Graduated Income Tax Definition Us History

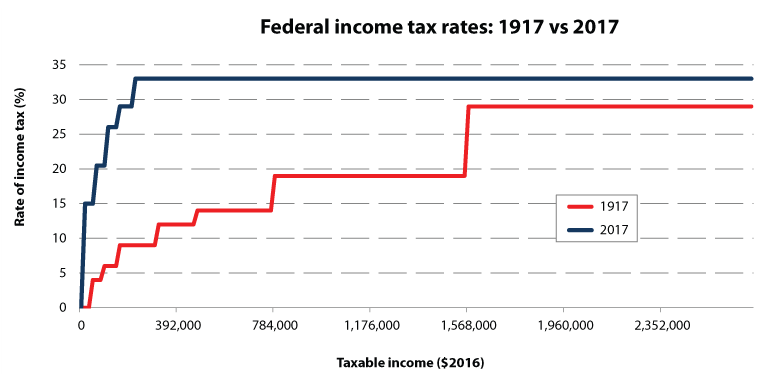

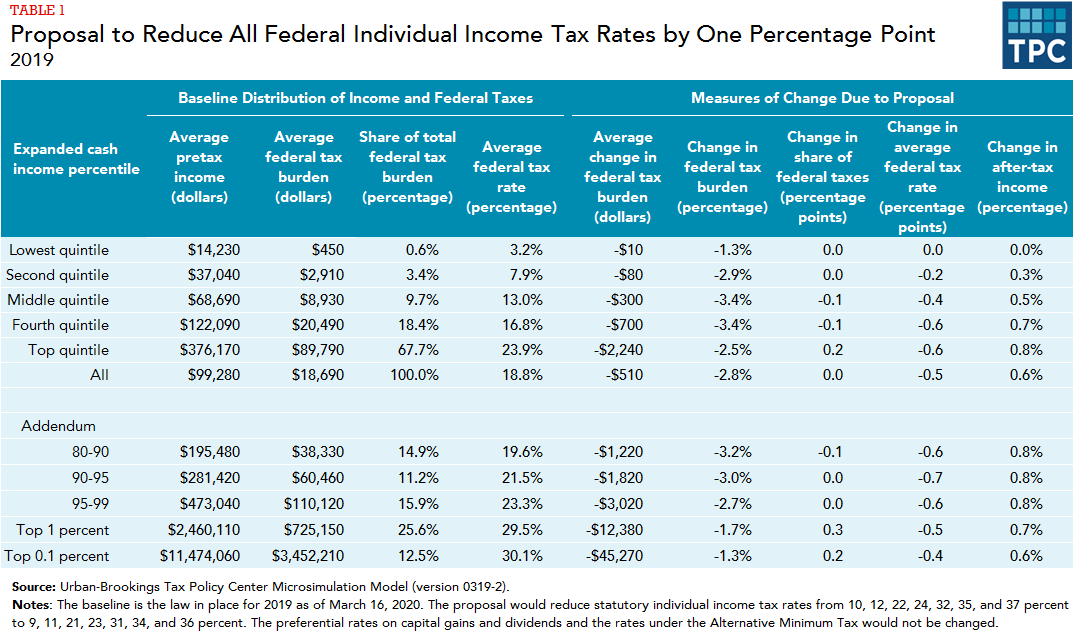

The highest income tax rate was lowered to 37 percent for tax years beginning in 2018.

Graduated income tax definition us history. Originally there wasn t an income tax and tariffs provided the main source of revenue for the government. The constitution empowered the federal government to raise taxes at a uniform rate throughout the nation and required that direct taxes be imposed only in proportion to the census population of each state. A history of taxes in the united states. For example the first 10 000 that you earn might be taxed at a rate of 5 percent the next 15 000 at 15 percent and any income above 25 000 would be taxed at 30 percent.

