The Income Statement And Balance Sheet Approaches Are Used To Estimate Uncollectible Accounts

It s an inevitable reality that not all customers will pay down their account balances.

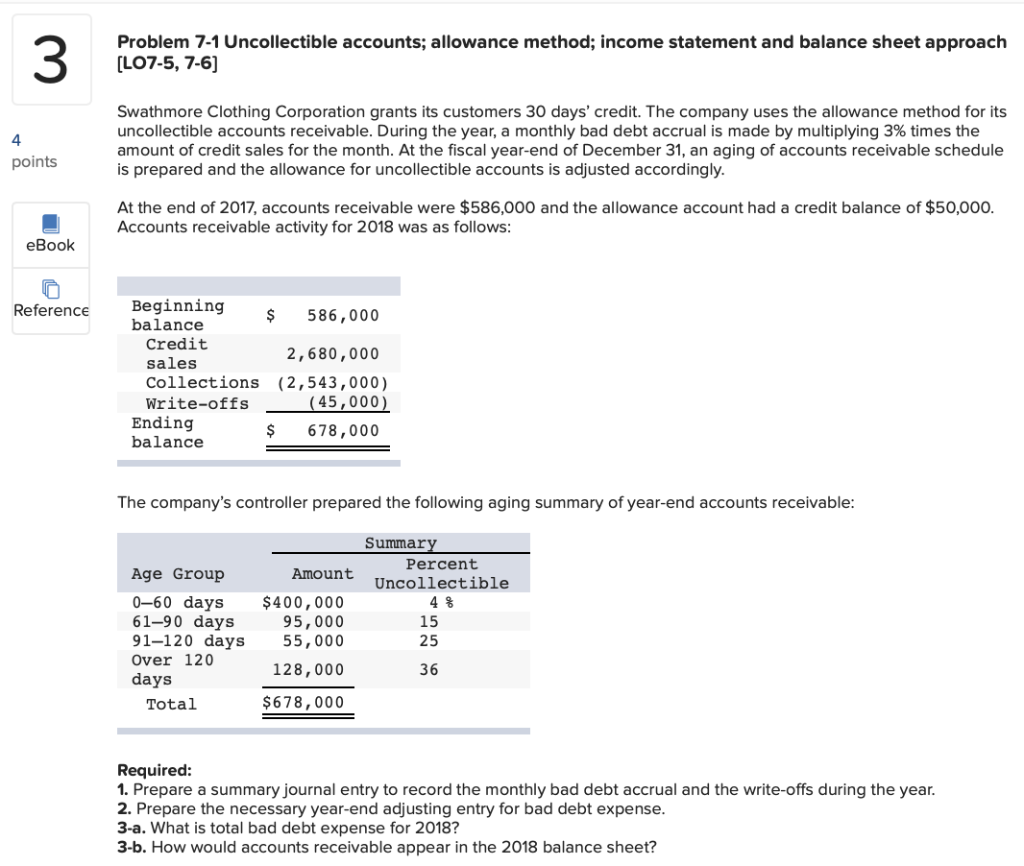

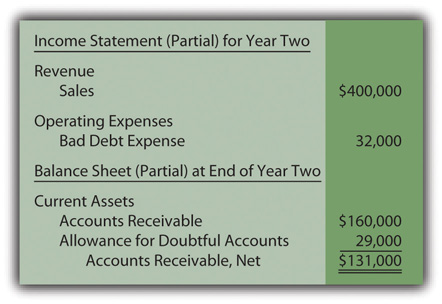

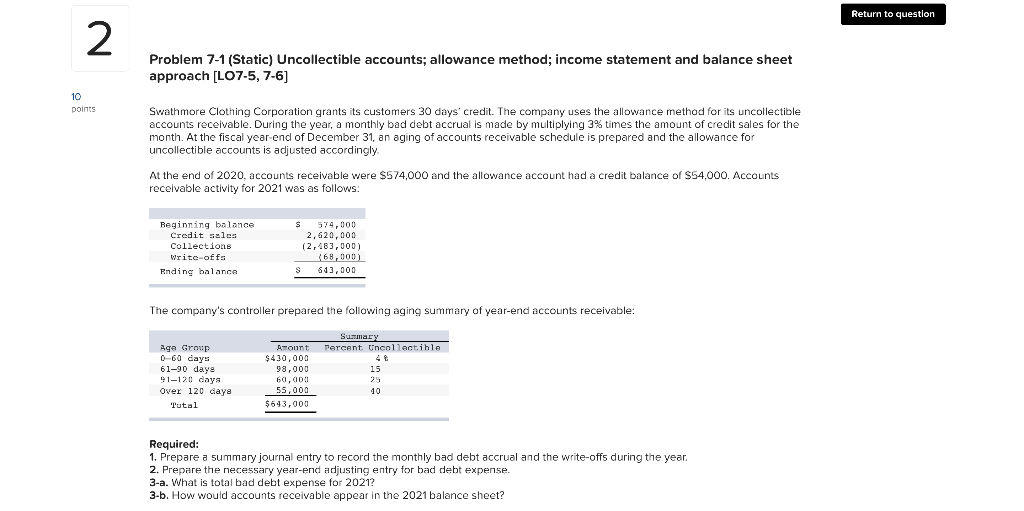

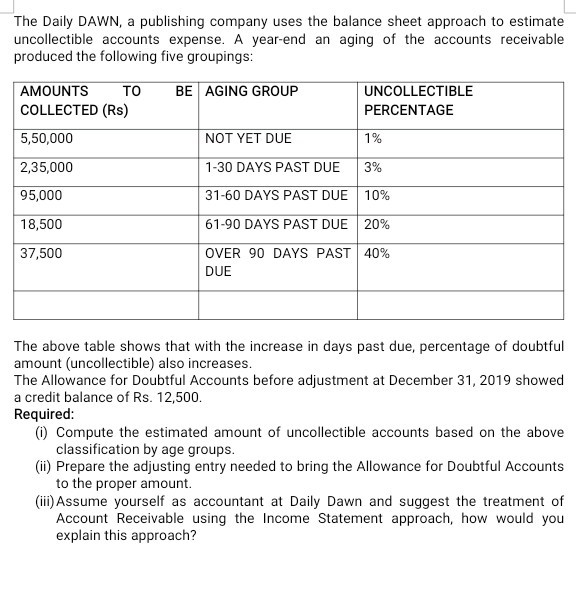

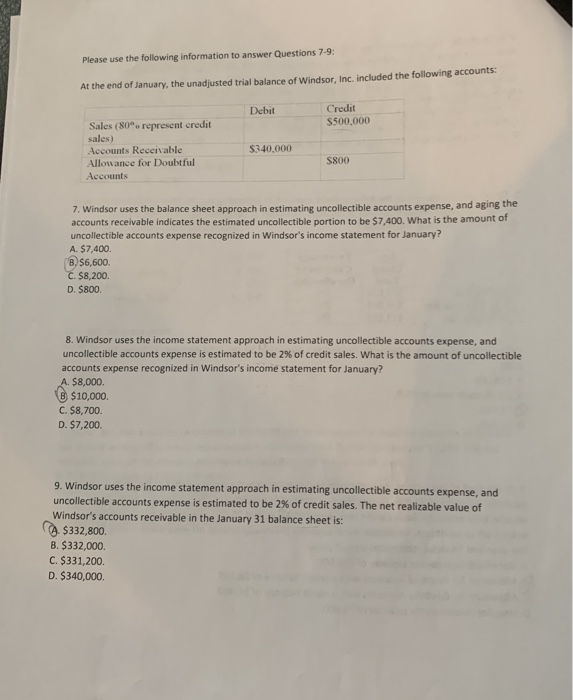

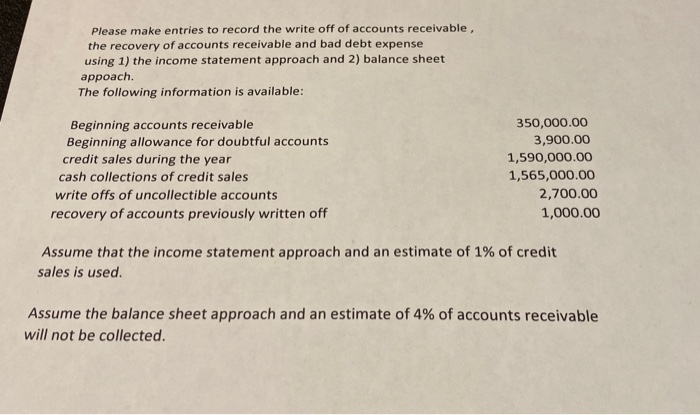

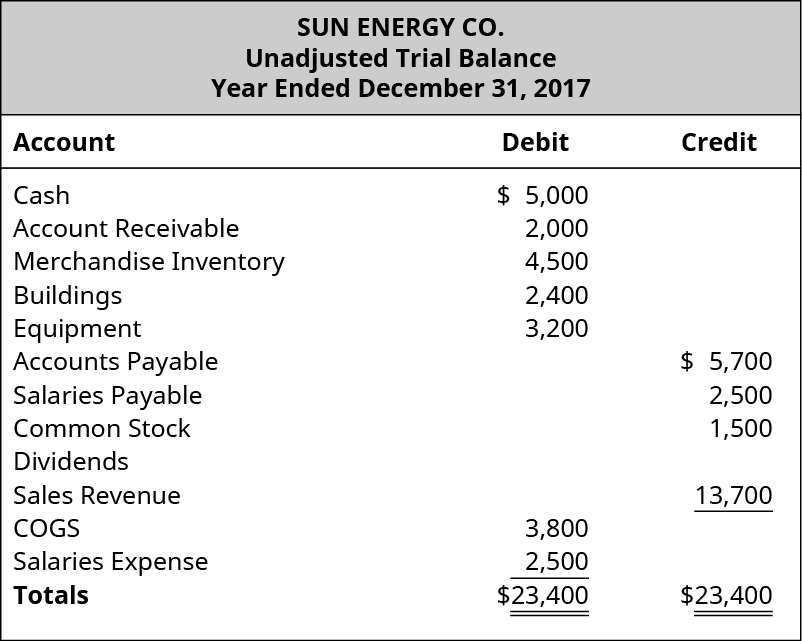

The income statement and balance sheet approaches are used to estimate uncollectible accounts. To account for this lost income businesses record bad debt expense on a periodic basis. The income statement and balance sheet approaches are used to estimate uncollectible accounts. Sales on account are 250 000 so the estimate for uncollectible accounts is 5 000 250 000 x 02. Account for uncollectible accounts using