Us Japanese Income Tax Treaty

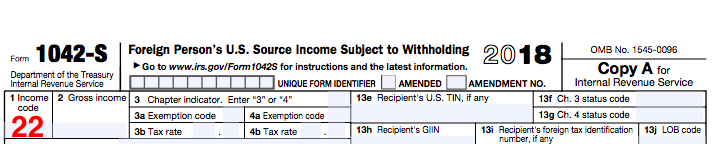

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or.

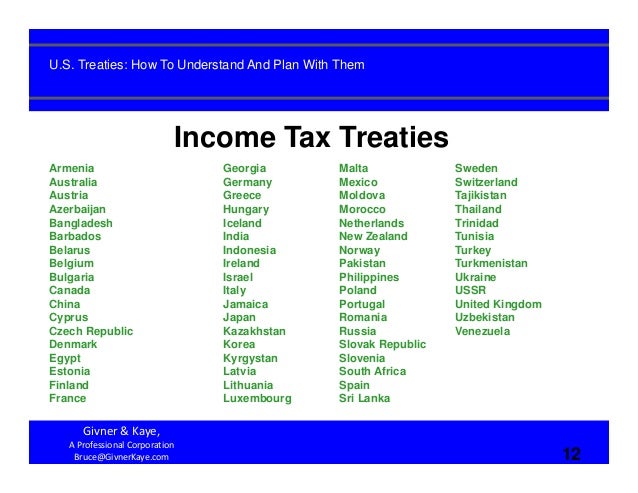

Us japanese income tax treaty. Treasury department reporting the entry into force of the protocol to the japan united states income tax treaty. A protocol the protocol to the us japan tax treaty the treaty which implements various long awaited changes entered into force on august 30 2019 upon the exchange of instruments of ratification between the government of japan and the government of the united states of america. Protocol amending the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income pdf 2013. The united states has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from u s.

Income taxes on certain income profit or gain from sources within the united states. On 20 december 2018 belgium and japan exchanged the instruments for the income tax treaty and protocol the revised treaty signed on 12 october 2016 1 to enter into force. B in the case of the united states the federal income taxes imposed by the. Income tax treaty pdf 2003.

These reduced rates and exemptions vary among countries and specific items of income. And ii the corporation tax hereinafter referred to as japanese tax. This convention shall apply to the following taxes. The protocol amends the existing income tax treaty 2003 and provides for.

Protocol pdf 2003. Lawfully admitted for permanent residence in the united states. The united states has tax treaties with a number of foreign countries. A in the case of japan.

Technical explanation pdf 2003. United states japan income tax convention a convention between the united states and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income was signed at tokyo on march 8 1971. Nevertheless the treaty is an important document for u s. Citizens living in japan vis a vis the u s.

I the income tax. Read text of the protocol and related documents. The date of the protocol s entry into force is 30 august 2019. A where a resident of japan derives income from the united states which may be taxed in the united states in accordance with the provisions of this convention the amount of the united states tax payable in respect of that income shall be allowed as a credit against the japanese tax imposed on that resident.

Read today s release from the u s. The revised treaty will enter into force on 19 january 2019 and will be applicable. Taxes on certain items of income they receive from sources within the united states.