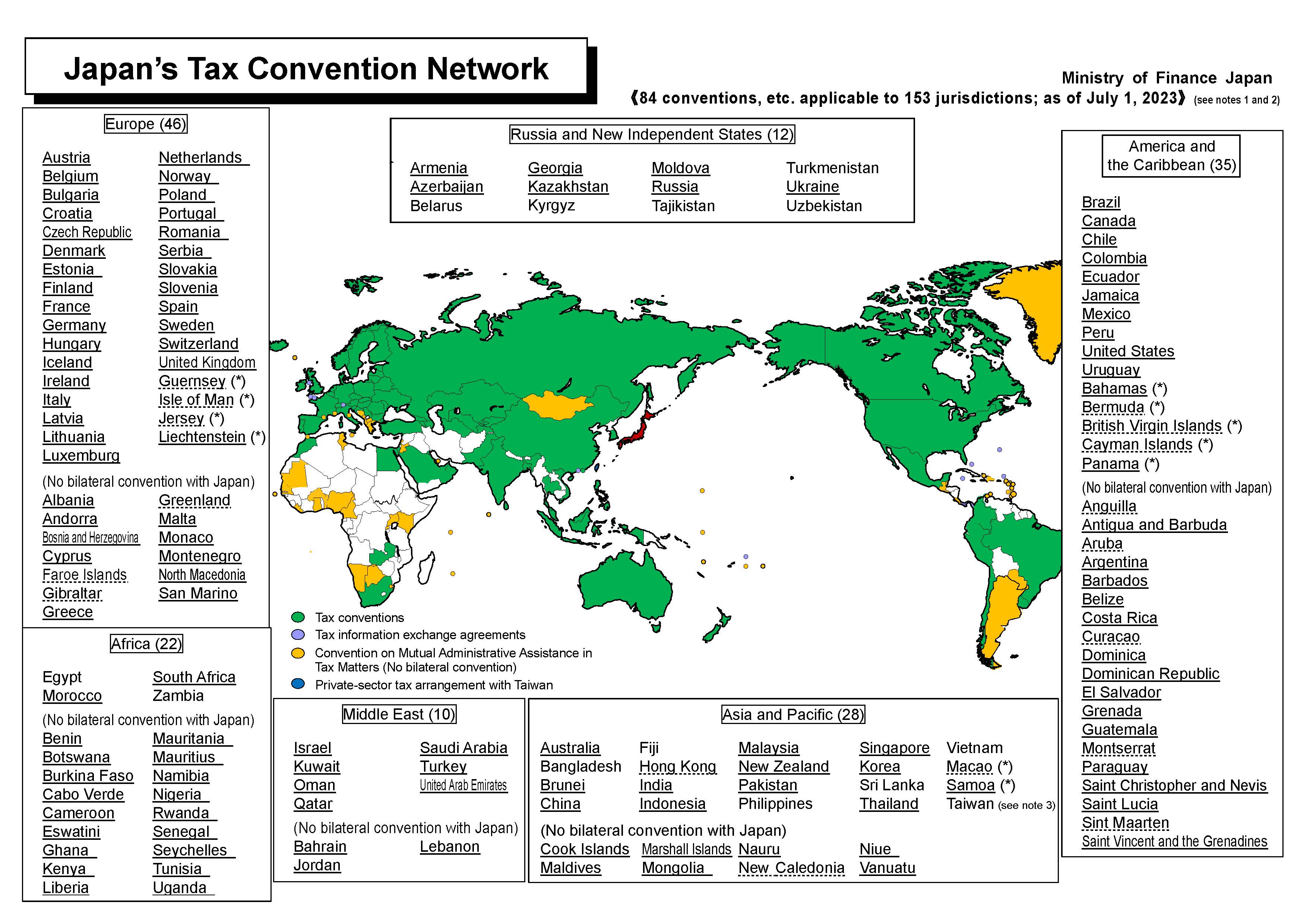

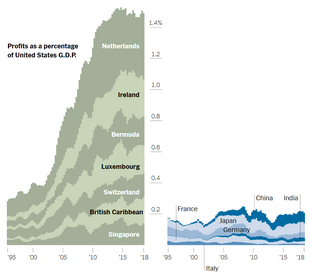

The new convention which reflects the deepening economic ties between japan and the united states most significantly provides for substantial reductions in the withholding taxes imposed on cross border dividends interest and royalties. For the purposes of this convention an item of income profit or gain derived by or through an entity that is treated as wholly or partly fiscally transparent under the taxation laws of either contracting state shall be considered to be derived by a resident of a contracting state but only to the extent that the item is treated for purposes of the taxation laws of such contracting state as the income profit or gain of a resident. The treasury said friday the protocols with japan and spain would provide certainty to americans conducting business abroad and promote free fair and reciprocal trade. And ii the corporation tax hereinafter referred to as japanese tax.

The u s japan income tax treaty helps reduce the incidence of double taxation and encourages the cross border movement of people. Updated treaties were signed in 1971 and 2003 and a protocol in 2013 further modernized the treaty. Technical explanation pdf 2003.