Uk Income Tax Rates History Graph

As the average rate paid by lower earners has fallen income tax paid by the highest income groups above 150 000 a year has risen.

Uk income tax rates history graph. When the united kingdom of great britain came into being on may 1 1707 the window tax which had been introduced across england and wales under the act of making good the deficiency of the clipped money in 1696 continued. Historical highest marginal personal income tax rates 1913 to 2020. When margaret thatcher came to power in 1979 the income tax top rate was 83 whilst the basic rate was 33. Most of this increase has occurred in the past five.

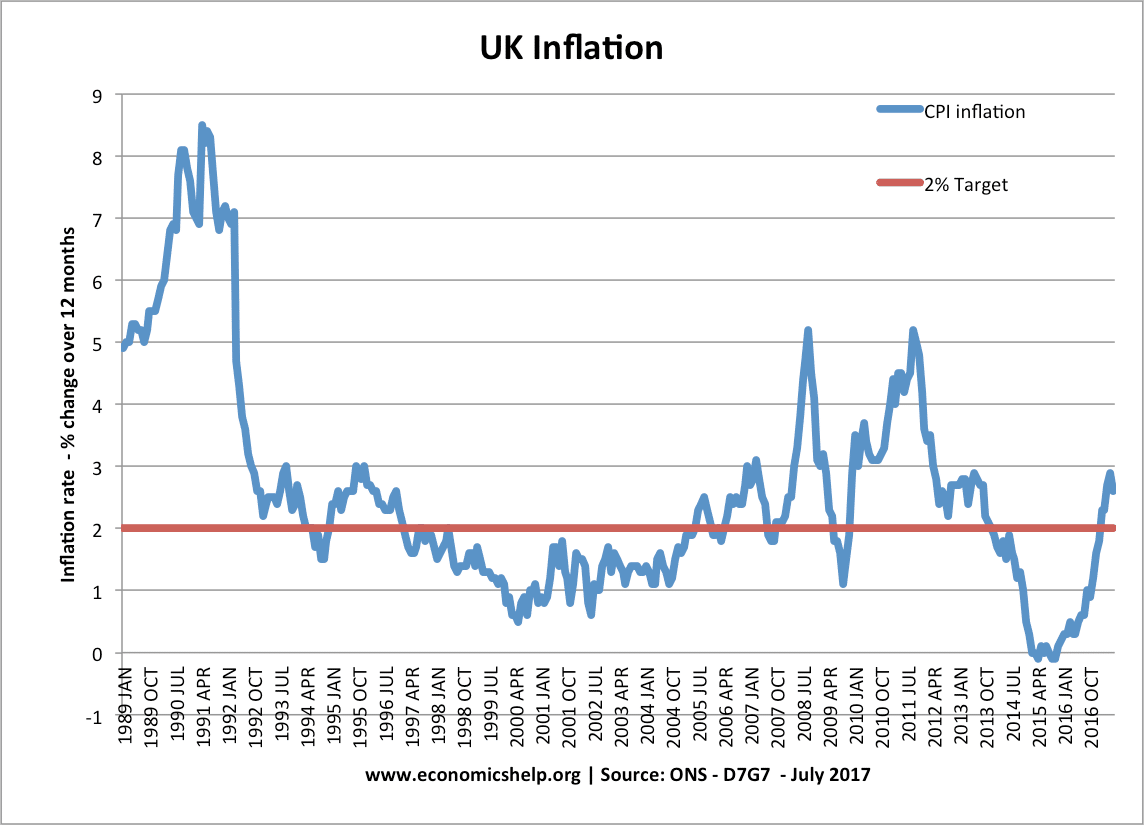

Personal income tax rate in the united kingdom averaged 42 26 percent from 1990 until 2020 reaching an all time high of 50 percent in 2010 and a record low of 40 percent in 1991. Historical and future rates you can view income tax rates and allowances for previous tax years. Download toprate historical pdf 8 91 kb. During the 1950s and 1960s income tax in the uk was at its highest levels reaching 90 at its highest rate.

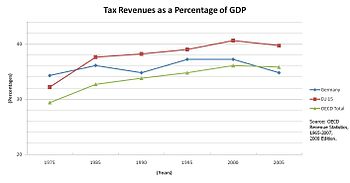

Corporate tax rate in the united kingdom averaged 30 98 percent from 1981 until 2020 reaching an all time high of 52 percent in 1982 and a record low of 19 percent in 2017. New tax bands and allowances are usually announced in the chancellor of the exchequer s budget. The corporate tax rate in the united kingdom stands at 19 percent. The share of taxpayers who pay income tax at the higher rate has increased from 6 5 per cent in 1990 91 to a projected 16 per cent in 2014 15.

Download toprate historical xlsx 12 15 kb. Here s a look at income tax rates and brackets over the years. It had been designed to impose tax relative to the prosperity of the taxpayer but without the controversy that then surrounded the idea of income tax. Income tax bands are different if you live in scotland.

Then the internal revenue service adjusts the income brackets each year usually in late october or early november based on inflation. This page provides united kingdom corporate tax rate actual values historical data forecast chart statistics economic calendar and news. 2021 tax rates and income brackets use these. The uk income tax system is therefore more progressive.

This page provides united kingdom personal income tax rate actual values historical data forecast chart statistics economic calendar. Congress sets the rates and a baseline income amount that falls into them when a tax law is created or changed. In 1965 a separate corporation tax was established for businesses.