A Firm S Income Statement Reports The Results From Operating The Business

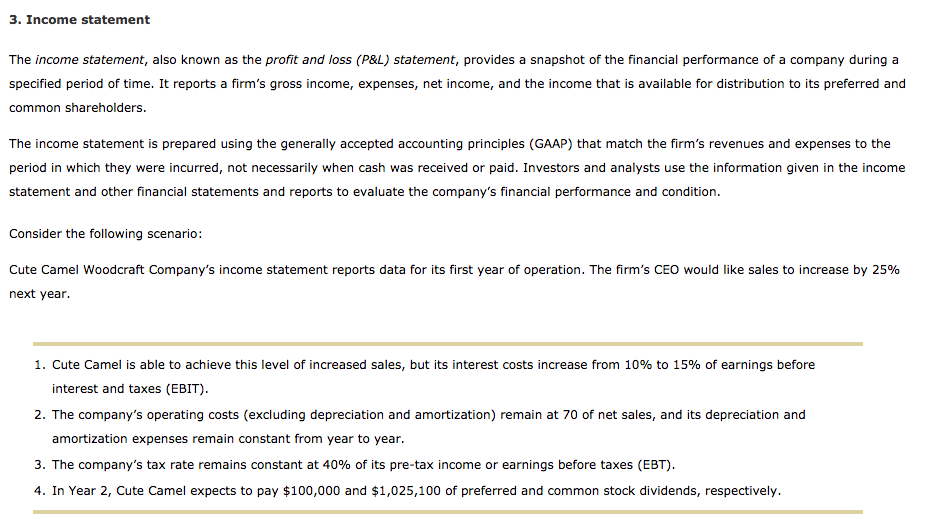

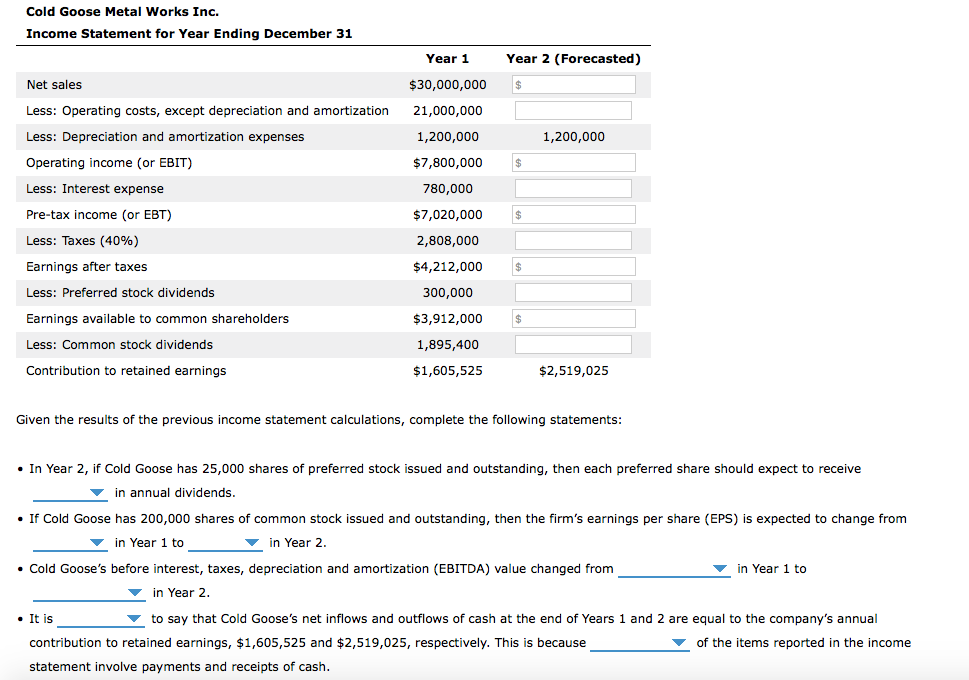

Generally accepted accounting principles state that revenue cannot be booked unless persuasive evidence of an agreement exists services have been rendered the price is fixed or determinable.

A firm s income statement reports the results from operating the business. Operating income examples. A firm s income statement reports the results from operating the business for a period of time while the firm s balance sheet provides a snapshot of the firm s financial position at a specific point in time. A true b false. Many companies focus on operating income when measuring the operational success of the business.

The income statement sometimes called an earnings statement or profit and loss statement reports the profitability of a business organization for a stated period of time. An income statement is a company s financial statement that indicates how the revenue money received from the sale of products and services before expenses are taken out also known as the top line is transformed into the net income the result after all revenues and expenses have been accounted for also known as net profit or the bottom line. A firm s income statement reports the results from operating the business for a period of time while the firm s balance sheet provides a snapshot of the firm s financial position at a specific point in time. A profit and loss statement p l or income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

Essentially the different measures of profitability in a multiple step income statement are reported at four different levels in a business operations gross operating pre tax and after tax. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement. The income statement for a consulting firm begins with consulting revenue. Reports how much of the firms earnings were retained in the business rather than paid out in dividends.

In accounting we measure profitability for a period such as a month or year by comparing the revenues earned with the expenses incurred to produce these revenues. A firms income statement reports the results from operating the business for a period of time while the firms balance sheet provides a snapshot of the firms financial position at a specific point in time. Summarizes the firms revenues and expenses over an accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)