Income Tax Rates Train Law

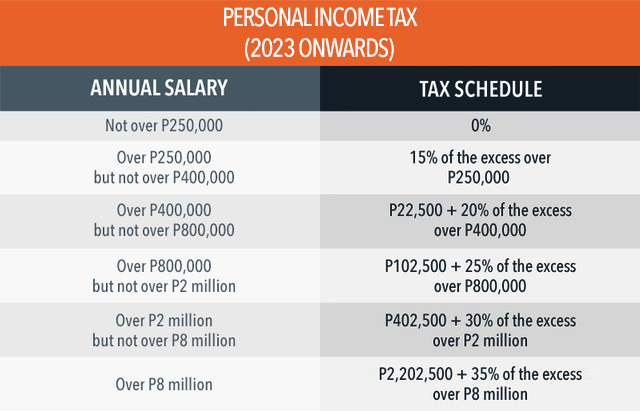

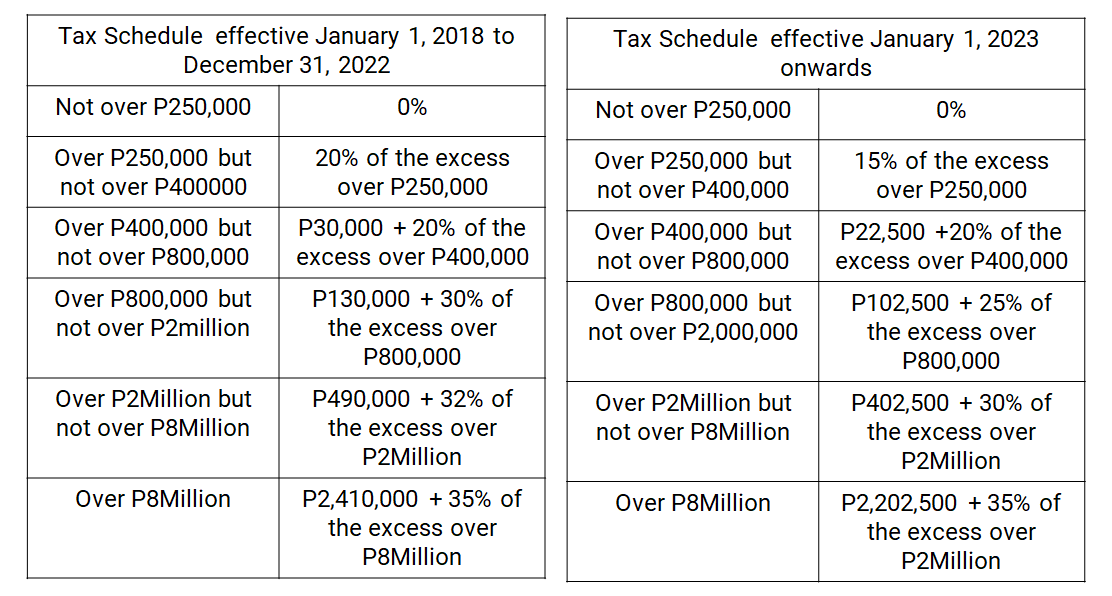

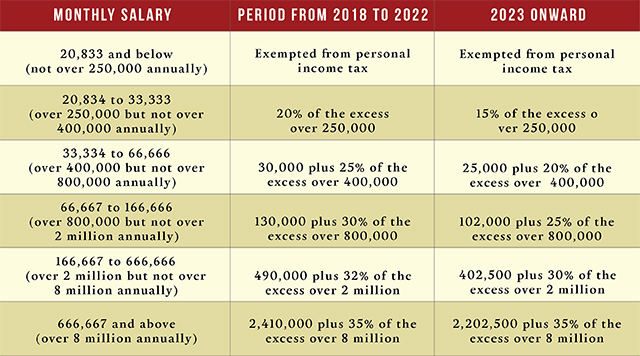

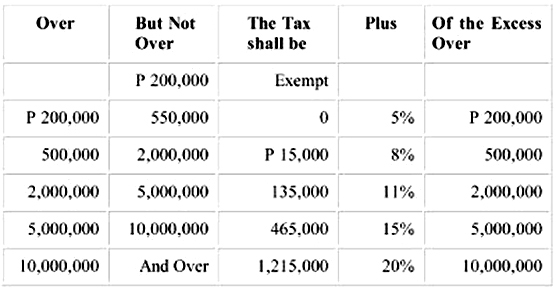

Income tax computations under train from year 2023 onwards now from the year 2023 onwards a new graduated income tax tables will be in use.

