Income Tax Treaty Us Japan

Income tax treaty pdf 2003.

Income tax treaty us japan. Income taxes on certain income profit or gain from sources within the united states. Governments put into effect on friday a protocol amending the bilateral tax treaty to avoid double taxation and prevent tax evasion some six years after they agreed on it in. The simple answer is that unless specifically excluded by the u s japan tax treaty they must be included in taxable income. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the united states from using the provisions of a tax treaty in order to avoid taxation of u s.

So let s take a look at the treaty. The japanese and u s. United states japan income tax treaty convention november 2003. A protocol the protocol to the us japan tax treaty the treaty which implements various long awaited changes entered into force on august 30 2019 upon the exchange of instruments of ratification between the government of japan and the government of the united states of america.

Citizens are taxed on all their income whatever its source and wherever in the universe they may live. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. Article 17 1 holds that. This follows from the general rule that u s.

Convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed in washington november 6 2003. Exemption from withholding taxes on interest subject to certain exceptions. A convention between the united states and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income was signed at tokyo on march 8 1971. It was ratified by the president of the united states on december 28 1971.

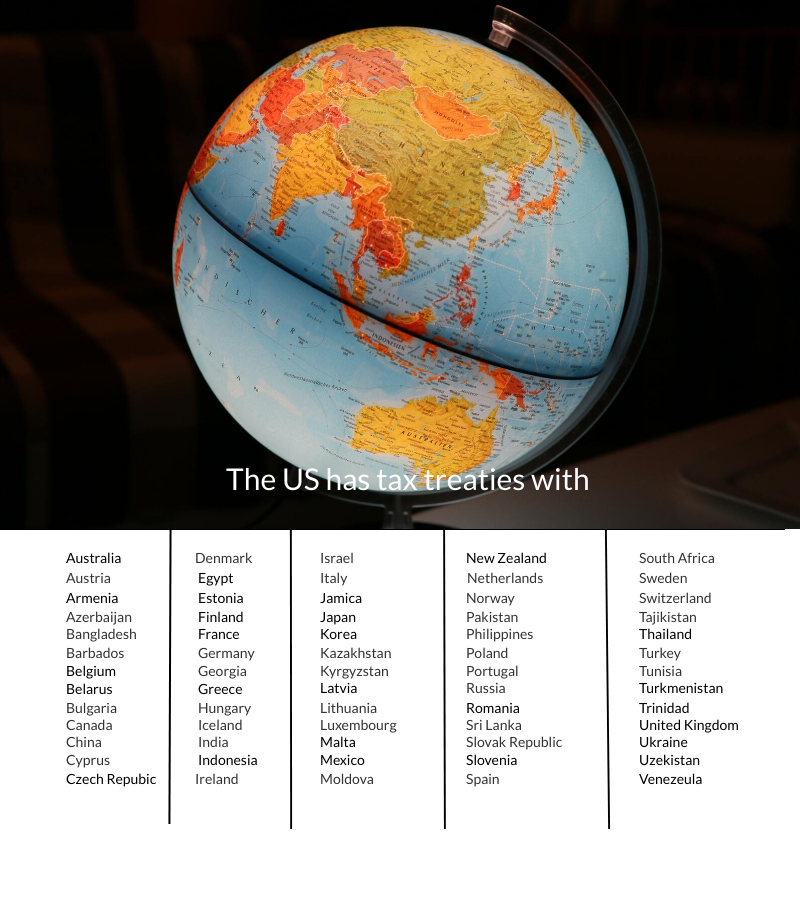

The united states has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from u s. A where a resident of japan derives income from the united states which may be taxed in the united states in accordance with the provisions of this convention the amount of the united states tax payable in respect of that income shall be allowed as a credit against the japanese tax imposed on that resident. Protocol amending the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income pdf 2013. Read today s release from the u s.

Technical explanation pdf 2003.