Income Tax Withholding Allowances

The internal revenue service irs form w 4 is used to calculate and claim.

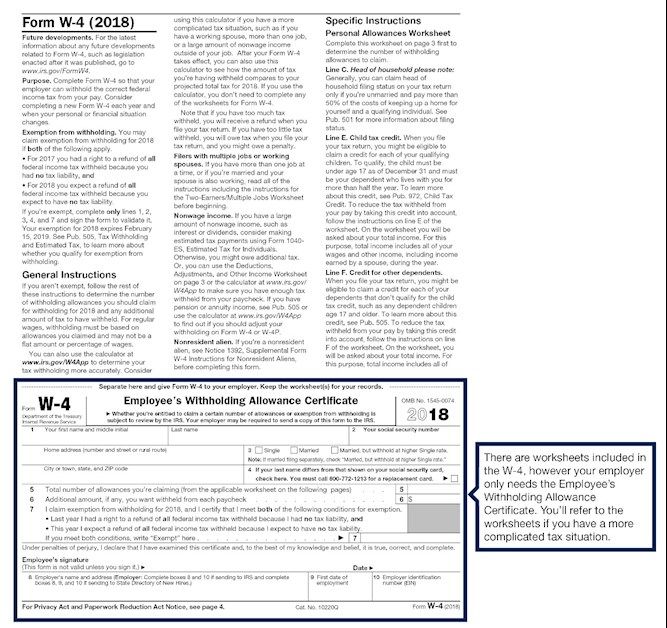

Income tax withholding allowances. The number of withholding allowances you claim depends on the number of your eligible children and your income. Three types of information you give to your employer on form w 4 employee s withholding allowance certificate. Changing your withholding allowances. If the irs questions the number of exemptions you claim you ll have to justify your claim.

Employees file irs form w 4 to indicate their withholding allowances. Here you ll enter the number of tax allowances you re claiming. At the end of the year employees sit down to do their income taxes and determine how much they owe. Here you can claim exemption from tax withholding if you meet both criteria.

Thus more allowances result in more subtracted from the employee s pay to determine withholding and a smaller taxable remainder. Employers are required to withhold some funds from each paycheck and submit these funds to tax agencies. The irs might ask your employer for your w 4 depending on your number of tax withholding allowances. To determine federal income tax withholding use the wage bracket method tables for manual payroll systems with forms w 4 from 2019 or earlier.

We ll look at the employee s federal income tax withholding for situations where they claim 0 allowances and 1 allowance. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee s paycheck. If you were to have claimed zero allowances your employer would have withheld the maximum amount. How many withholding allowances you claim.

A withholding allowance reduces the amount of income tax you withhold from an employee s paycheck. Withholding allowances are exemptions from income tax. As an employee claims fewer exemptions you will withhold more income tax from their wages. But now you bring withholding allowances back into the picture.

Each allowance you claim reduces the amount withheld. If you withhold at the single rate or at the lower married rate. So when you claimed an allowance you would essentially be telling your employer and the government that you qualified not to pay a certain amount of tax. If you withhold an additional amount.

The amount of income you earn. As an employee claims more exemptions you will withhold less income tax from their wages. Here you can enter any additional amount of income you want withheld from your paychecks. A withholding allowance was like an exemption from paying a certain amount of income tax.

Employees can claim withholding allowances on form w 4 which you use to calculate the total withholding.