Income Statement List Of Revenue Accounts

The operating revenue accounts are paired with their associated contra revenue accounts to derive net sales which is reported in the income statement.

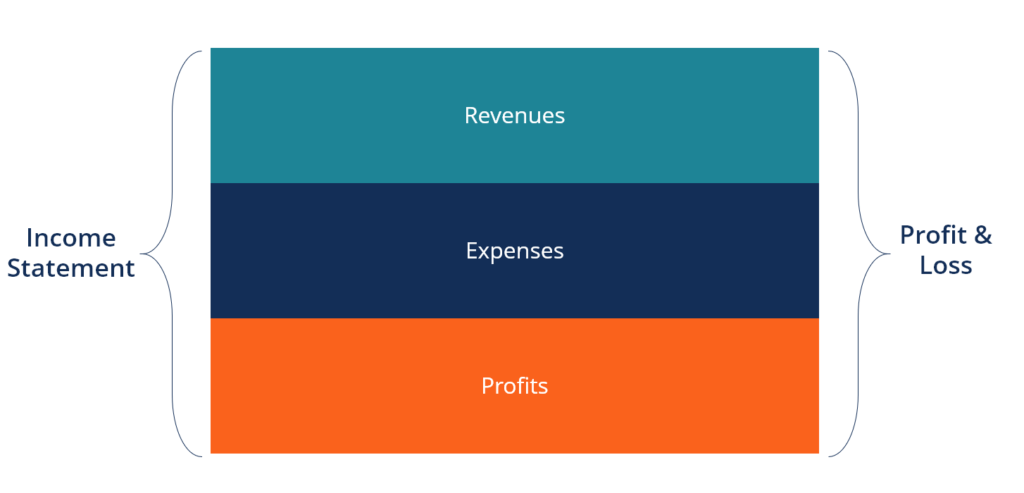

Income statement list of revenue accounts. These accounts are usually positioned in the general ledger after the accounts used to compile the balance sheet. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. The revenue account is only debited if goods are returned and. Each line item and account title is described for you to know and understand what items are reported under revenues in the income statement.

Unlike other accounts revenue accounts are rarely debited because revenues or income are usually only generated. The income statement. Revenue accounts keep track of any income your business brings in from the sale of goods services or rent. List of revenue accounts.

The amounts stored in these accounts should be recorded as of the dates when services are delivered or goods shipped subject to more specific revenue recognition rules under the accrual basis of accounting. This guide provides an overview of the main differences between revenue vs income. Revenue is the sales amount a company earns from providing services or selling products the top line. The income statement portion of the chart of accounts normally begins by listing revenue accounts followed by the expense accounts.

Income statement accounts are those accounts in the general ledger that are used in a firm s profit and loss statement. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Revenues or income refer to economic benefits received from business activities. Examples of income statement accounts a few of the many income statement accounts used in a business include sales sales returns and allowances service revenues cost of goods sold salaries expense wages expense fringe benefits expense rent expense utilities expense advertising expense automobile expense depreciation expense interest expense gain on disposal of truck and many more.

The revenues are grouped or classified based on whether they are related to the normal.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)