Income Tax Brackets Germany 2020

The 2020 federal income tax brackets on ordinary income.

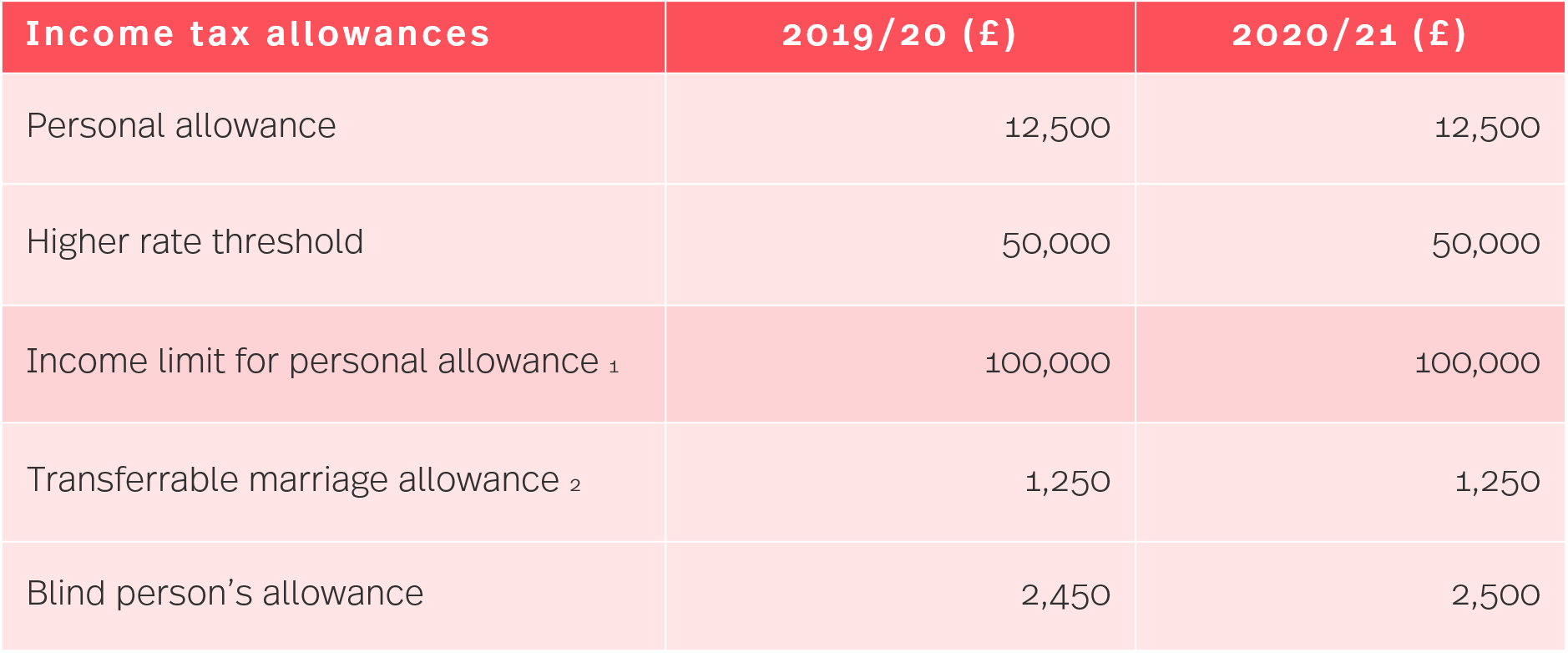

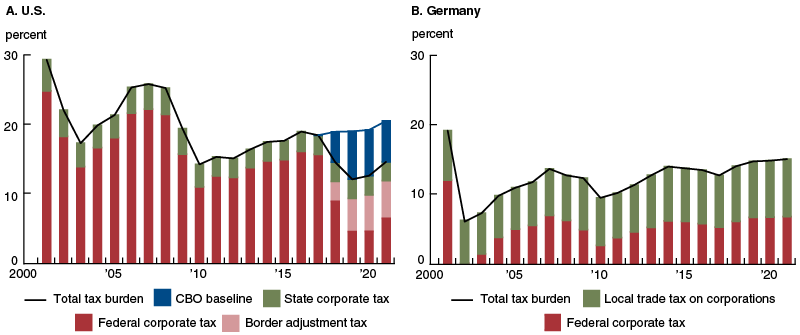

Income tax brackets germany 2020. The top 42 rate applies to income above 55 961. Personal income tax rate in germany averaged 47 94 percent from 1995 until 2020 reaching an all time high of 57 percent in 1996 and a record low of 42 percent in 2005. Tax rates on income in germany annual income of less than 9 168 is not taxed at all. Income tax in germany is progressive.

The german annual income tax calculator for the 2020 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 2020 21 and your net pay the amount of money you take home after deductions. Income tax rates for the year ended 31st december 2020. Due to covid 19 reason the government accepted a lowering from 1st july 2020 until 31st december 2020 for the rates. Income from 270 501 00 and above.

The german income tax is a progressive tax which means that the average tax rate. The amounts double for married couples filing joint returns. Germany residents income tax tables in 2020. Geometrically progressive rates start at 14 and rise to 42.

Surcharges on income tax to improve the economic situation and infrastructure for certain regions in need the german government is levying a 5 5 solidarity surcharge tax. This page provides the latest reported value for germany personal income tax rate plus previous releases historical high and low short term forecast and long. Income tax starts with 14 77 and gradually goes up to 44 31 top tax rate applies to taxable income of more than 55 960. The rate of income tax in germany ranges from 0 to 45.

Germany has progressive tax rates ranging as follows 2020 tax year. The personal income tax rate in germany stands at 45 percent. Income tax rates and thresholds annual tax rate taxable income threshold income from 0 00. Income from 9 409 00 to.

Germany has a bracketed income tax system with four income tax brackets ranging from a low of 0 00 for those earning under 8 005 to a high of 45 00 for those earning more then 250 730 a year. Rates start at 14 and incrementally rise to 42. 10 tax rate up to 9 875 for singles up to 19 750 for joint filers 12 tax rate up to 40 125. Very high income levels above 265 327 are taxed at 45.

Thus the standard rate is currently lowered to 16 and the reduced rate to 5.

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)