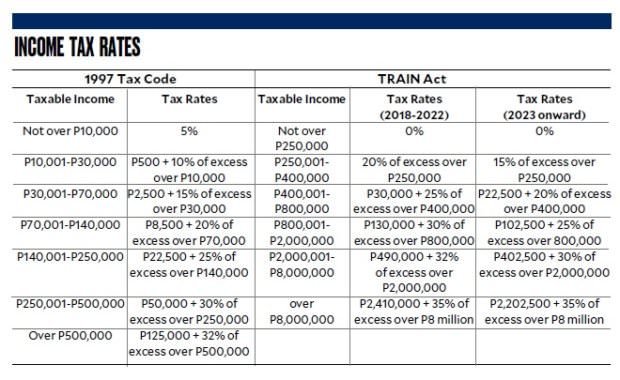

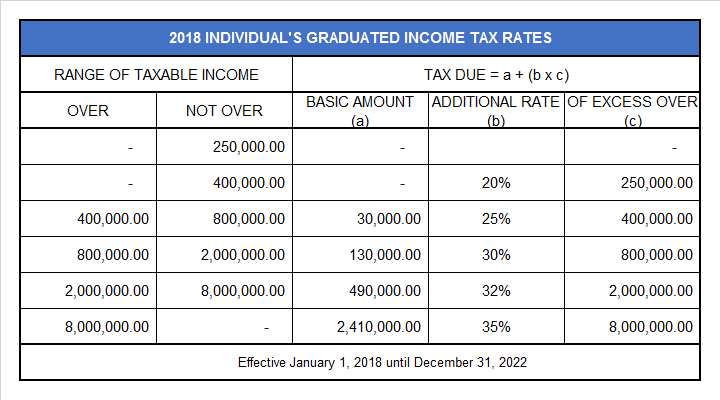

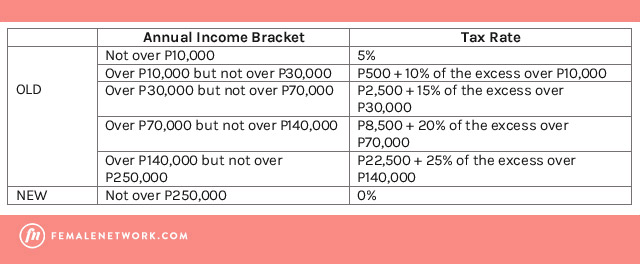

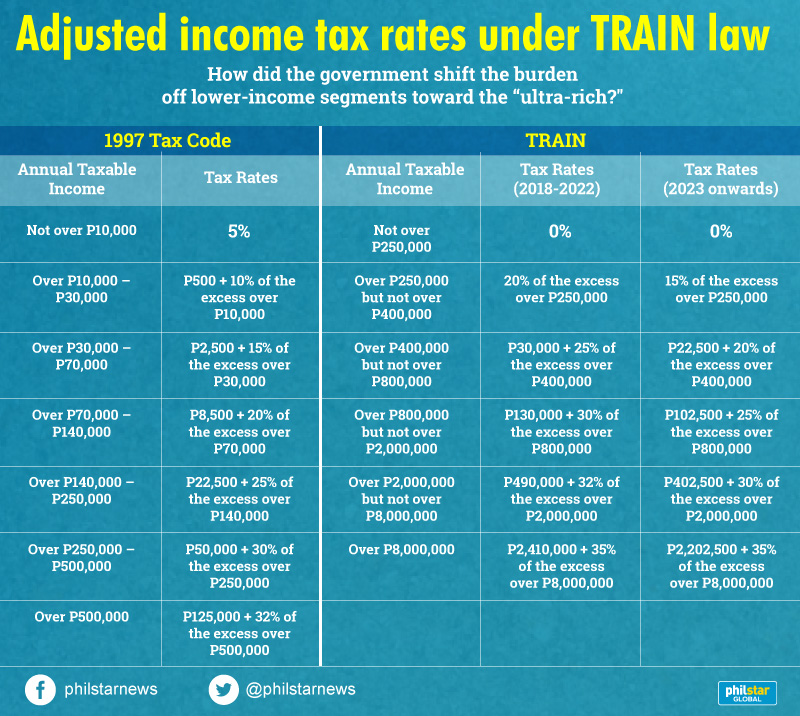

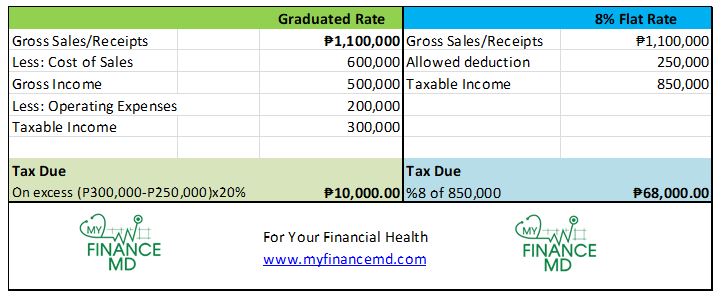

Income tax rates train law. The tax reform for acceleration and inclusion train act has lowered the personal income tax since the 2018 taxable year. While people earning more than p250 000 but not over p400 000 annually will be charged with 20 percent tax on the excess over p250 000. Paying p190 000 income tax on taxable income of p1 million the taxpayer is charged an effective income tax rate of 19. The tax reform for acceleration and inclusion train act officially cited as republic act no.

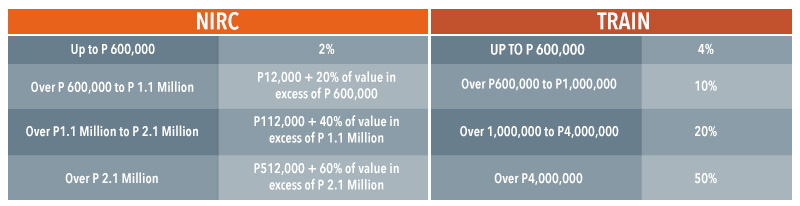

The train act is the first of four packages of tax reforms to the national internal revenue code of 1997 or the tax code as amended. The tax reform law introduced a new tax structure that has resulted in higher take home pay for employees in the philippines.