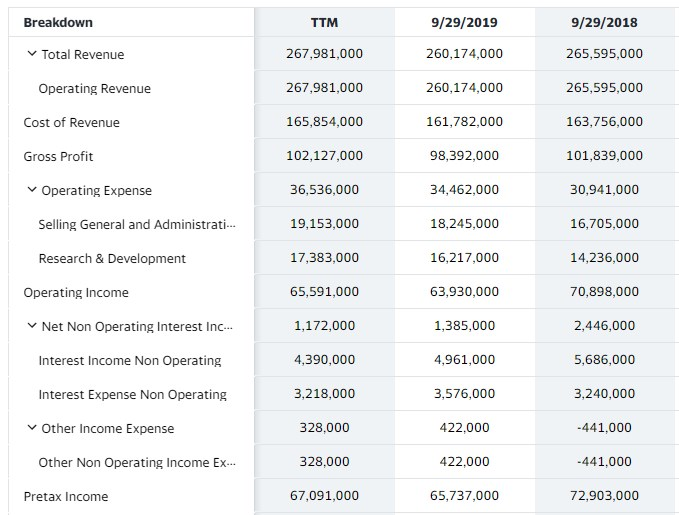

Multi Step Income Statement For Target

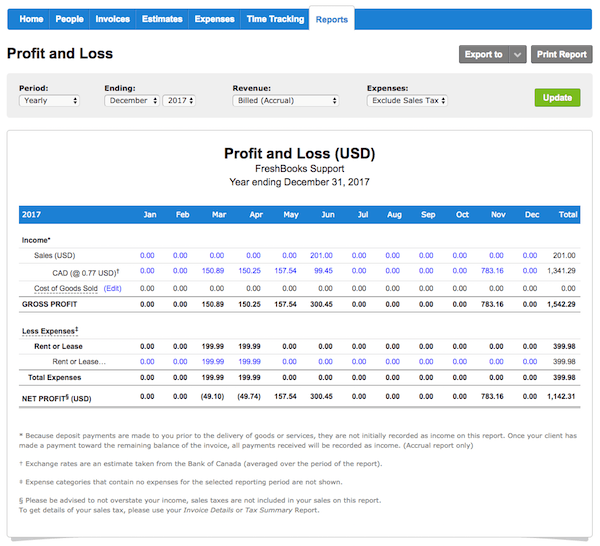

View tgt financial statements in full including balance sheets and ratios.

