2019 Income Limit While On Social Security

If you earn more than this amount you can expect to have 1 withheld from your.

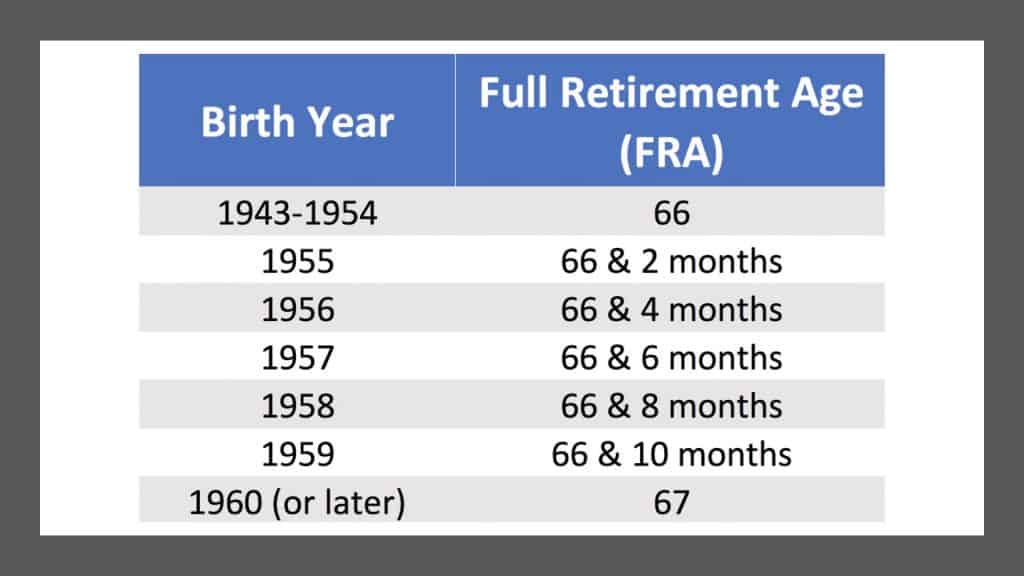

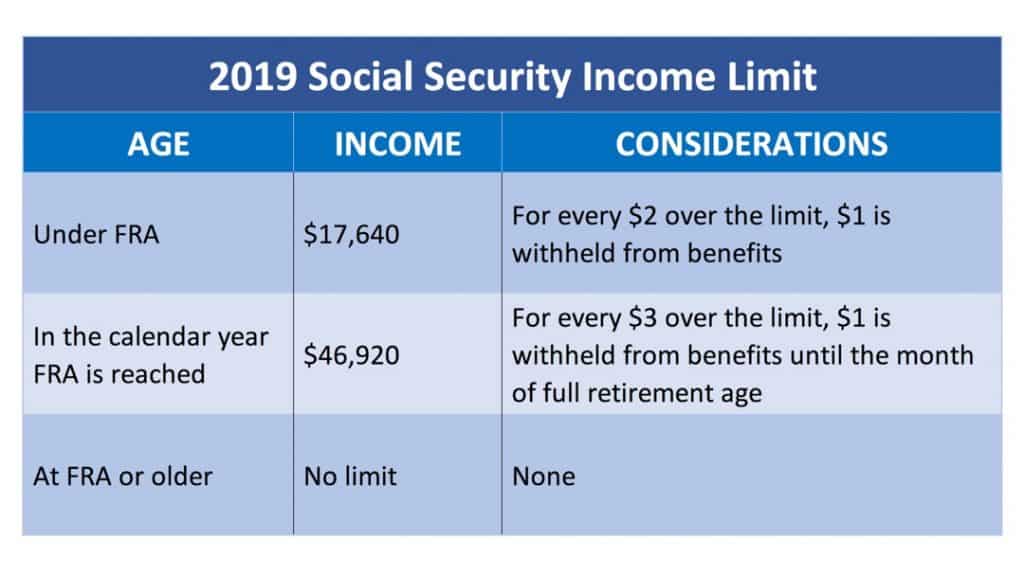

2019 income limit while on social security. In 2019 the annual earnings limit for those achieving full retirement age in 2020 or later was. It s important to do this as it s one way to help avoid being overpaid by social security. For 2019 people in this category will have 1 of their social security benefits withheld for every 2 in earned income in excess of 1 470 per month or 17 640 per year. For example let s say jane is age 62 her social security benefit is 600 per month and she expects to earn 25 000 in 2019 or 7 360 more than the allowed earnings limit.

Some assets and interest may count towards the monthly total while others may not. Based on the increase in the consumer price index cpi w from the third quarter of 2017 through the third quarter of 2018 social security and supplemental security income ssi beneficiaries will receive a 2 8 percent cola for 2019. Tip how much you can earn while drawing on your social security. Even if you may have substantial gainful activity you can still apply for ssdi ssi.

The social security earnings limit is 1 470 per month or 17 640 per year in 2019 for someone age 65 or younger. Other important 2019 social security. Reporting wages to social security. When referring to ssi it gets a bit trickier.

As of 2019 income limits have changed but the youngest age you can begin receiving social security benefits remains at 62. The annual social security earnings limit for those reaching full retirement age fra in 2021 or later is 18 240. Learn about social security income limits what to know about working while receiving retirement benefits. Social security disability insurance ssdi payments will stop if you are engaged in what social security calls substantial gainful activity sga as it s known is defined in 2020 as earning more than 1 260 a month or 2 110 if you are blind.

28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)