the balance sheet and income statement approaches last updated save as pdf page id 2800 contributed by openstax accounting i sourced from openstax fundamentals of.

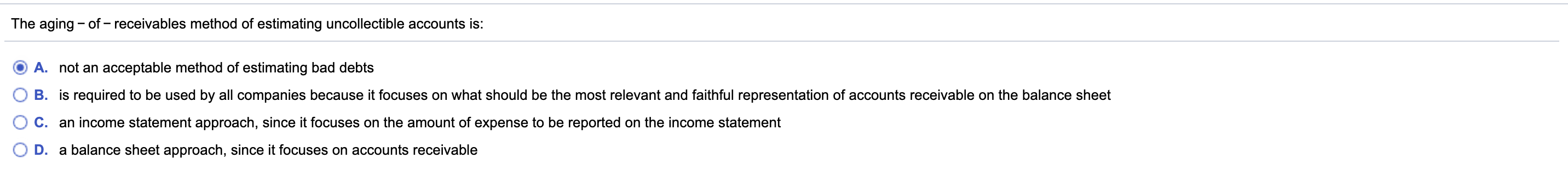

The journal entry to record this is to debit bad debt expense an income statement account and credit allowance for. Which of the following comments. Under this method the uncollectible accounts expense is recognized on the basis of estimates. There are two general approaches to estimate uncollectible accounts expense.

At the end of two months your friend has not repaid the money. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i e it recognizes uncollectible accounts expense in the period in which the related sales are made. The proper entry would involve a debit to office equipment and credit to accounts payable 5. The balance sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable.

53 account for uncollectible accounts using the balance sheet and income statement approaches you lend a friend 500 with the agreement that you will be repaid in two months. The difference between. Example of depreciation usage on the income statement and balance sheet a company acquires a machine that costs 60 000 and which has a useful life of five years. The income statement and balance sheet approaches are used to estimate uncollectible accounts.

9 2 account for uncollectible accounts using the balance sheet and income statement approaches 9 3 determine the efficiency of receivables management using financial ratios 9 4 discuss the role of accounting for 9 5. Depreciation on the income statement is an expense while it is a contra account on the balance sheet. The balance sheet approach s main goal is to properly value assets and liabilities. Want to read.