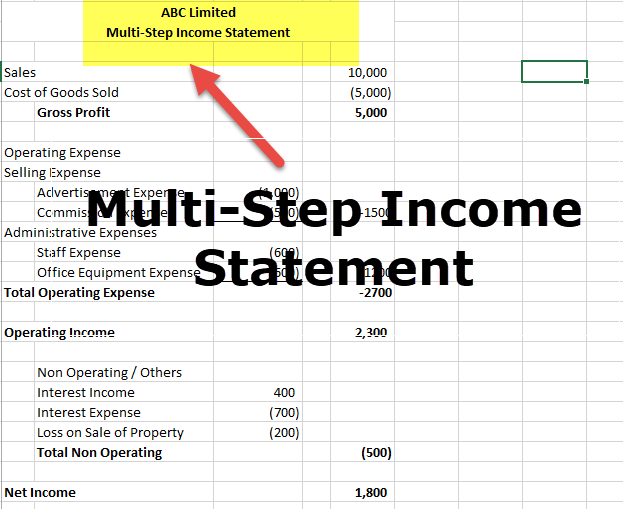

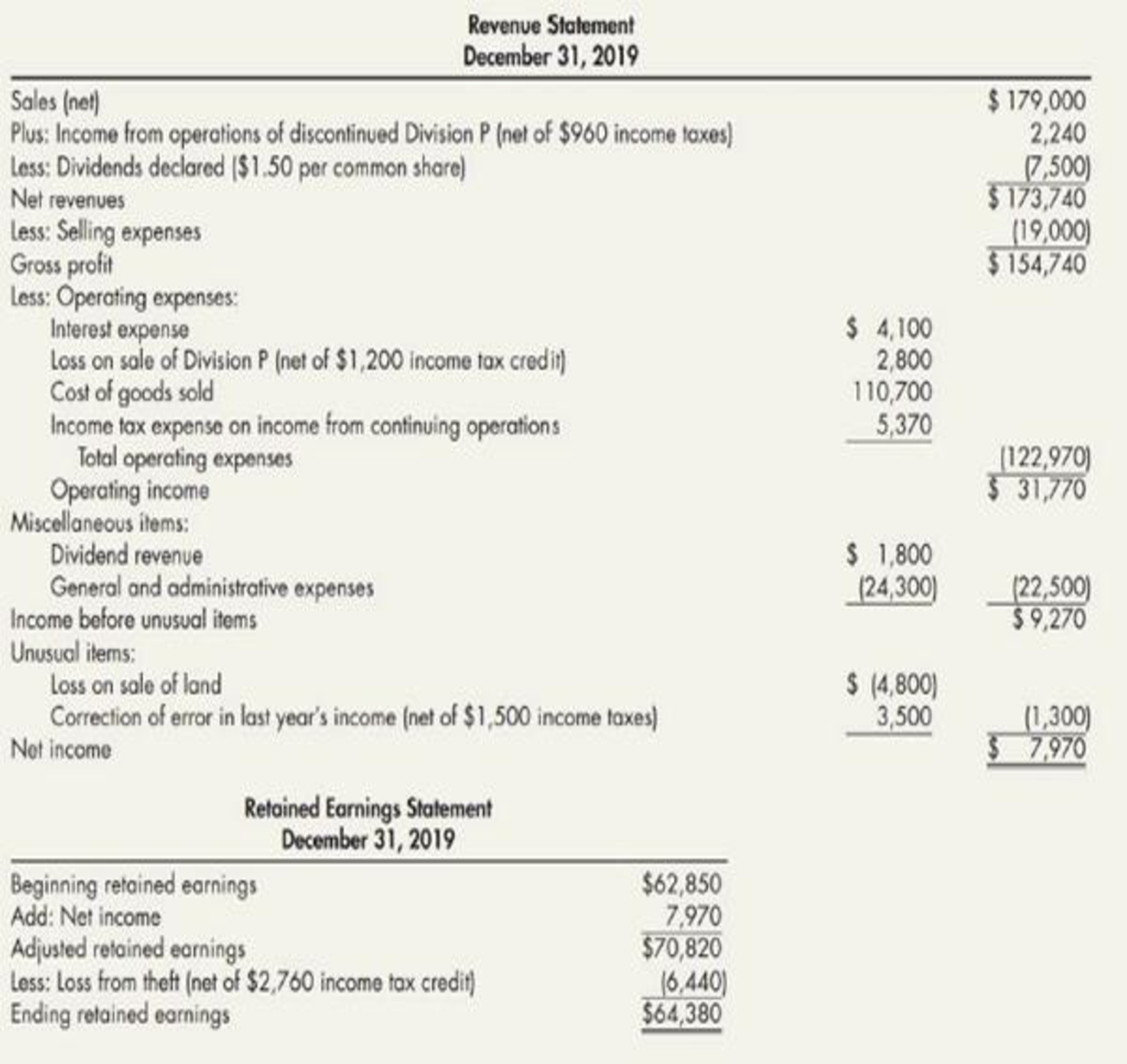

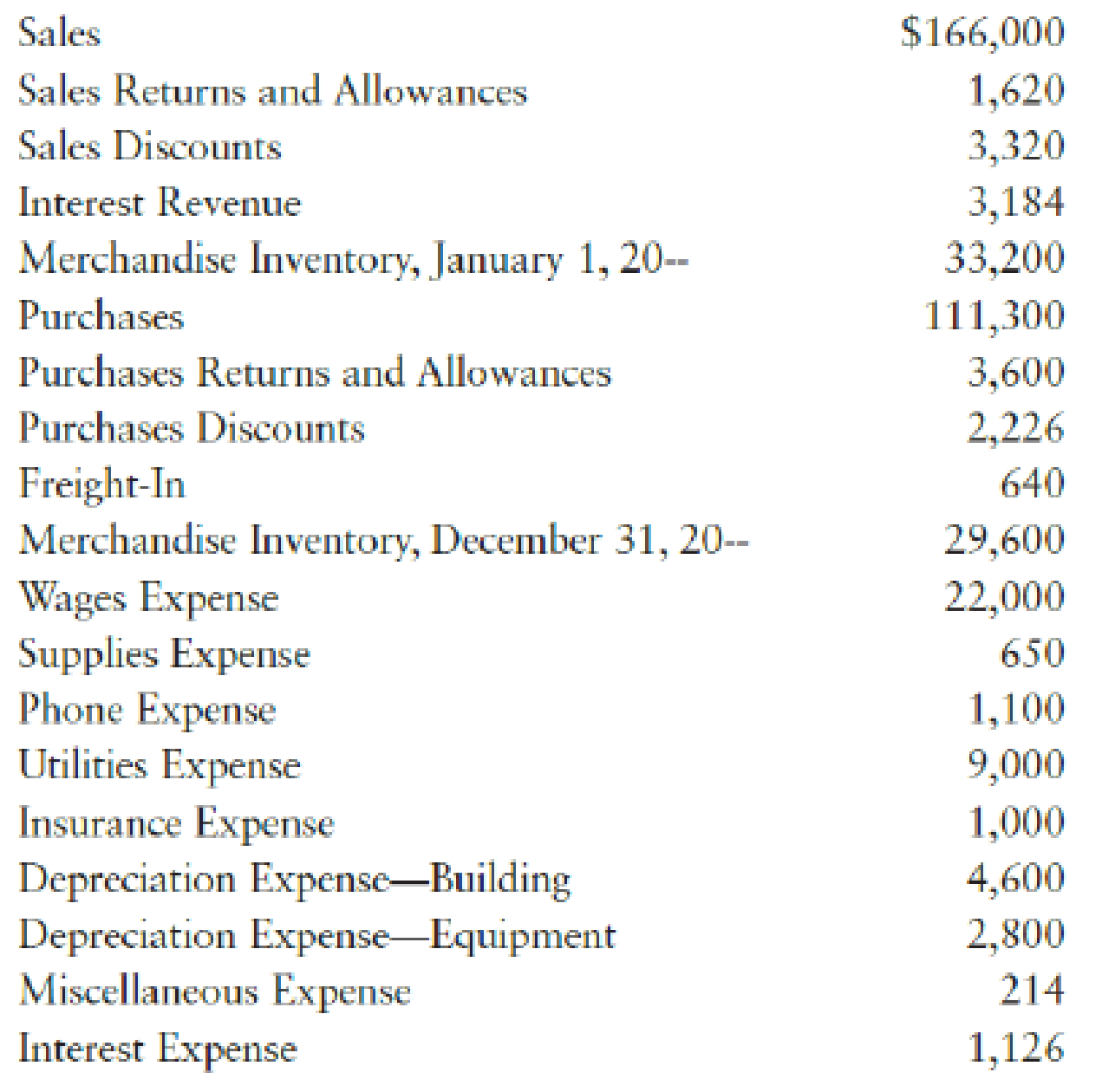

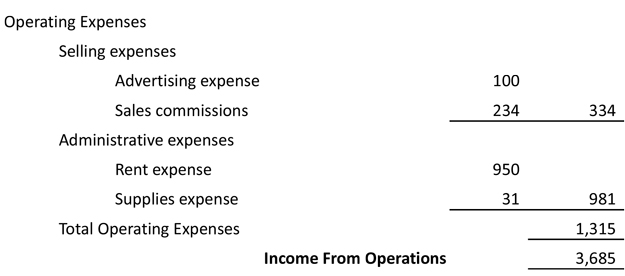

Multi step income statement for target. An alternative to the single step income statement is the multiple step income statement because it uses multiple subtractions in computing the net income shown on the bottom line. The multiple step profit and loss statement segregates the operating revenues and operating expenses from the nonoperating revenues nonoperating expenses gains and losses. Get the detailed quarterly annual income statement for target corporation tgt. Compute net income income from.

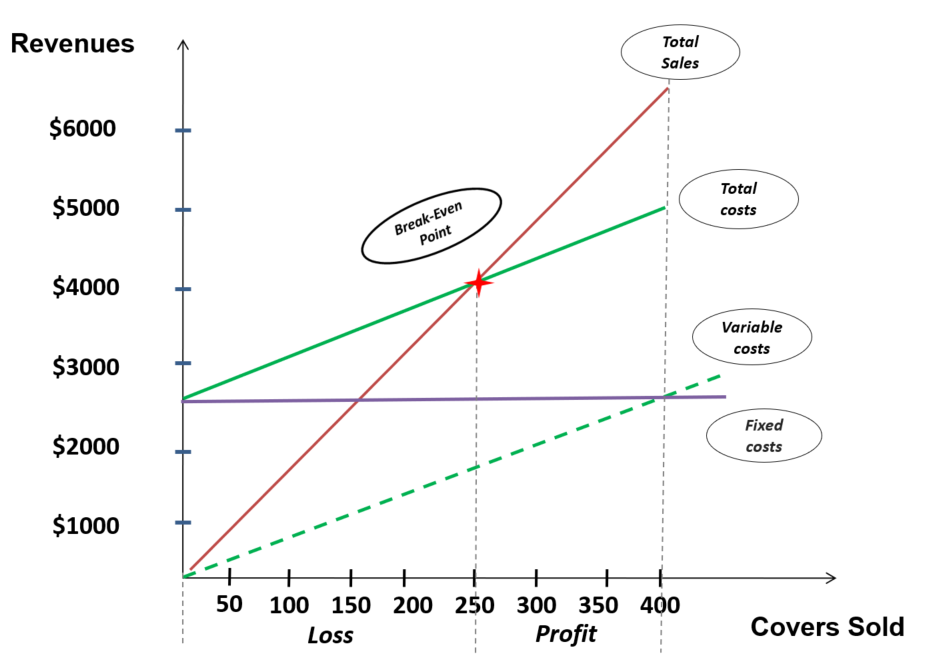

Compute income from operations gross profit operating expenses step 3. Multi step income statement is the income statement of the company which segregates the total operating revenue of the company from non operating revenue and total operating expenses of the company from non operating expenses thereby separating the total revenue and expense of a particular period into two different sub categories i e operating and the non operating. If you had to decide which company was more successful using only the multiple step income statement you created which one would you be more likely to invest in and why. Find out the revenue expenses and profit or loss over the last fiscal year.

As you can see this multi step income statement template computes net income in three steps. Additionally an accounting multi step income statement is useful for companies that have unique situations or need to be able to deduct. Compute gross profit total sales cost of goods sold step 2. 2016 annual report another key difference under ifrs is that expenses must be recorded.

Target produced a multiple step income statement that displays its earnings from continuing operations before interest and income tax expenses as well as the earnings after interest and income tax expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)