Income In Respect To Decedent Examples

Income in respect of a decedent ird is income earned by the decedent deceased person prior to his death but was payable or paid after his death.

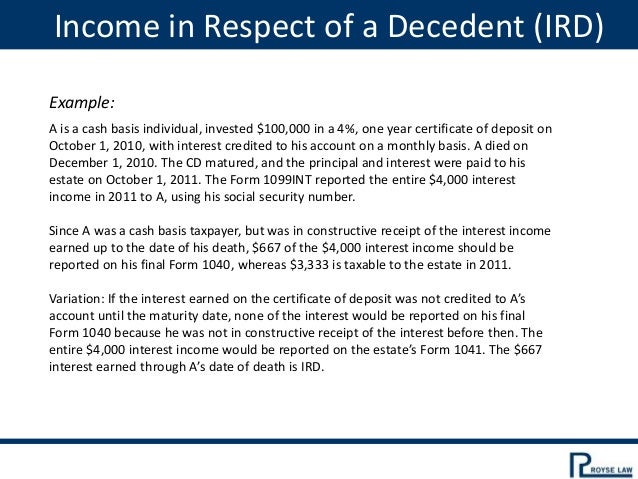

Income in respect to decedent examples. However there are many other less readily identifiable types of ird. Such items might include real estate taxes state income tax and deductible interest. Income in respect of a decedent ird is money owed to a person before they passed away like a salary or wages. Income in respect of a decedent ird defines a category of receipts received after the taxpayer passes away which are taxed differently from most of the decedent s other assets.

Income in respect of a decedent ird is income to which a person is entitled at death and that was never taxed during the person s life. The person or entity that inherits the income pays the taxes. In this course you will learn how to define ird. One way to initially reduce the tax to the beneficiary is by claiming a deduction in respect to decedent drd to offset the revenue.

The character of the income in the hands of the beneficiary is the same as the character of the income would have been in the hands of the decedent. For example if the ird would have been subject to capital gains tax rates for the decedent then it is considered capital gains for the beneficiary. Examples of ird include unpaid wages deferred compensation accrued interest on bonds income from exercise of stock options and qualified retirement plan distributions including iras. There are also deductions in respect of a decedent drd which can offset ird.

Deductions in respect to a decedent. High died on february 15 before receiving payment. Income in respect to decedent includes the taxable portions of annuities traditional iras and tax deferred retirement plans series ee u s. Instead such income referred to as income in respect of a decedent or ird is included as gross income in the decedent s estate for federal estate tax purposes.

Drd items are deductible expenses that were owed at the time of death but not yet paid. The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds. Income in respect of a decedent ird is the gross income a deceased individual would have received had he or she not died and that has not been included on the deceased individual s final income tax return. The most common types of ird include annuities retirement plans and final wage payouts.

Income in respect to decedent ird defined. And ird also becomes taxable income to the person or entity who ultimately receives it in direct contrast to the general rule that inherited property is not included in an.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)