Gain On Sale Of Equipment Income Statement Presentation

The sale would appear on the income statement but as a gain or loss on sale not revenue.

Gain on sale of equipment income statement presentation. The gain is classified as a non operating item on the income statement of the selling entity. The sale of a business segment presumes that the operations associated with that segment will terminate for the disposing business. Eighteen months later it sells these shares for 750 000. In paragraph 205 20 45 1e to be classified as held for sale 2.

Under operating activity you deduct gain on the sale of the forklift of 2 000 because the 2 000 from the gain on sale is already included in the net income shown at the top of the operating section. To record this transaction you show proceeds from the sale of the forklift of 7 000 under investing activity. There were no other transactions in july. This is an important distinction when determining how to report the sale.

For an example if the initial loss was 10 000 and our current surplus is 15 000 from this 10 000 is recognized on the income statement as gain reversal of the expense and the rest 5 000 in this case is going straight to equity under the line revaluation surplus. Businesses should report the sale of business segments. Presentation of financial statements topic 205 and property plant and equipment topic 360. For example a business buys a machine for 10 000 and subsequently records 3 000 of depreciation.

Discontinued operation are presented in the statement where net income is reported or statement of. The gains increase the net income and thus the increase in earnings per share and retained earnings. The gain on the sale of these ford shares is the 750 000 sales price less the 700 000 purchase price or 50 000. That would be the general idea behind the surplus.

Statement of financial accounting standards number 144 defines how u s. You sell the forklift for 7 000. The company records this 50 000 as a gain on sale of investments on its income statement under other income. On july 1 good deal sells the equipment for 900 in cash and records a loss of 180 in the account loss on sale of equipment on its income statement.

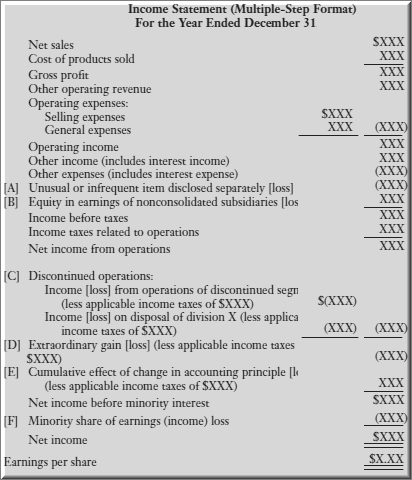

A gain on sale of assets arises when an asset is sold for more than its carrying amount the carrying amount is the purchase price of the asset minus any subsequent depreciation and impairment charges. There is no impact of such gains on the cash flow statement. Where it goes the typical income statement starts with sales revenue then subtracts operating expenses which are just the regular day to day costs of doing business. Our financial reporting guide financial statement presentation details the financial statement presentation and disclosure requirements for common balance sheet and income statement accounts it also discusses the appropriate classification of transactions in the statement of cash flows and addresses the requirements related to the statements of stockholders equity and other comprehensive.

A company purchases 700 000 in shares of ford.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)