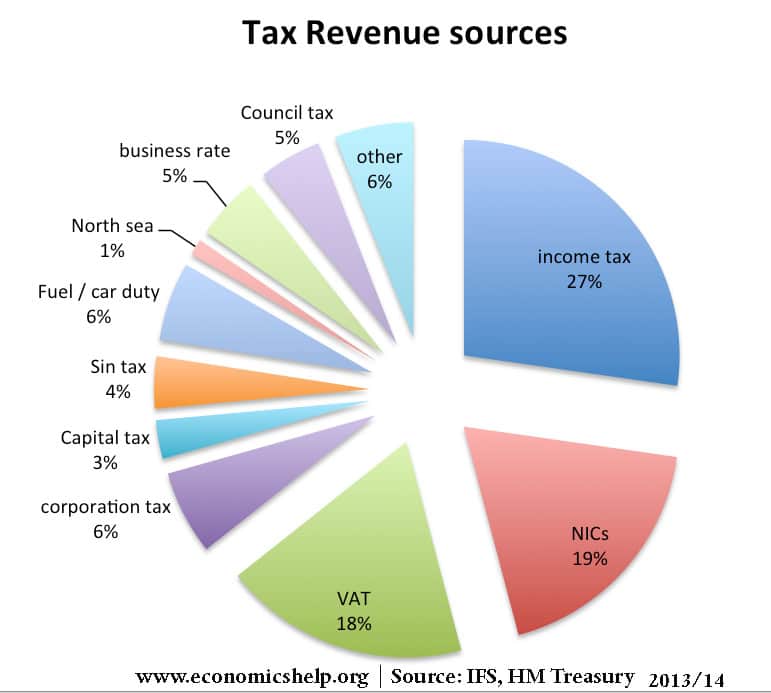

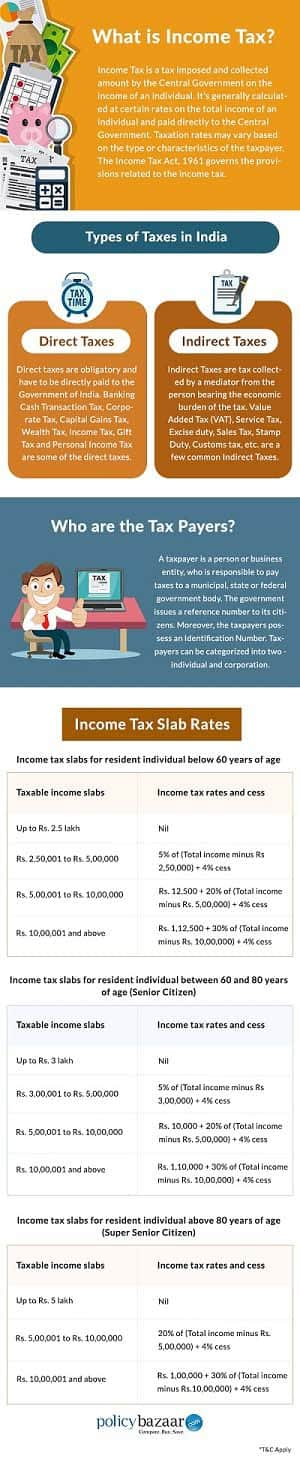

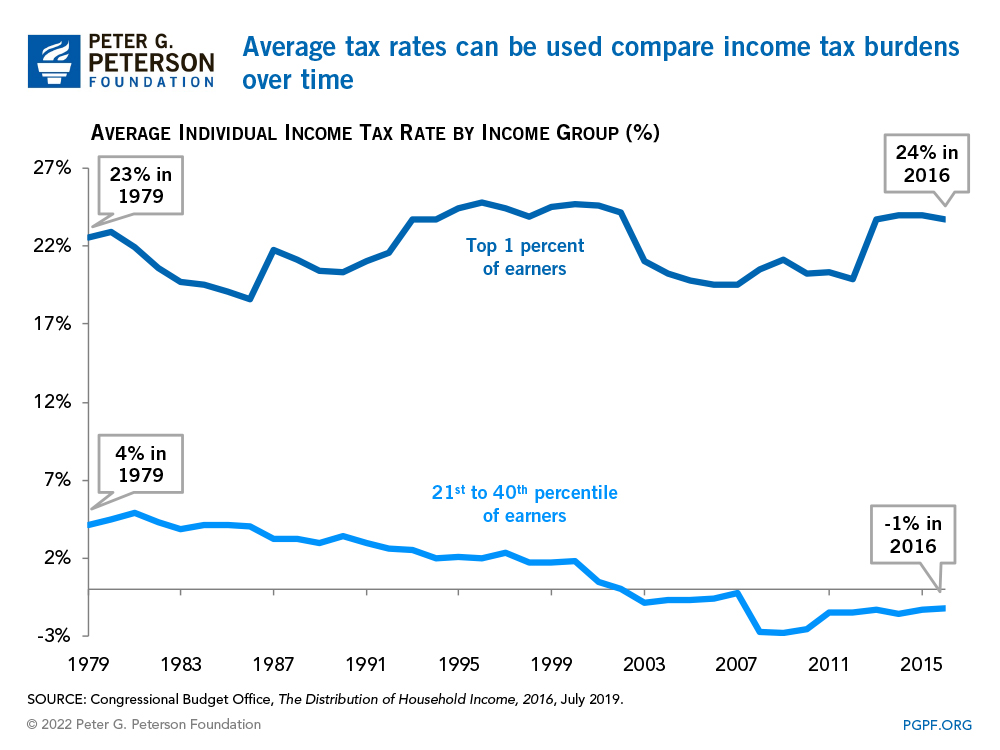

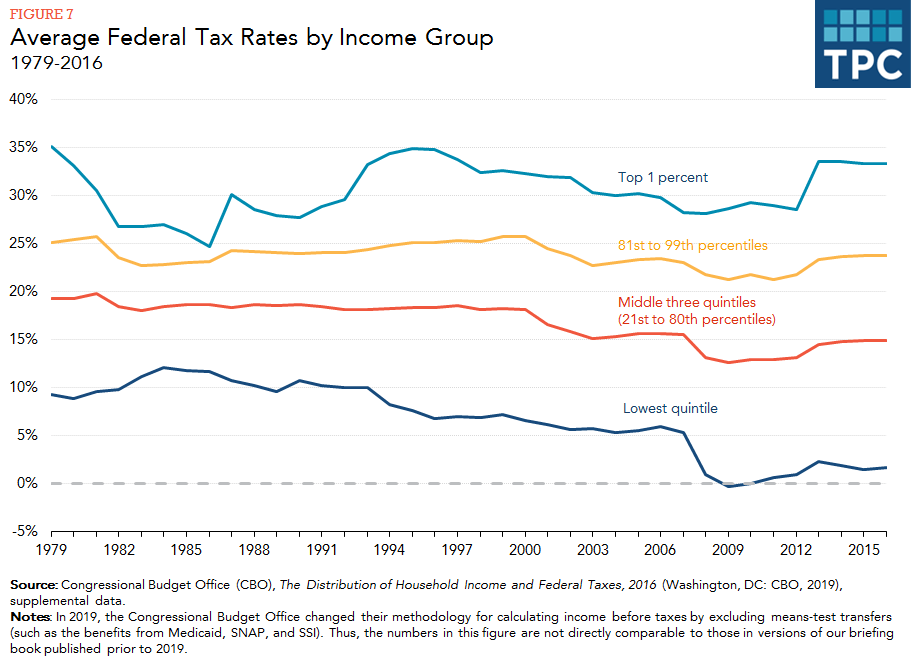

In 1862 congress established a limited income tax only on people who made more than 600 but abolished it in 1872 in favor of higher excise taxes on. Learn vocabulary terms and more with flashcards games and other study tools. Taxation of income in the united states has been practised since colonial times. A progressive tax is one where higher earners pay a higher portion of their income in tax.

During the civil war from 1861 to 1865 the government realized that tariffs and excise taxes alone could not generate enough revenue to both run the government and conduct the war against the confederacy. Congress state legislatures political parties and politicians the american people. Tax that increased with income the rich pay higher percentage in taxes than the poor. The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent.

It s hard to believe but america was founded to avoid high taxation. Some southern states imposed their own taxes on income from property both before and after independence. Enactment of the 16th amendment to the united states constitution. The opposite is a regressive tax where people earning more money pay a lower portion of their income in tax.

Through a constitutional amendment replaced tariffs with a graduated income tax as the main source of revenue for the u s. In the united states the tax system has evolved dramatically throughout the nation s history. Start studying us history unit 1. Early income taxes came and went.

Income taxes in the united states are imposed by the federal most states and many local governments the income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductions individuals and corporations are directly taxable and estates and trusts may be taxable on undistributed income. The tax rates only apply to the income in that category. What this means for you.