Estate Income Tax Brackets 2020

As we saw last year there was no change to the 12 brackets of the estate tax for 2020.

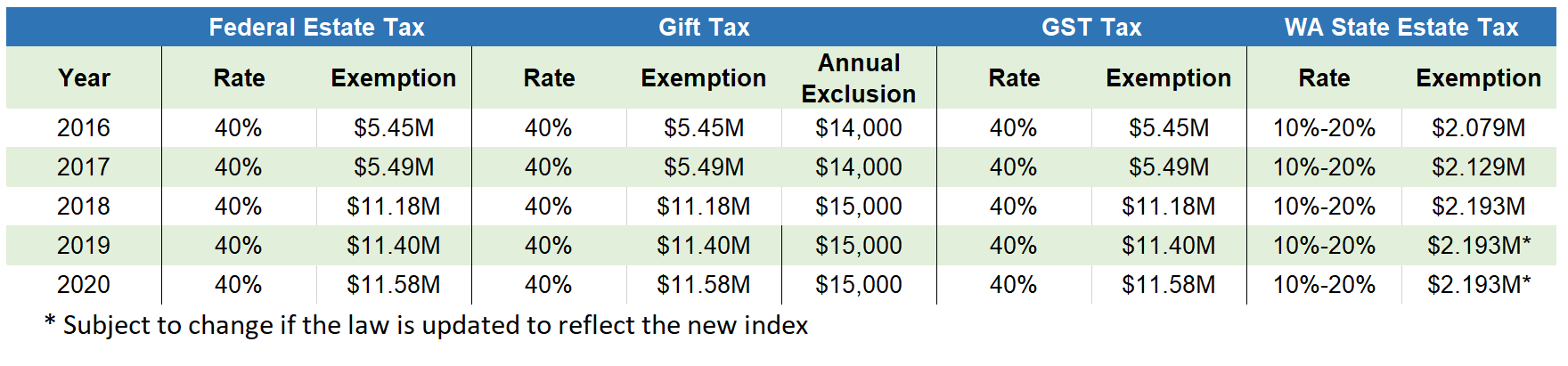

Estate income tax brackets 2020. 31 2020 may be subject to an estate tax with an applicable exclusion amount of 11 580 000 increased from 11 4 million in 2019 the top marginal rate remains 40 percent. Capital gains rates will not change for 2020 but the brackets for the rates will change. The 2020 rates and brackets were announced by the irs in rev. The lifetime gift tax exemption for gifts made during 2020 is 11 580 000 increased from 11 4 million in 2019.

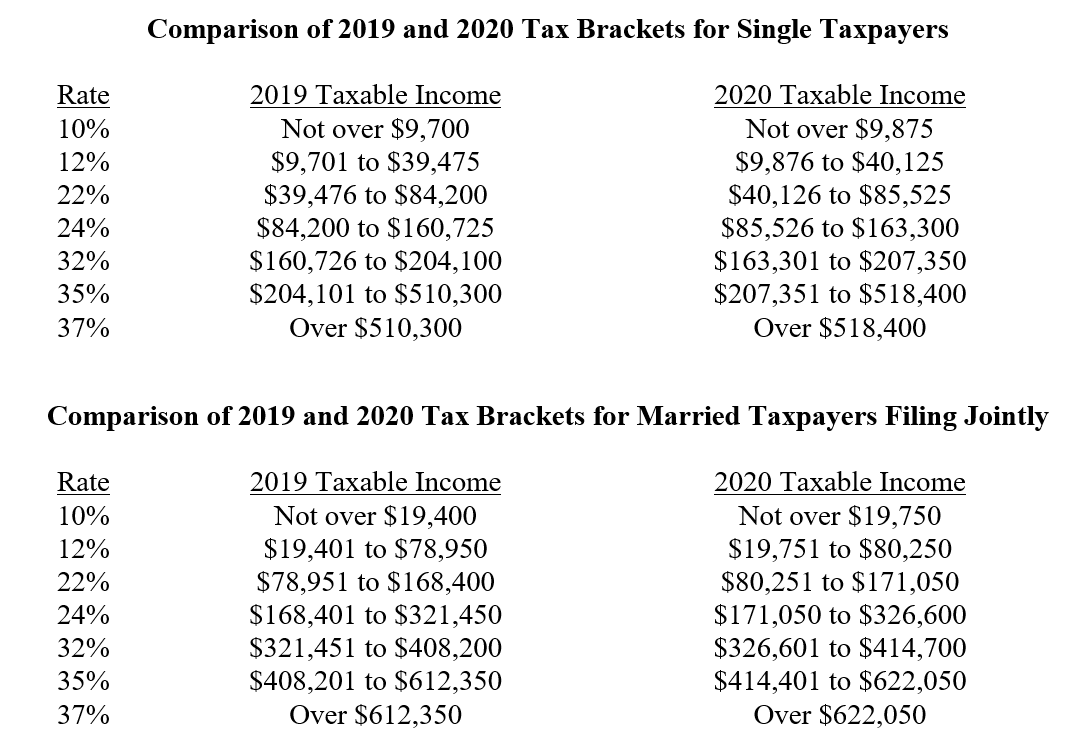

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. For joint married couples the amount is 612 350 divided into two if they are filing separate reports. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples.

By these numbers alone you will see how beneficial it is for your tax planning to have a trust or an estate. Income tax rates for the year ended 31st december 2020. How much of your pre retirement income will social security replace. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1.

Generally a person dying between jan. While other tax brackets reach their final column with 518 000 and a 37 income tax trust reach it with 12 750. What is the form for filing estate tax return. Maryland is the only state to impose both now that new jersey has repealed its estate tax.

Also to note that the schedule k 1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that. Income tax return for estates and trusts. For instance if you re single with taxable income of 9 850 you re in the 10 tax bracket and you ll pay tax of 10 of. The 2020 estate tax rates.

Due to political impasse in spain the 2020 budget was not passed and therefore the 2018 2019 tax rates and allowances continue to be used for 2020. 2020 estate and trust income tax rates base taxable incometax on base add on excess over base 0 0 10 2 600 260 00 24 9 450 1 940 00 35 12 950 3 129 00 37 unified credit exemption equivalent 2019 11 400 000 2020 11 580 000 annual gift tax exclusion for 2019 and 2020 is 15 000.